I’m thrilled to sit down with Dominic Jainy, a seasoned IT professional whose expertise spans artificial intelligence, machine learning, and blockchain. With a keen eye for emerging technologies, Dominic has been closely following the rapid evolution of data center infrastructure across Europe. Today, we’ll dive into the latest developments in Germany and Austria, exploring innovative projects, the challenges of balancing growth with sustainability, and the strategic decisions shaping this dynamic industry.

What can you tell us about the Frank Cube project in Birstein, Germany, and why Argaman Group chose a location roughly 37 miles outside Frankfurt?

The Frank Cube project in Birstein is a fascinating endeavor by Argaman Group, aiming to build a significant data center campus on 11 hectares in the Main-Kinzig district. The decision to locate about 37 miles northeast of Frankfurt likely stems from a mix of practical and strategic factors. Frankfurt is a major data center hub with over 2GW of capacity, but it’s grappling with grid connection delays and heightened scrutiny over environmental impact. By moving to a more rural area like Birstein, Argaman Group can potentially sidestep some of these bottlenecks, secure larger plots of land at a lower cost, and tap into alternative energy sources, which I understand they’re planning to do with on-site gas plants and nearby wind turbines.

How does a 200MW capacity fit into the vision for Frank Cube, and what kind of demand is Argaman Group anticipating?

A 200MW capacity is substantial, positioning Frank Cube as a major player even in a market as saturated as Frankfurt’s broader region. This scale suggests Argaman Group is targeting high-demand clients, likely hyperscale cloud providers or large enterprises with significant computational needs, such as AI or big data analytics. The demand for data center capacity in Europe, especially in hubs like Frankfurt, continues to surge with the growth of digital services, so they’re likely banking on capturing a sizable share of this expanding market by 2028, when the project is slated to launch.

With the launch planned for 2028, what hurdles or key steps do you think Argaman Group will need to navigate to stay on schedule?

Meeting a 2028 timeline for a project of this magnitude is ambitious. Key steps will include securing permits, especially given Germany’s strict environmental and zoning regulations. Construction of a 200MW facility also demands significant investment and coordination with local utilities for power infrastructure. Challenges could arise from supply chain delays for critical equipment like transformers or cooling systems, as well as potential community pushback over energy use or environmental concerns. Balancing these factors while sticking to the timeline will be a real test of their planning and execution.

Can you walk us through how the mix of on-site gas plants and nearby wind turbines will support Frank Cube’s energy needs?

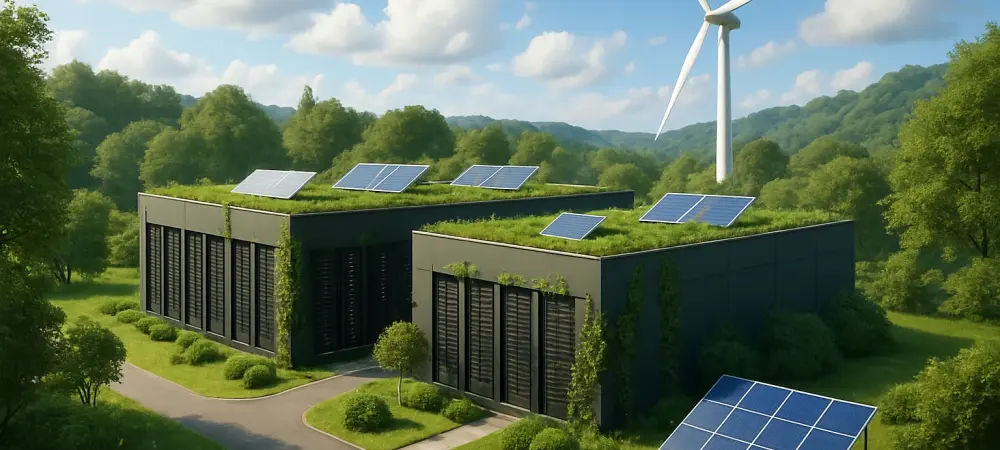

Combining on-site gas plants with nearby wind turbines is a smart approach to ensure both reliability and sustainability. Gas plants can provide a stable, controllable power source to meet baseline demands and handle peak loads, which is critical for a data center where uptime is non-negotiable. Wind turbines, on the other hand, contribute renewable energy, reducing the carbon footprint and aligning with Europe’s push for greener infrastructure. The challenge lies in integrating these sources seamlessly—ensuring the gas plants can ramp up when wind generation dips due to weather variability. It’s a hybrid model that could set a precedent for future projects if executed well.

