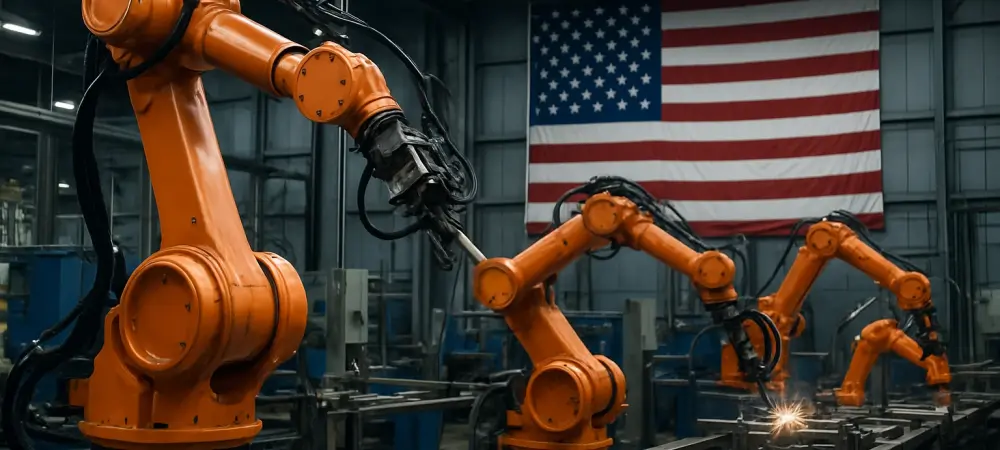

Imagine a factory floor where machines outnumber humans, tirelessly assembling products with precision and speed, addressing a critical labor shortage while boosting output. This scenario is no longer a distant vision but a rapidly unfolding reality across American industries. Automation, particularly through industrial robotics, is transforming the manufacturing landscape, offering solutions to some of the most pressing challenges faced by the sector today. This surge in robotic integration signals a pivotal shift, positioning the United States as a contender in a highly competitive global market. The focus here is on how this trend is reshaping industries through significant investments, market growth, and strategic foresight.

Surge in Domestic Robotics Manufacturing

Market Growth and Adoption Trends

The industrial robotics market in the US is on a steep upward trajectory, with projections estimating an increase of $3,212.3 million by 2030, driven by a compound annual growth rate (CAGR) of 5.8%. This growth reflects a burgeoning demand for automation as industries seek to optimize operations amid economic pressures. Such figures underscore the potential for robotics to redefine productivity standards, providing a much-needed boost to sectors struggling with inefficiencies.

Despite this promising outlook, the US continues to trail behind global leaders like China in robotics adoption. Reports from industry analyses highlight a significant gap, with the US installing fewer robots per worker compared to its Asian counterparts. This lag poses a challenge to maintaining a competitive edge in manufacturing, where speed and precision often dictate market share. Addressing this disparity remains a priority for policymakers and industry stakeholders alike.

To encourage investment in automation, legislative incentives such as the first-year depreciation allowance under the “Big Beautiful Bill,” effective until 2029, have been introduced. This measure aims to lower the financial barriers for companies adopting robotic technologies, fostering a more conducive environment for growth. Such policies signal a commitment to bridging the adoption gap and enhancing the nation’s industrial capabilities over the coming years.

Key Investments by Industry Giants

Yaskawa, a global leader in robotics, has taken a monumental step by establishing an 800,000-square-foot facility in Franklin, Wisconsin. This marks the company’s first high-volume robot production site on US soil, integrating production, training, and packaging under one roof. The facility is poised to streamline operations and cater to the rising demand for automation solutions across North America.

Similarly, FANUC has made a significant $110 million investment in a 650,000-square-foot expansion in Auburn Hills, Michigan. This West Campus development enhances manufacturing capabilities, offers extensive warehouse space for robots and spare parts, and houses the FANUC Academy for specialized training. Such infrastructure not only boosts production capacity but also prioritizes skill development for the workforce.

These expansions by Yaskawa and FANUC address critical supply chain vulnerabilities exposed by recent global disruptions. By localizing production, these industry giants ensure quicker access to advanced automation technologies for American manufacturers, reducing dependency on imports. This strategic move strengthens domestic industrial ecosystems, paving the way for more resilient and responsive supply networks.

Strategic Importance According to Industry Leaders

Expert opinions within the robotics sector emphasize the importance of onshoring production as a means to enhance supply chain resilience. Leaders argue that domestic manufacturing reduces risks associated with international disruptions, ensuring a steadier flow of critical technologies. This shift is seen as vital for sustaining economic growth in an era of uncertainty.

Industry voices also highlight how investments by companies like FANUC and Yaskawa can help close the adoption gap in the US. Beyond merely increasing production, these initiatives create high-skill job opportunities and foster innovation through collaboration between American and international engineers. Such partnerships are expected to drive technological advancements tailored to local needs.

However, challenges remain, as experts point to the absence of a comprehensive national robotics strategy. They stress the need for sustained legislative support to maintain momentum in this sector. Without cohesive policies and long-term planning, the full potential of these investments may not be realized, underscoring the importance of strategic governmental involvement.

Future Outlook for US Industrial Robotics

Looking ahead, the US could see a wave of increased foreign investments in robotics manufacturing, potentially positioning the nation as a global hub for this technology. As more companies recognize the benefits of localized production, the industrial landscape might shift dramatically, attracting further innovation and capital. This trend could redefine the country’s role in the international automation arena.

The benefits of such growth are manifold, including job creation in high-tech sectors and reduced lead times for robotic equipment delivery. Improved service capabilities will also enhance customer satisfaction across industries like manufacturing and logistics. Yet, challenges such as workforce readiness and the risk of over-reliance on technology must be addressed to ensure balanced progress.

Broader implications of enhanced automation extend to transforming multiple sectors, from revolutionizing assembly lines to optimizing supply chains. However, this rapid integration raises concerns about economic disparities, as smaller businesses may struggle to keep pace with technological advancements. Balancing innovation with inclusivity will be crucial to mitigating potential divides in the industrial ecosystem.

A Transformative Path Forward

Reflecting on the journey, investments by FANUC and Yaskawa marked a turning point for the US industrial robotics sector, bolstering market growth and workforce development. These initiatives tackled critical gaps in domestic production and adoption, setting a foundation for enhanced competitiveness. Their impact resonated through strengthened supply chains and elevated technological access for American industries.

As a next step, stakeholders were encouraged to build on this momentum by advocating for robust policies that support automation expansion. Investing in education to prepare a skilled workforce emerged as a priority, ensuring that technological advancements translated into widespread benefits. Collaborative efforts between government, industry, and academia promised to drive innovation further.

Ultimately, the path ahead demanded a unified commitment to nurturing this transformative trend. By fostering an environment conducive to growth through strategic incentives and partnerships, the US positioned itself to thrive in the global automation landscape. These actionable steps offered a blueprint for sustaining progress and securing a resilient industrial future.