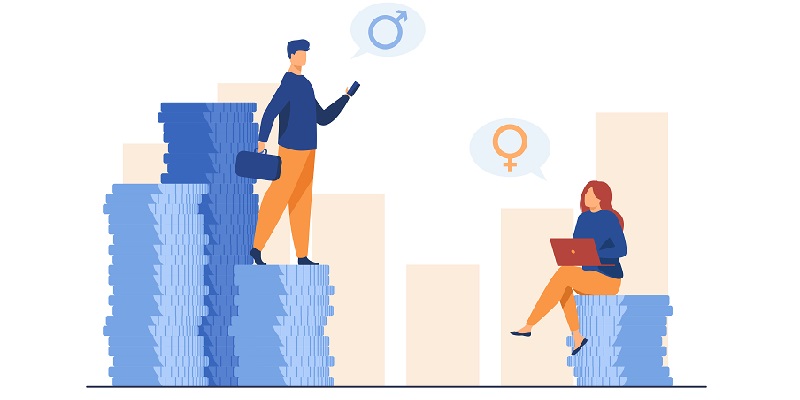

The disparity in salary increases between Australian men and women continued this year, according to a new report. Despite ongoing discussions regarding the gender pay gap, this data demonstrates that the disparity continues. A survey from ADP revealed that pay rises for women in the past 12 months averaged 4.4%, lower than the 5.7% recorded for men. These findings once again highlight the persistent gender pay gap in Australia.

The findings of the ADP survey

The ADP survey sheds light on the stark difference in salary increases for men and women. The average pay rise for women in the past year was only 4.4%, significantly lower than the 5.7% recorded for men. This disparity indicates that women are not receiving fair compensation for their work, contributing to the ongoing gender pay gap in the country.

Persistent gender pay gap despite discussions

Despite ongoing discussions and increased awareness surrounding the gender pay gap, this report’s findings reveal that the disparity continues to persist. The wage gap between men and women remains a pressing issue that requires immediate attention and action. It is disheartening to see that progress in narrowing this gap is slow, and women continue to be disadvantaged in terms of salary increases.

Future expectations

The survey also examined salary expectations for the next 12 months. It found that women are only expecting a 5.2% increase, while men are expecting a higher 6.3%. This discrepancy suggests that the gender pay gap may not disappear anytime soon. It is alarming that despite efforts to close the wage gap, women still have lower salary expectations than their male counterparts.

Implications for financial well-being

The gender pay gap has significant implications for the financial well-being of women in Australia. As the cost of living continues to rise, Australians, regardless of gender, are grappling with genuine financial difficulties. However, unequal pay limits women’s ability to contribute equally to household expenses, exacerbating their financial challenges. It is disheartening that women are not being paid in a way that enables them to fully participate in the economy on an equal footing with men.

Australia’s record-low gender pay gap

The survey came as Australia’s gender pay gap recently hit a record low of 13%. While this may seem like progress, the fact remains that women still only make 87 cents for every dollar a man earns. This statistic highlights the persistent inequality in pay between genders, indicating that there is still a long way to go in achieving true wage equality.

The significance of Equal Pay Day

On August 25, Australia marked its Equal Pay Day 2023, the 56th day into the financial year that women must work to earn, on average, the same as men did the previous year. This highlights the extensive amount of time it takes for women to catch up in terms of earnings. Equal Pay Day serves as a stark reminder that pay parity remains a distant goal, demanding urgent action to rectify the long-standing wage imbalance.

Worries about the current economic challenges

This situation is worrisome given the current economic challenges facing Australia. People across the country are grappling with increasing utility prices and interest rates, which put further strain on their financial well-being. In such circumstances, it becomes even more crucial to ensure fair and equal compensation for all individuals, regardless of their gender.

Expert perspective

Kylie Baullo, Managing Director at ADP ANZ, described the results of the survey as “disheartening.” Her sentiments resonate with the frustration many women feel about the persistent gender pay gap. It is essential to consider and amplify expert perspectives in discussions surrounding the gender pay gap, as they offer valuable insights and potential solutions.

The ongoing disparity in salary increases between Australian men and women is a clear indication that the gender pay gap remains a pressing issue. Despite discussions, awareness, and progress made in narrowing the gap, there is still much work to be done. The recent survey from ADP highlights the need for immediate action to address the gender pay gap, ensuring fair and equal compensation for all individuals. It is crucial that steps are taken to close this gap and create an inclusive and equitable society where everyone has an equal opportunity to succeed.