How do you see Argaman Group addressing environmental concerns while powering a 200MW facility like Frank Cube?

Environmental concerns are a hot topic for data centers, especially in Europe where regulations are tightening. For a 200MW facility, energy consumption is massive, so Argaman Group’s use of wind turbines is a step toward sustainability. However, relying on gas plants, even partially, will still draw scrutiny due to emissions. I expect they’ll need to invest in carbon offset programs or explore additional renewable tie-ins over time. Community engagement will also be key—transparency about their environmental impact and efforts to minimize it could help mitigate local opposition. It’s a delicate balance between operational needs and ecological responsibility.

Frankfurt is a powerhouse for data centers in Europe. What factors make it such a magnet for operators like Argaman Group?

Frankfurt’s status as a data center hotspot comes down to a few core strengths. It’s a major financial hub, home to institutions like the European Central Bank, which drives demand for low-latency, high-capacity digital infrastructure. Its central location in Europe also makes it ideal for connectivity, with excellent fiber networks and proximity to other key markets. Add to that a relatively stable political and economic environment, and you’ve got a recipe for attracting operators. Even with challenges like grid delays, the sheer volume of business in Frankfurt—over 2GW of capacity—keeps it at the top of the list alongside cities like London and Amsterdam.

With grid connection wait times becoming an issue in central Frankfurt, how significant a problem is this for the data center industry right now?

Grid connection delays are a growing pain point in Frankfurt and other mature hubs. As demand for data center capacity skyrockets, local power infrastructure is struggling to keep up. Wait times for new connections can stretch into years, which is a nightmare for operators working on tight project schedules. This bottleneck is pushing companies to look at peripheral areas like Birstein, where grid access might be less congested, or to invest in private power solutions. It’s a systemic issue that could slow down growth if utilities and regulators don’t adapt quickly.

Turning to another project, what drove Telemark to launch a new data center in Menden, about 18 miles east of Dortmund?

Telemark’s new data center in Menden, a small city in North Rhine-Westphalia, seems to be a strategic move to serve a more localized market. Positioned just 18 miles east of Dortmund, it’s likely targeting regional businesses or public sector clients who need proximity for low-latency services. Telemark, with its background in telecom and fiber infrastructure, might also be leveraging existing networks in the area to offer bundled services. Plus, being outside a major hub like Dortmund could mean less competition and easier access to resources like land and power.

The Menden facility is quite small at just over 2,000 square feet. What kind of market or specific needs do you think this size is designed to address?

At just over 2,000 square feet, the Menden data center is clearly not aimed at hyperscale clients. Instead, it’s probably tailored for niche or local needs—think small to medium-sized enterprises, local government services, or even specific industries in the region that require secure, nearby data storage. Telemark might also be positioning this as an edge computing facility, handling data closer to end-users for faster processing. It’s a compact setup, but with a €2 million investment, it shows they’re serious about carving out a targeted market share.

Looking at the broader picture, what’s your forecast for the future of data center development in regions like Germany and Austria over the next decade?

I’m optimistic about the trajectory of data center development in Germany and Austria, but it won’t be without challenges. Demand will continue to grow, fueled by AI, cloud computing, and digital transformation across industries. We’ll likely see more projects in secondary locations like Birstein or Lend in Austria, as operators seek to bypass urban constraints and tap into renewable energy sources. Sustainability will be a defining factor—facilities that can’t demonstrate a low carbon footprint will face regulatory and public pressure. At the same time, innovations in cooling and power management, alongside better grid infrastructure, could ease some current pain points. I expect these regions to solidify their roles as critical nodes in Europe’s digital backbone, provided they balance growth with environmental and community considerations.