Setting the Stage for Financial Transformation

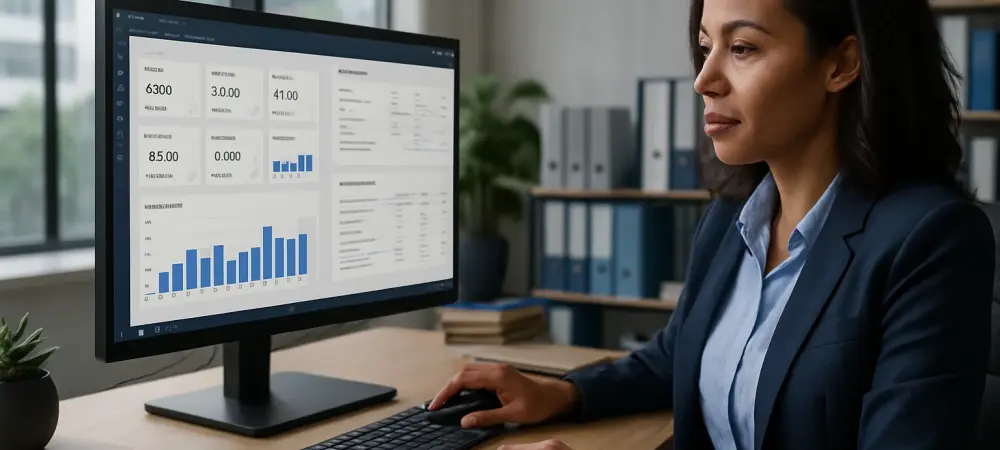

Imagine a global enterprise juggling the financial intricacies of multiple business units, each relying on shared services like IT and HR, yet struggling to allocate costs fairly and transparently. Inefficiencies creep in, errors multiply, and accountability falters under the weight of manual processes, a scenario far too common among large organizations where the complexity of financial management can hinder strategic growth. Microsoft Dynamics 365 Finance (D365 Finance) steps into this arena as a robust enterprise resource planning (ERP) solution, promising to streamline these challenges with automation and precision. This review dives deep into how this platform addresses the critical need for accurate cost allocation and enhanced decision-making in today’s fast-paced business environment.

The significance of D365 Finance lies in its ability to transform financial operations through data-driven tools. Designed for large enterprises, it tackles the daunting task of managing shared service costs across diverse segments. By integrating cutting-edge technology, the platform not only simplifies complex processes but also aligns with the growing demand for transparency in financial reporting. This sets the stage for a closer examination of its capabilities and real-world impact.

In-Depth Analysis of Key Features

Streamlining with Ledger Allocation Rules

At the heart of D365 Finance are its ledger allocation rules, a feature engineered to automate the distribution of costs across multiple accounts. This functionality minimizes manual intervention, reducing the risk of human error while ensuring that shared service expenses are allocated with precision. For enterprises managing centralized functions, this means costs for departments like Legal or Finance can be distributed equitably, reflecting true usage or predefined percentages.

The importance of this feature cannot be overstated, especially for organizations with intricate financial structures. Ledger allocation rules allow for both fixed and dynamic distributions, adapting to specific business needs. This adaptability ensures that financial managers can maintain control over allocations while saving significant time during reporting cycles, paving the way for more accurate financial insights.

Leveraging Statistical Accounts for Deeper Insights

Another standout aspect is the use of statistical accounts, which incorporate non-financial data as drivers for cost allocation. Metrics such as employee headcount, office space utilization, or service request volume can serve as the basis for distributing expenses. This approach enables a more nuanced and fair allocation process, ensuring that costs mirror actual resource consumption across business units.

By integrating these drivers, D365 Finance offers a level of customization that traditional methods often lack. Financial teams can tailor allocations to reflect operational realities, fostering a sense of fairness among departments. This capability not only enhances accuracy but also supports a deeper understanding of how non-financial factors impact overall costs, enriching the decision-making process.

Flexibility through Customizable Scheduling and Audit Trails

D365 Finance further distinguishes itself with customizable scheduling options, allowing allocations to be processed on a monthly, quarterly, or annual basis. This flexibility ensures alignment with organizational reporting cycles, accommodating diverse fiscal calendars and operational rhythms. Such adaptability is crucial for enterprises that require timely and relevant financial data to inform strategic planning.

Equally vital are the built-in audit logs, which provide a clear record of all allocation activities. These logs bolster transparency, making it easier to trace decisions and comply with regulatory standards. For businesses under strict governance requirements, this feature serves as a safeguard, ensuring that financial processes remain accountable and defensible during audits or reviews.

