The stark reality of skyrocketing memory component prices has yet to reach the average consumer’s wallet, creating a deceptive calm in the technology market that is unlikely to last. While internal costs for manufacturers are hitting record highs, the price tag on your next gadget has remained curiously stable. This analysis dissects these hidden market dynamics, explaining why this calm precedes a storm and what it means for consumers. It explores the current state of the memory shortage, the strategies buffering consumers from the immediate impact, and the long-term outlook for device pricing.

The Anatomy of a Delayed Crisis

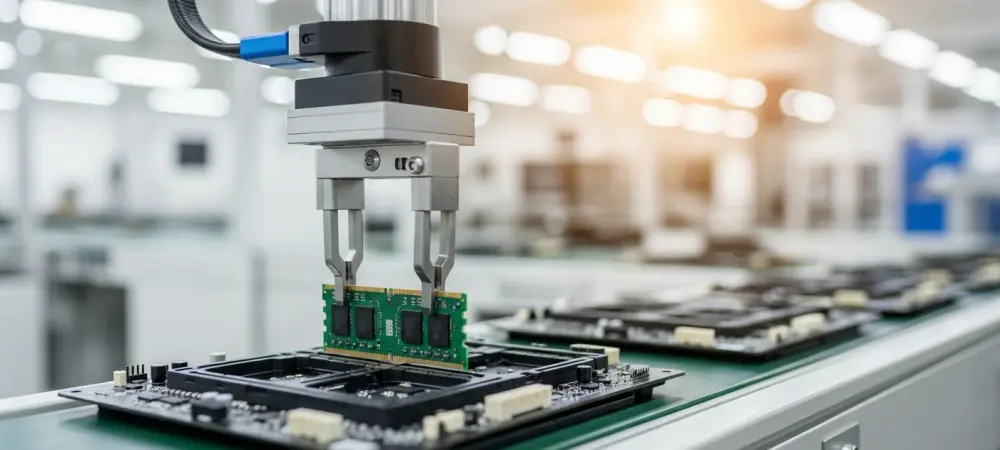

The Growing Divide Between Component and Retail Costs

A significant spike in the cost of memory components has created a supply-side crisis felt deeply within manufacturing circles. Data clearly shows this upward trend, yet a walk through any electronics store reveals something paradoxical: retail prices for major laptops, consoles, and smartphones have largely remained unchanged. This stability masks the underlying turmoil, creating a widening gap between production costs and what consumers pay at checkout.

This phenomenon is attributed to a “shockwave” effect, where a considerable lag exists between when a cost increase occurs in the supply chain and when it surfaces on a retail shelf. The journey from a component factory to a finished product involves numerous stages, each with its own inventory and pricing agreements. Consequently, it can take several months for the full financial impact to travel through this complex network and manifest as a higher price for the end user.

Real-World Buffers: How Major OEMs Absorb the Shock

The primary buffer against immediate price hikes has been the strategic foresight of large Original Equipment Manufacturers (OEMs). A prime case study is Asus, which has effectively insulated the market by securing components well in advance of production needs, thereby creating vast stockpiles. These reserves act as a financial cushion, allowing the company to absorb the initial surge in memory costs without immediately passing that burden on to its customers.

This strategy is particularly evident in the competitive console market. Sony, for example, is believed to have a substantial DRAM stockpile for its PS5 console, a move that could delay potential price hikes longer than its competitors. In contrast, other players in the space who may lack similar long-term supplier agreements could be forced to adjust their pricing much sooner, creating a potential shift in market dynamics as consumers weigh both performance and cost.

An Insider’s Warning on Finite Reserves

Insights from industry insiders confirm that this period of price stability is a temporary measure, not a new standard. Sascha Krohn, the Director of Technical Marketing at Asus, has emphasized that the current situation is a calculated delay. He warns that OEM stockpiles, while substantial, are ultimately finite. As these reserves are depleted over the coming months, companies will have no choice but to reflect the higher component costs in their product pricing.

The effects of this pressure are already visible among smaller companies that lack the scale and capital to absorb sustained losses. Framework, a company known for its modular notebooks, has already raised its prices, citing the direct impact of the memory shortage. This serves as a clear indicator that the market’s protective buffers are beginning to wear thin, with smaller players being the first to feel the strain.

The Road Ahead: Price Hikes and a New Normal

The short-term forecast indicates a gradual but inevitable increase in the prices of new devices as corporate stockpiles run dry. This adjustment is not expected to be a sudden, market-wide shock but rather a staggered series of increases as different manufacturers exhaust their reserves and introduce new product cycles. Consumers should anticipate that the next generation of laptops, phones, and consoles will likely launch with higher price tags than their predecessors.

Looking further ahead, Krohn offers a cautiously optimistic timeline, predicting that the underlying memory shortage could begin to ease by 2027 as new memory factories ramp up their production capacity. However, a significant long-term challenge looms even after supply stabilizes. History has shown that OEMs may be reluctant to reduce prices once the shortage ends. This could establish a new, permanently higher price baseline for consumer electronics, altering consumer expectations and budgets for years to come.

Conclusion: Preparing for the Coming Shift

The current memory shortage has created a ticking clock for consumer electronics pricing. An analysis of market behavior has confirmed that a buffer created by large OEM stockpiles has temporarily protected consumers, but this protection is a finite and dwindling resource. The impending price adjustments are poised to affect consumer purchasing power and reshape market dynamics across the entire tech industry. Ultimately, the situation signals that consumers need to anticipate rising costs for future technology, while the industry faces a critical test in how it manages pricing and consumer trust after the shortage eventually subsides.