The Race to Angstroms: TSMC’s Bold Leap into the Future

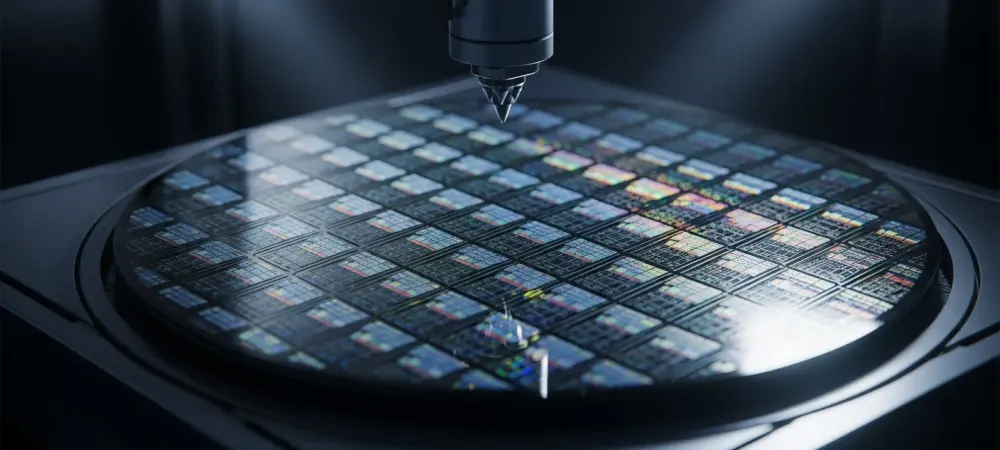

In a decisive move that signals its intent to dominate the next generation of semiconductor manufacturing, Taiwan Semiconductor Manufacturing Co. (TSMC) is accelerating its timeline for 1.4-nanometer (nm) chip production. Driven by unexpectedly promising initial yields, the foundry giant is fast-tracking the construction of its new fabrication plant, setting the stage for risk production in 2027 and mass production by 2028. This strategic acceleration is more than a technical milestone; it is a powerful statement in the high-stakes race to shrink transistors to the atomic scale. This article will explore the context behind this ambitious push, analyze the technological and economic strategies at play, and assess the profound implications for a global tech industry hungry for more powerful and efficient chips.

The Unrelenting March of Moore’s Law: A Legacy of Innovation

For decades, the semiconductor industry has been defined by the relentless pace of Moore’s Law, the principle that the number of transistors on a microchip doubles approximately every two years. TSMC has long been the primary engine of this progress, consistently delivering cutting-edge process nodes that have powered everything from smartphones to supercomputers. The company’s journey from 7nm to 3nm and its on-schedule ramp-up of 2nm production have solidified its market leadership. This constant innovation is crucial, as each new node brings tangible benefits in performance, power efficiency, and density. The accelerated push to 1.4nm is a direct continuation of this legacy, a necessary move to stay ahead of fierce competitors and to meet the insatiable demands of the AI and high-performance computing (HPC) revolutions.

Deconstructing the 1.4nm Push: Strategy, Technology, and Investment

A Strategic Acceleration Driven by Early Success

TSMC’s decision to expedite its 1.4nm timeline is a calculated risk, underpinned by early but significant technical achievements. The primary driver is better-than-expected production yields for the next-generation process, even at this nascent stage. While the exact figures are proprietary, they are promising enough to justify the colossal NT$1.5 trillion (approximately $49 billion) investment in a new facility at the Central Taiwan Science Park. This acceleration occurs as demand for TSMC’s 2nm process is already so high that it necessitates building additional capacity. By pulling forward its 1.4nm schedule, TSMC is not only signaling confidence in its R&D capabilities but also working to preemptively absorb the future demand of its most critical partners.

The Battle for a Trillion Transistors: Securing Key Customers

The success of any new process node hinges on securing anchor customers willing to invest billions in adopting the technology. Given its long-standing partnership with TSMC, Apple is widely expected to be a primary candidate for the first wave of 1.4nm capacity, having already claimed a significant portion of the initial 2nm supply. However, TSMC is also diversifying its offerings to cater to the booming HPC market. The company is reportedly developing a 1.6nm process, for which NVIDIA is rumored to be the sole initial customer. This tailored approach allows TSMC to serve the distinct needs of the mobile and AI markets simultaneously, securing long-term, high-margin revenue streams and locking in the world’s most influential tech companies.

The High-NA EUV Gambit: Innovation Without Exorbitant Costs

Perhaps the most intriguing aspect of TSMC’s 1.4nm strategy is its apparent decision to achieve these advancements without relying on ASML’s latest and most expensive High-NA Extreme Ultraviolet (EUV) lithography machines. At a cost of $400 million per unit, these tools represent a staggering capital expense. By aiming to perfect the 1.4nm process with existing, albeit highly advanced, EUV technology, TSMC is making a strategic bet on its engineering prowess to control costs and protect margins. This approach stands in contrast to competitors who are early adopters of High-NA EUV. If TSMC succeeds, it will have created a significant cost advantage, proving that groundbreaking innovation can be achieved through both ingenuity and fiscal discipline.

The Future of Fabrication: Beyond 1.4 Nanometers

TSMC’s move to 1.4nm, also known as A14 in angstrom-era terminology, is a critical step toward a future where chip features are measured in tens of atoms. This relentless pursuit of miniaturization pushes the known limits of physics and requires breakthroughs in materials science and transistor architecture. The new plant in Central Taiwan, projected to create up to 10,000 jobs and generate $16 billion in annual revenue, will be the epicenter of this next wave of innovation. This development not only cements TSMC’s technological leadership but also reinforces Taiwan’s indispensable role at the heart of the global technology supply chain, shaping the trajectory of AI, quantum computing, and beyond.

Navigating the Angstrom ErKey Takeaways and Strategic Imperatives

The key takeaways from TSMC’s accelerated roadmap are clear: the company is leveraging early technical success to solidify its competitive advantage, strategically managing customer relationships to capture growth in both mobile and AI, and making a calculated technological bet to optimize costs. For stakeholders, the implications are significant. Investors can view this as a sign of TSMC’s enduring market leadership and robust long-term growth prospects. For tech companies like Apple and NVIDIA, securing early access to these advanced nodes is paramount to maintaining product superiority. For the industry at large, TSMC’s aggressive timeline sets a new, faster pace for innovation, compelling competitors to re-evaluate their own roadmaps.

Conclusion: Solidifying Dominance in the Next Wave of Computing

TSMC’s accelerated 1.4nm production plan is far more than a simple update to a product roadmap; it is a defining strategic maneuver designed to secure its foundry dominance for the next decade. By aggressively pushing the frontiers of semiconductor technology while prudently managing immense capital expenditures, the company is positioning itself to be the exclusive enabler of future technological revolutions. This forward-looking decision directly influences the development of next-generation AI models, smarter consumer devices, and more powerful data centers. As the digital world demands ever-increasing levels of performance and efficiency, TSMC lays the foundation, one angstrom at a time, to build its future.