Trends Shaping Financial Automation

The broader landscape of financial management is witnessing a seismic shift toward automation and transparency, driven by the increasing scale and complexity of modern enterprises. Manual methods, once the norm, are being sidelined due to their propensity for errors and inefficiencies. D365 Finance aligns seamlessly with this trend, offering tools that replace cumbersome spreadsheets with sophisticated, data-driven solutions for cost allocation.

Beyond automation, there is a rising demand for integrated systems that unify cost distribution with comprehensive financial planning and analysis. D365 Finance meets this need by embedding allocation mechanisms within broader budgeting tools, enabling organizations to forecast expenses and allocate resources more effectively. This convergence of functionalities positions the platform as a forward-thinking solution in an era where holistic financial oversight is paramount.

Practical Impact Across Industries

Real-world applications of D365 Finance reveal its versatility in managing shared service costs across various sectors. Industries ranging from manufacturing to professional services utilize the platform to allocate expenses for centralized functions like IT, HR, and Legal. This ensures that each business unit bears a fair share of costs, enhancing visibility into segment-specific performance and accountability.

Consider a multinational corporation allocating IT expenses based on support ticket volume. Using D365 Finance, the company can track costs in a centralized cost center, dynamically distribute them based on actual usage data, and post allocations automatically during financial close. This practical implementation not only reduces administrative burden but also ensures that departments are charged according to their real consumption, driving fairness and operational clarity.

The ripple effect of such applications is significant, as they empower organizations to make informed decisions about resource allocation. By providing detailed insights into cost distribution, D365 Finance helps financial leaders identify inefficiencies and optimize spending. This fosters a culture of accountability, where business units are motivated to manage their reliance on shared services more effectively.

Navigating Challenges and Limitations

Despite its strengths, adopting D365 Finance is not without hurdles, particularly when transitioning from manual cost allocation methods. Traditional approaches often suffer from time inefficiencies, frequent mistakes, and a lack of auditability, creating a steep learning curve for teams accustomed to outdated systems. Initial setup of the platform can be complex, requiring careful configuration to align with existing processes.

Additionally, staff training emerges as a potential barrier, as employees must adapt to new workflows and functionalities. Resistance to change or gaps in technical expertise can slow down implementation, impacting early returns on investment. However, ongoing updates and support resources provided by Microsoft aim to mitigate these issues, simplifying adoption for organizations committed to modernizing their financial operations.

A balanced perspective acknowledges that while challenges exist, they are not insurmountable. Continuous improvements to the platform demonstrate a commitment to user-friendliness, with enhancements designed to address setup complexities and training needs. Enterprises willing to invest time in onboarding can unlock substantial benefits, overcoming initial obstacles with strategic planning and support.

Looking Ahead at Future Developments

Peering into the horizon, D365 Finance holds promise for even greater innovation in financial management. Potential enhancements, such as advanced AI-driven allocation models, could further refine cost distribution by predicting usage patterns and optimizing rules dynamically. Such advancements would elevate precision to new heights, catering to the evolving needs of complex enterprises.

Deeper integration with other Microsoft tools also looms as a likely direction, creating a more cohesive ecosystem for financial and operational data. This could streamline workflows across departments, linking cost allocation with broader business intelligence initiatives. As regulatory landscapes shift and business demands grow, these integrations will be crucial for maintaining compliance and agility.

The long-term impact of automated cost allocation on financial governance cannot be ignored. By embedding transparency and efficiency into core processes, D365 Finance is poised to redefine how enterprises approach strategic decision-making. Its adaptability to future trends and challenges ensures that it remains a relevant tool for organizations navigating an ever-changing economic environment.

Reflecting on the Verdict

Looking back, the evaluation of Microsoft Dynamics 365 Finance reveals a platform that excels in addressing the intricate demands of shared service cost allocation. Its robust features, from ledger allocation rules to statistical drivers, deliver unmatched accuracy and efficiency for large enterprises. The ability to automate complex processes and provide transparent audit trails stands out as a game-changer in financial management.

Beyond its current capabilities, the review highlights how the platform adapts to real-world challenges, offering practical solutions across industries. For organizations looking to move forward, the next step involves a strategic approach to implementation—investing in thorough training and leveraging Microsoft’s support resources to ease the transition. This ensures maximum value from the system’s extensive toolkit.

As a final consideration, enterprises are encouraged to explore how D365 Finance can integrate with their long-term financial goals, potentially unlocking new avenues for growth and oversight. The journey with this technology proves transformative, and those ready to embrace its potential find themselves well-equipped to tackle the future of financial governance with confidence.