Setting the Stage for a Tech-Driven Tug-of-War in Howell Township

In the heart of Livingston County, Michigan, about 60 miles northwest of Detroit, a 1,000-acre plot in Howell Township has become the epicenter of a high-stakes market clash. Here, a proposed data center campus by Stantec Consulting Michigan and Randee LLC, potentially serving a Fortune 100 technology firm, promises to reshape the rural landscape into a hub of digital infrastructure. Yet, with over 2,100 residents signing a petition against it and the township’s planning commission recommending rejection, this project encapsulates a broader struggle between technological expansion and community preservation. This market analysis delves into the forces shaping data center investments in rural areas like Howell Township, examining current trends, community pushback, and future projections for this burgeoning sector. Understanding these dynamics is critical for stakeholders navigating the delicate balance between economic growth and local priorities in Michigan’s evolving tech landscape.

Dissecting the Data Center Boom: Trends and Tensions in Michigan’s Market

Rising Demand Meets Rural Resistance

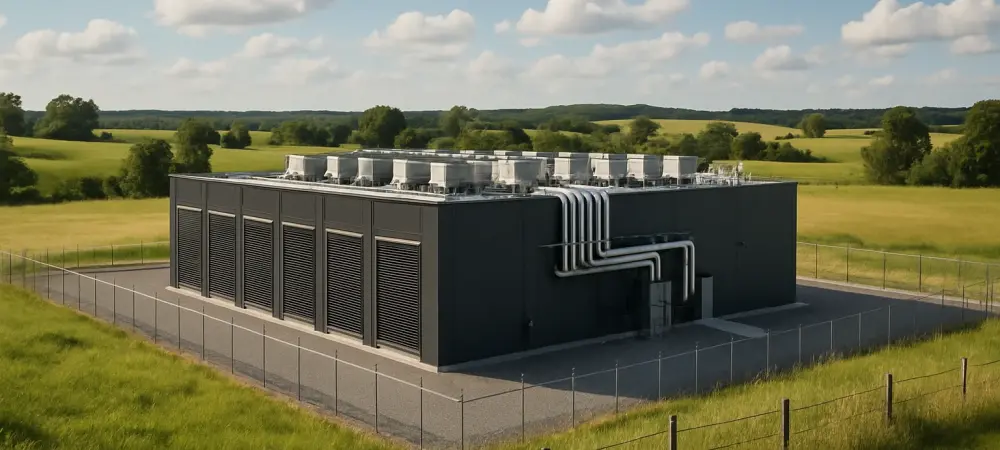

The data center market in Michigan, particularly around Detroit, is experiencing a significant upswing driven by the global surge in cloud computing, streaming services, and AI technologies. Companies such as EdgeConneX, US Signal, and Verizon have already carved out a presence, capitalizing on the state’s competitive energy costs and abundant land. Rural areas like Howell Township, with sprawling parcels, are prime targets for hyperscale facilities that require vast spaces for server farms and cooling systems. However, this growth trajectory is hitting a wall as local opposition mounts, reflecting a market tension where the promise of economic benefits clashes with the preservation of agricultural and residential character. The proposed 1,000-acre campus, spanning land along Marr, Fleming, Warner, and Owosso Roads, exemplifies this conflict, as it seeks to rezone diverse parcels into a high-tech research zone.

Community Pushback as a Market Barrier

A pivotal factor shaping this market is the robust resistance from rural communities, which acts as a significant barrier to entry for developers. In Howell Township, with a population of just under 7,900, the scale of dissent is striking—evidenced by a Change.org petition titled “Stop the Construction of Michigan’s Largest Data Center in Howell” and a Facebook group, “Stop the Data Centers – Livingston County,” boasting around 1,300 members. Concerns center on environmental impacts, including massive energy consumption and water usage for cooling, alongside fears of rising household energy costs due to increased grid demand. This pushback is not isolated; similar sentiments echo in Washtenaw County, where projects like Thor Equities’ 800-acre campus in Augusta Township face comparable hurdles. Such opposition signals a market challenge where social license to operate is as critical as financial and logistical feasibility.

Zoning and Planning: Regulatory Roadblocks to Expansion

Another layer impacting the data center market in rural Michigan is the regulatory landscape, particularly zoning and master planning constraints. The Howell Township Planning Commission’s unanimous recommendation to deny the proposed campus after a marathon seven-hour meeting underscores the importance of aligning development with long-term community frameworks. The push to update the township’s master plan before approving a transformative rezoning highlights a cautious approach among local authorities. This regulatory friction is a broader market signal, indicating that developers must navigate a patchwork of local policies that prioritize existing land use over rapid industrialization. Without streamlined zoning processes or state-level support, the pace of data center deployment risks significant delays, affecting investment timelines and returns.

Forecasting the Future: Opportunities and Obstacles Ahead

Technological and Policy Innovations on the Horizon

Looking toward the next few years, from 2025 to 2027, the data center market in Michigan could see transformative shifts through technological advancements and policy evolution. Innovations in energy-efficient designs and renewable power integration are poised to address some environmental concerns, potentially easing community apprehensions about resource strain. On the policy front, there is growing speculation that state-level frameworks might emerge to standardize zoning for tech infrastructure, reducing the regulatory unpredictability that developers currently face. If implemented, such measures could unlock rural areas for controlled expansion, balancing local needs with market demands. These developments suggest a market poised for cautious optimism, provided stakeholders adapt to emerging standards.

Economic Potential Versus Social Costs

The economic upside of data centers remains a compelling driver for market growth, with projections indicating substantial property tax revenue and infrastructure investment for host communities. However, the social costs—perceived or real—continue to weigh heavily on market acceptance. Misconceptions about job creation, often inflated by promises of high-paying roles that may be automated or outsourced, further complicate the narrative. Market analysts anticipate that developers will need to pivot toward tangible community benefits, such as funding local job training or energy cost mitigation programs, to shift public perception. Without such strategies, the economic potential of projects like the one in Howell Township risks being overshadowed by social resistance, stunting long-term market penetration.

Regional Patterns and Competitive Positioning

Examining regional patterns, Michigan’s data center market is part of a larger Midwest trend where rural areas are increasingly targeted for digital infrastructure. Yet, competition with neighboring states, coupled with local pushback, positions Michigan at a critical juncture. Projects in nearby Washtenaw County, including Related Digital’s 2.2 million square foot campus in Saline Township, mirror Howell’s challenges, suggesting a regional market dynamic where community engagement becomes a competitive differentiator. Developers who can successfully partner with local stakeholders, as seen with farmer Ryan Van Gilder’s support for the Howell project, may gain a strategic edge. This competitive landscape hints at a future where market success hinges on localized trust-building as much as on financial and operational prowess.

Reflecting on Market Insights and Strategic Pathways

Looking back, the analysis of Howell Township’s data center controversy reveals a market fraught with opportunity yet constrained by deep-rooted community and regulatory challenges. The fierce opposition from residents, coupled with zoning hurdles, paints a picture of a sector struggling to find footing in rural Michigan. For stakeholders, the path forward demands a shift in approach—developers must prioritize transparent dialogue and concrete environmental solutions to win local trust. Local governments are encouraged to proactively update planning frameworks to anticipate tech-driven growth, while communities need to articulate clear demands for benefits like green energy commitments. These strategic insights underscore that bridging the gap between innovation and preservation is not just possible but essential for sustainable market expansion in regions like Livingston County.