Embedded Finance

- Embedded Finance

The current economic landscape of 2026 reveals a striking paradox where small business owners report record levels of optimism despite facing a rigorous environment defined by fluctuating cash flows and evolving labor markets. While these entrepreneurs remain the backbone of

- Embedded Finance

The current economic landscape of 2026 reveals a striking paradox where small business owners report record levels of optimism despite facing a rigorous environment defined by fluctuating cash flows and evolving labor markets. While these entrepreneurs remain the backbone of

Popular Stories

- Embedded Finance

The current economic landscape of 2026 reveals a striking paradox where small business owners report record levels of optimism despite facing a rigorous environment defined by fluctuating cash flows and evolving labor markets. While these entrepreneurs remain the backbone of

Deeper Sections Await

- Embedded Finance

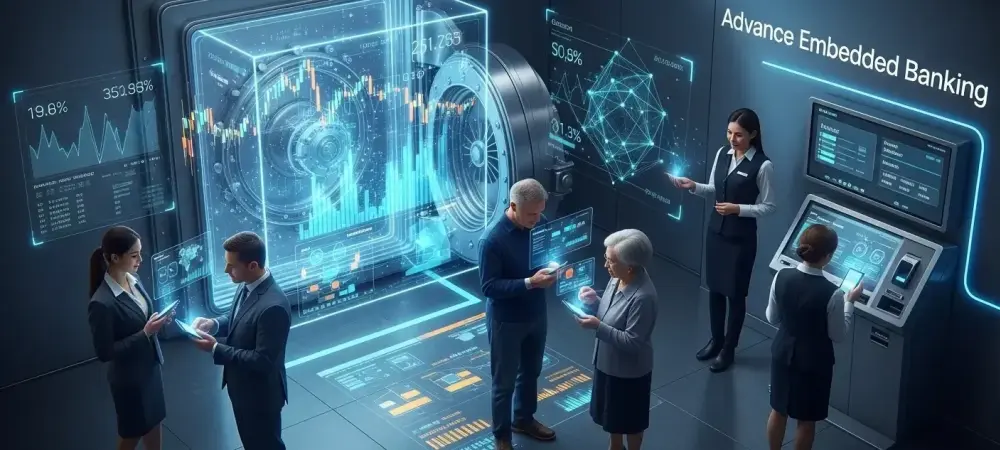

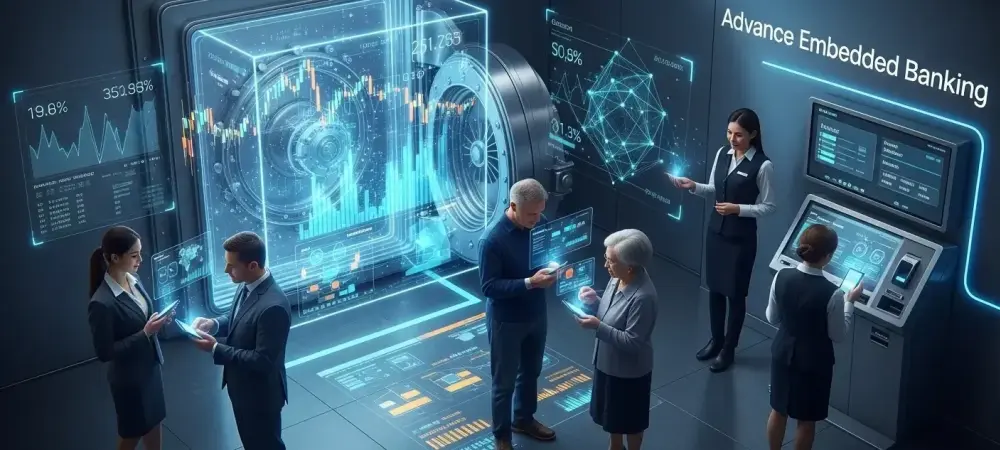

The traditional bank branch, once a cornerstone of financial life, is increasingly becoming a relic as financial services seamlessly integrate into the digital platforms where consumers and businesses already operate. In this rapidly evolving landscape, Thread Bank has distinguished itself

- Embedded Finance

The persistent toggle between a company’s accounting software and its online banking portal has long been an accepted, albeit inefficient, reality for corporate finance teams. The rise of Embedded ERP Banking represents a significant advancement, challenging this status quo by

Browse Different Divisions

- Embedded Finance

The traditional bank branch, once a cornerstone of financial life, is increasingly becoming a relic as financial services seamlessly integrate into the digital platforms where consumers and businesses already operate. In this rapidly evolving landscape, Thread Bank has distinguished itself

- Embedded Finance

The strategic conversation surrounding financial services integration has decisively shifted from a debate over whether to build or buy to a consensus that partnership is the only viable path to market leadership. For any non-financial brand, the decision to embed

- Embedded Finance

For countless small business owners, the triumphant story of entrepreneurial success is perpetually haunted by the specter of personal financial ruin, a reality where one misstep can erase a lifetime of savings. In this high-stakes environment, the emergence of embedded

- Embedded Finance

Measuring the success of integrated financial tools within retail once revolved around a straightforward calculation of dollars and cents, but today’s most forward-thinking businesses are tracking a far more sophisticated and strategic set of returns. The conversation around embedded finance

- Embedded Finance

As the financial landscape shifts, embedded finance is emerging not as a trend, but as a fundamental rewiring of how consumers and businesses interact with banking. We sat down with Nikolai Braiden, a renowned FinTech expert and an early advocate

- Embedded Finance

The persistent toggle between a company’s accounting software and its online banking portal has long been an accepted, albeit inefficient, reality for corporate finance teams. The rise of Embedded ERP Banking represents a significant advancement, challenging this status quo by

Browse Different Divisions

Popular Stories

Uncover What’s Next