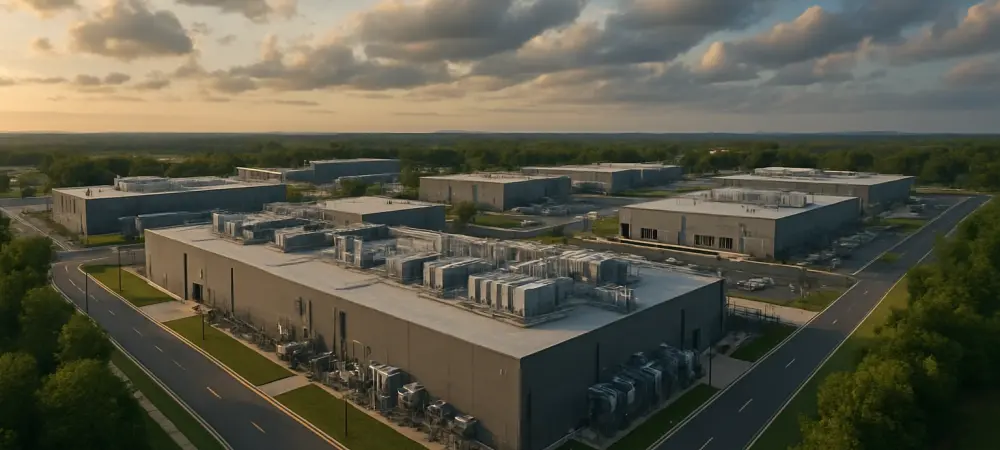

Virginia’s ascent as a pivotal hub for data centers is nothing short of remarkable, with the state now hosting over 35% of the world’s hyperscale data center capacity, often dubbed the “Data Center Capital of the World.” This explosive growth underscores a critical shift in the digital economy, where robust tech infrastructure is essential for supporting cloud computing, AI advancements, and global connectivity. As tech giants and developers pour billions into the region, Virginia’s landscape is transforming into a cornerstone of modern technology. This analysis delves into the surge of investments, spotlighting major projects by Google and other key players, exploring stakeholder insights, and examining the future trajectory of this transformative trend.

Surge in Data Center Investments in Virginia

Scale and Scope of Google’s Expansion

Google’s commitment to Virginia is a driving force behind the state’s data center boom, with a staggering $9 billion investment pledged through 2027. One flagship endeavor, codenamed Project Peanut, spans 300 acres in Chesterfield County near Richmond, featuring plans for three buildings, each encompassing 285,000 square feet. Acquired for $18.1 million, this site could see construction kick off imminently, with a phased approach starting with a single structure, reflecting the rapid pace of development.

Beyond Project Peanut, Google’s footprint extends to Project Skye in Moseley and Project Loch near Westchester Commons, collectively covering over 1,200 acres with acquisition costs nearing $60 million. Additional expansions in Bristow and Botetourt County, alongside a cloud region operational for several years and a recent $1 billion infrastructure pledge, highlight Google’s strategic focus on scalability. These initiatives position Virginia as a central node in the company’s global network, emphasizing long-term growth.

The financial scale and accelerated timelines of these projects illustrate not just corporate ambition but also confidence in Virginia’s infrastructure and policy environment. With multiple sites under development simultaneously, Google’s investments signal a transformative impact on regional tech capabilities, setting a benchmark for industry standards in the state.

Parallel Developments by Other Players

Meanwhile, other developers are seizing opportunities to contribute to Virginia’s data center landscape, notably the Province Group through Newport Equities LLC in Powhatan County. A significant milestone came with the rezoning approval of 61.8 acres off Page Road from agricultural to light industrial use, building on a prior 120-acre approval earlier this year. This combined 181-acre campus is poised to host a 2 million square foot data center with a capacity of 300-400MW.

Situated near the Chesterfield County line at the undeveloped Ellis Farm site in Midlothian, owned by JMS Investments LLC, this project overcame initial resistance from county staff and the Planning Commission. Local government ultimately greenlit the development after concessions were made, reflecting a pragmatic approach to balancing growth with community concerns. This approval marks a pivotal step for large-scale tech infrastructure in the area.

The Province Group’s initiative underscores a broader trend of diversified investment in Virginia’s data center sector, beyond the dominance of tech giants like Google. With plans for substantial capacity, this campus promises to enhance regional digital capabilities while navigating the complexities of local zoning and public sentiment, showcasing the intricate dynamics of such developments.

Stakeholder Perspectives on Economic and Strategic Impact

Local leaders in Powhatan County, including Vice Chairman Mark Kinney and Chairman Bill Donati Jr., have championed the economic upside of data center projects, highlighting substantial tax revenue potential with minimal disruption to community life. Their support reflects a strategic vision to integrate industrial growth into the county’s development plans, viewing these facilities as a boon for fiscal stability and regional prominence.

From a corporate standpoint, Google’s emphasis on Virginia as a strategic hub for cloud and data services reveals a calculated approach to scalability and market presence. The company’s multi-site expansions are not merely about physical infrastructure but also about cementing a long-term role in shaping the state’s tech ecosystem, aligning with broader industry demands for reliable, high-capacity data solutions.

However, the journey to approval in areas like Powhatan County was not without friction, as initial hesitations from local stakeholders underscored concerns over land use and industrial rezoning. Concessions played a critical role in swaying opinions, illustrating a nuanced balance between economic aspirations and community priorities. This diversity of perspectives enriches the discourse around data center proliferation, highlighting the need for collaborative solutions.

Future Prospects for Data Center Growth in Virginia

Virginia’s trajectory as a leading data center destination appears poised for further solidification, with sustained investments from tech behemoths like Google and emerging players like the Province Group. The state’s favorable policies, proximity to major markets, and robust connectivity infrastructure make it an attractive locale for continued expansion, potentially setting a national standard for tech hubs over the coming decade.

The benefits of this growth are manifold, including job creation in construction and tech sectors, as well as modernization of local infrastructure to support high-demand facilities. Yet, challenges loom, such as potential land use conflicts and environmental considerations tied to energy consumption and resource allocation. Addressing these issues will be critical to maintaining public support and ensuring sustainable development.

On a broader scale, the influx of data centers could reshape regional economic dynamics, striking a balance between commercial expansion and residential needs. As Virginia cements its role in the national tech landscape, the ripple effects may influence policy frameworks and investment patterns across other states, positioning the Commonwealth as a model for integrating technology with economic strategy.

Key Takeaways and Call to Action

Reflecting on the past, Virginia’s emergence as a data center powerhouse was fueled by Google’s multi-billion-dollar commitments and expansive projects like Project Peanut, alongside significant developments such as the Province Group’s 181-acre campus in Powhatan County. These milestones marked a pivotal era of tech infrastructure growth, supported by local approvals despite early challenges.

Looking ahead, stakeholders must prioritize sustainable practices and community engagement to navigate the complexities of rapid expansion. Policymakers and developers should collaborate on innovative solutions to address environmental concerns and land use tensions, ensuring that growth benefits all facets of society. Monitoring these evolving dynamics will be essential for shaping a balanced and forward-thinking tech ecosystem in Virginia.