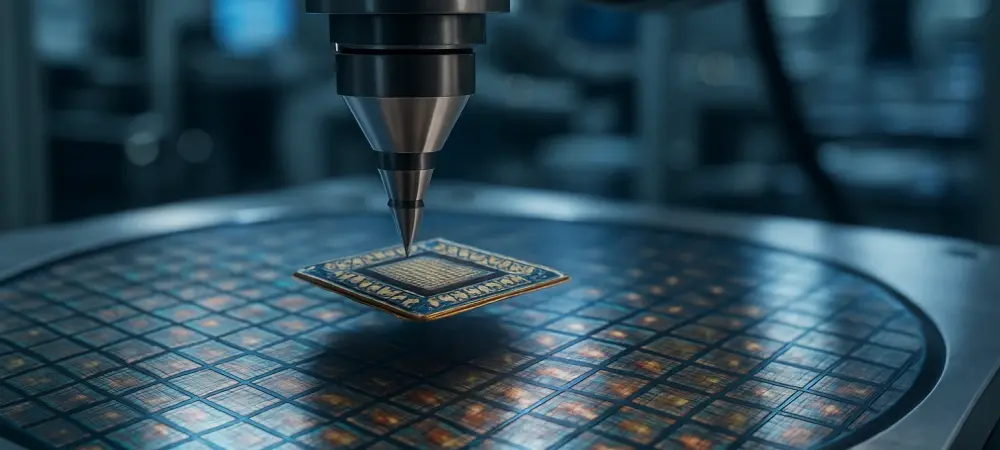

The microscopic world of semiconductor manufacturing has become the new global battlefield where nations and corporations are locked in a high-stakes race measured in nanometers. These advanced semiconductors are the bedrock of modern innovation, powering everything from the artificial intelligence revolution and high-performance computing (HPC) to critical national security systems. This analysis explores the key market drivers, the fierce competitive landscape, and the future trajectory of this critical technological frontier.

The Accelerating Drive for Next-Generation Nodes

The Market Push Unprecedented Demand for Cutting Edge Power

An insatiable demand for computational power, primarily from the burgeoning AI and HPC sectors, is fueling the race for smaller process nodes. These industries are the principal consumers of advanced 4nm, 3nm, and soon 2nm chips, which are essential for training complex algorithms and running sophisticated simulations. This surge is creating unprecedented pressure on foundries to deliver.

The AI boom, in particular, has generated overwhelming demand that is reshaping production strategies. Reports indicate that leading foundries like TSMC are now forced to prioritize and dramatically scale up capacity for their most advanced processes. This market pull is not just a tailwind; it has become the primary force dictating the pace and direction of manufacturing investment and innovation.

The Strategic Imperative Building Resilient Domestic Supply Chains

In response to both market demand and geopolitical pressures, companies are making bold strategic moves. TSMC’s decision to accelerate its 3nm production timeline at its Arizona facility to 2027, nearly a year ahead of schedule, serves as a prime example of this repositioning. This move aims to establish a resilient domestic supply chain for its key U.S. customers.

This acceleration is also a direct reaction to an intensifying competitive environment. Samsung Foundry is aggressively upgrading its Taylor, Texas, facility for 2nm production and has already secured a major deal with Tesla, signaling that customers are actively seeking alternatives. Meanwhile, Intel is making significant strides with its 18A process, creating a three-way race for market dominance that leaves no room for complacency.

Expert Perspectives The High Stakes Competitive Landscape

Industry analysts observe that market leaders like TSMC are under immense pressure to maintain their technological edge amidst this fierce competition. The consensus among experts is that aggressive capacity expansion is the only viable strategy to fend off determined rivals like Samsung and Intel, who are closing the gap with their own substantial investments.

However, this strategy is fraught with immense challenges. The capital expenditures required are staggering, with potential U.S. investments nearing $300 billion. Furthermore, global expansion efforts, including new facilities in Japan, are straining a limited pool of skilled labor, creating significant operational hurdles. Despite these obstacles, the cost of inaction is seen as far greater than the risks of expansion.

Charting the Future Beyond 3 Nanometer Fabrication

The industry’s roadmap now points decisively toward 2nm nodes and beyond, pushing the known physical and financial limits of Moore’s Law. As transistors shrink to the size of a few atoms, the engineering challenges and the cost of building new fabrication plants soar, raising fundamental questions about the long-term sustainability of this pace. Successfully navigating these challenges promises transformative benefits, including breakthroughs in AI capabilities, unprecedented computing power, and significant gains in energy efficiency. In contrast, the risks are equally substantial. The escalating production costs and intense geopolitical tensions tied to controlling the chip supply chain could stifle innovation and create global economic instability. The future of technology leadership, economic prosperity, and innovation itself hangs in the balance.

Conclusion The New Era of Semiconductor Supremacy

The analysis demonstrated that the relentless push in advanced chip manufacturing was driven by two powerful, converging forces: the surging, insatiable demand from the AI sector and the strategic global race to secure and control resilient supply chains. This technological frontier was confirmed as a critical arena that shaped the landscape of economic and geopolitical power.

Ultimately, the moves made by industry giants reflected a clear understanding that leadership in this sector was not optional but essential for future relevance. The high-stakes competition and staggering investments observed were not just part of a market cycle but defined the dawn of a new era of semiconductor supremacy.