The generative AI wave revolutionizing our digital lives carries an unseen price tag, one that is quietly inflating the cost of the next smartphone you will purchase. This massive global investment in artificial intelligence is straining the supply chain for critical components, forcing manufacturers into a corner. This analysis examines this emerging trend, exploring the surging price of RAM and using the upcoming Nothing Phone (4a) as a case study to explore the difficult choices brands now face and what this means for the future of consumer electronics.

The AI Boom’s Unseen Impact on Smartphone Hardware

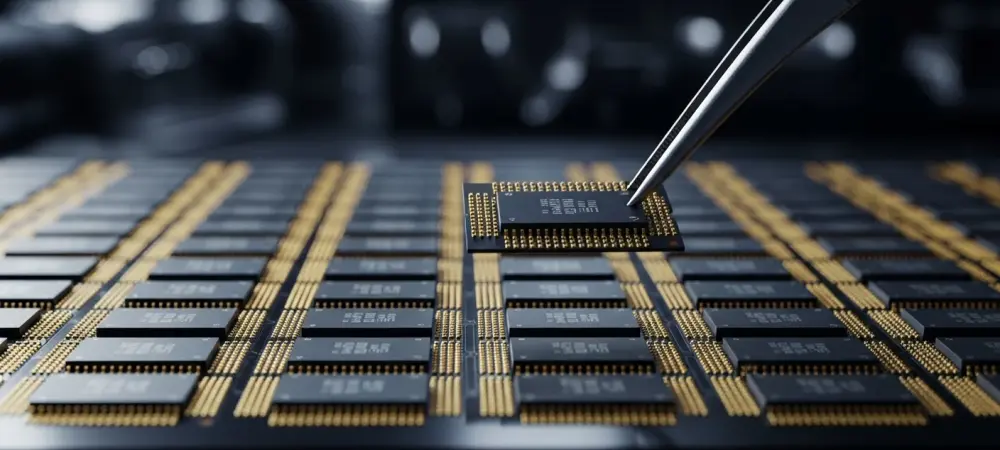

Surging Demand and the Soaring Price of Memory

Recent market data reveals a dramatic increase in RAM pricing, a direct consequence of the tech industry’s heavy investment in AI development. These advanced systems consume vast amounts of high-performance memory, creating a surge in demand that has rippled throughout the global supply chain, impacting everything from data centers to consumer-grade devices.

This shift has created a new market reality where manufacturers face unprecedented cost pressures for essential components. According to Nothing CEO Carl Pei, the competition for memory is no longer just between smartphone makers but now includes the entire AI sector, fundamentally altering the economics of device production and forcing a re-evaluation of product strategy.

Case Study: Nothing’s Strategic Pivot

In a clear application of this market pressure, Nothing has confirmed its upcoming Phone (4a) series will feature upgraded UFS 3.1 storage, a significant improvement over the UFS 2.2 found in previous models. This decision provides a tangible performance boost for users, enabling faster app loading times and file transfers.

However, this move marks a notable reversal of the company’s prior stance. Nothing previously claimed the real-world benefits of the faster storage were “marginal,” a justification for using the more cost-effective component. This pivot is a direct response to the new component landscape, where the rising cost of one part necessitates strategic changes in others.

Manufacturer Strategies in a High-Cost Environment

Carl Pei on the Inevitable Trade-Offs

Pei outlines a stark choice for phone manufacturers navigating this environment: either raise device prices significantly—by as much as 30%—or downgrade other specifications to offset the skyrocketing cost of RAM. This presents a difficult balancing act between maintaining profitability and delivering value to consumers.

He suggests this trend inadvertently benefits Nothing’s core philosophy of prioritizing a holistic user experience and unique design over winning a “war on specs.” The new economic reality forces a more deliberate focus on what truly matters to users, moving beyond simple component checklists to a more nuanced approach to product development.

A Reality Check on Market Performance

While Nothing’s strategy to focus on experience over raw specifications is a compelling narrative, the article notes that its current sales numbers do not yet reflect a market-leading advantage. Competitors who may opt for different compromises continue to hold dominant positions, suggesting that the broader market has not yet fully embraced this philosophy over the appeal of a high-end spec sheet.

Future Outlook: The New Economics of Consumer Devices

The End of Predictable Spec Bumps

Consumers should expect to see more devices with strategically unbalanced specifications. The era of every new model being a clear, across-the-board upgrade may be ending, replaced by more nuanced products that feature a mix of upgraded and downgraded components tailored to specific price points and use cases.

This shift will compel consumers to look beyond the spec sheet and consider the overall value and user experience a device offers. Brand reputation, software support, and design will likely play an even larger role in purchasing decisions as raw performance metrics become less straightforward to compare year-over-year.

Challenges and Opportunities for Niche Brands

This trend could create an opening for brands like Nothing to differentiate themselves on design, software optimization, and user experience rather than competing on component costs alone. It allows smaller players to carve out a niche by focusing on a specific vision instead of trying to match the raw power of flagship devices from larger rivals.

Conversely, the challenge remains significant. Smaller brands with less purchasing power may struggle to absorb component cost increases, potentially putting them at a severe disadvantage against larger manufacturers who can leverage vast economies of scale to secure better pricing and supply.

Conclusion: Adapting to an AI-Driven Supply Chain

Summary of Key Findings

The AI revolution’s immense demand for high-performance memory is fundamentally altering the smartphone component market. This trend is driving up RAM prices and forcing manufacturers like Nothing to make difficult strategic decisions about product features and pricing.

The upcoming Nothing Phone (4a) serves as a perfect example of this dilemma. Its upgrade to faster storage, while beneficial to users, is part of a broader calculus that must account for rising memory costs, leading to inevitable price hikes or other compromises in the final product.

A Forward-Looking Call to Action

The evolution of artificial intelligence ultimately had a profound impact, felt not just in the software we used but in the physical hardware we bought. Consumers and analysts alike had to adapt to a new reality, where the cost of innovation was reflected directly in the price and configuration of our most essential devices.