The triumphant announcement of record-breaking subscription growth often masks a frantic, behind-the-scenes reality where finance teams are navigating a labyrinth of spreadsheets and manual corrections to simply close the books. This paradox highlights a critical, yet often overlooked, challenge for modern businesses: the very enterprise resource planning (ERP) system meant to be the financial bedrock is frequently the primary obstacle to scalable recurring revenue. As companies pivot toward continuous customer relationships, the structural limitations of traditional ERPs become a significant source of operational friction, turning a growth engine into an anchor.

This misalignment is not a minor inconvenience but a strategic threat. The inability of a core financial system to natively handle the complexities of subscriptions—from mid-term contract changes to usage-based billing—forces organizations into a reactive state. Instead of focusing on innovation and customer value, teams become consumed by managing exceptions, reconciling data, and patching together disconnected systems. The core issue is that while the commercial side of the business embraces a dynamic, non-linear model, the financial infrastructure remains rooted in a transactional, one-off paradigm, creating a chasm that manual effort alone cannot bridge indefinitely.

As Your Subscription Revenue Climbs, Why Is Your Finance Team Drowning in Spreadsheets?

For many organizations experiencing a surge in subscription services, the finance department paradoxically becomes less efficient as revenue increases. The month-end close process, once a predictable routine, extends into a painstaking exercise of manual data consolidation. Teams find themselves exporting data from the ERP into spreadsheets to manage renewals, calculate complex revenue recognition schedules, and track customer entitlements that the core system cannot interpret. These spreadsheets become de facto subsystems, operating outside the controlled environment of the ERP and introducing significant risk of human error.

This reliance on manual workarounds is a direct symptom of an architectural mismatch. An ERP like Microsoft Dynamics 365 FSCM excels at managing discrete, predictable financial events. However, the subscription lifecycle is a continuous stream of events—upgrades, downgrades, add-ons, pauses, and variable usage—that do not fit neatly into a traditional sales order and invoice structure. Consequently, finance professionals are forced to become system interpreters, manually bridging the gap between what the business sells and what the ERP can understand, a task that becomes exponentially more difficult with scale.

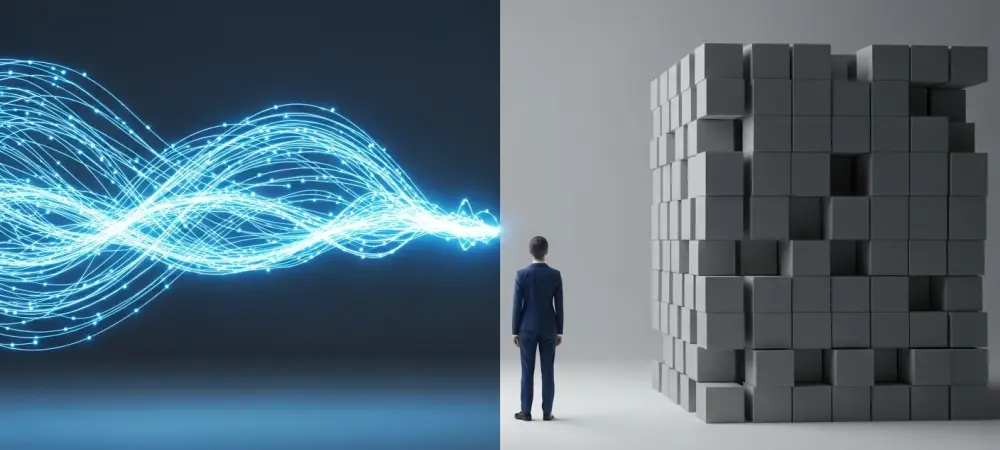

The Great Divide: Why Traditional ERPs Weren’t Built for Recurring Revenue

The fundamental conflict stems from a design philosophy. Traditional ERP systems were engineered to provide stability and control over linear, transactional business processes: an order is placed, a product is shipped, an invoice is sent, and revenue is recognized. This model prizes consistency and predictability, treating each transaction as a distinct and final event. It provides a powerful framework for financial governance in manufacturing, distribution, and project-based industries, where the value exchange is clearly defined and time-bound.

In stark contrast, the subscription economy operates on a model of continuous commerce and long-term customer relationships. The initial sale is merely the beginning of a fluid journey that can involve countless modifications over the contract’s lifetime. Revenue is not a single point-in-time event but a continuous stream that must be recognized over time, often according to complex standards like IFRS 15 and ASC 606. This dynamic, relationship-based model demands a system that can manage ongoing obligations and changes, a capability for which transactional ERPs were never architected.

The Warning Signs: How a Misaligned ERP Creates Operational Chaos

The operational strain caused by this misalignment manifests in several clear warning signs. One of the first indicators is a rise in billing inaccuracies and revenue leakage. When contract amendments are managed outside the core financial system, it becomes easy for billing triggers to be missed, resulting in under-charged customers or disputes over incorrect invoices. These errors not only impact the bottom line but also erode customer trust and increase administrative overhead as teams scramble to issue corrections and credits.

Moreover, a lack of unified visibility across the entire quote-to-value lifecycle becomes a significant handicap. Forecasting devolves into a reactive exercise of constant recalibration rather than a proactive strategic tool. Without a single system of truth that connects the commercial agreement, operational delivery, and financial reporting, leadership lacks a clear view of key metrics like annual recurring revenue (ARR), churn, and customer lifetime value. This information gap makes it difficult to make informed decisions, hampering the organization’s ability to respond to market changes or identify growth opportunities.

The Unsustainable Fix: Why Common Workarounds Lead to a Dead End

In an effort to cope, many organizations adopt one of two flawed strategies. The first is to fragment the subscription logic across multiple disconnected systems. Under this approach, the ERP is relegated to a simple back-office ledger, while critical processes like quoting, contract management, and usage tracking are handled in a CRM, a specialized billing add-on, or a collection of homegrown tools. While this may seem like a practical solution, it creates a brittle and complex architecture. Data synchronization becomes a constant challenge, compliance exposure increases, and the business is left without a single, authoritative view of its customer relationships.

The second common but equally unsustainable fix is to address the system’s limitations by increasing headcount. As transaction volume grows, more billing specialists and financial analysts are hired to manage the manual processes. This approach mistakes human capital for a scalable solution. It fails to resolve the underlying architectural problem, leading to operational costs that grow in lockstep with, or even faster than, revenue. This strategy also creates knowledge silos and makes the entire revenue operation more fragile and susceptible to disruption from employee turnover.

Expert Analysis: The Architectural Choice That Defines Scalability

Achieving durable growth in a subscription business is ultimately an architectural decision, not an operational one. The most resilient companies are those that proactively design their enterprise systems to reflect the realities of a recurring revenue model. This requires moving beyond tactical fixes and establishing an integrated revenue backbone that unifies the three critical domains of the business: the commercial agreement (what was sold), operational delivery (what the customer is entitled to receive), and financial reporting (how it is billed and recognized).

This unified framework creates a single source of truth that eliminates the friction between commercial agility and financial governance. When the system of record can natively manage the entire subscription lifecycle, from a complex initial quote to mid-term amendments and renewals, the need for external spreadsheets and manual interventions disappears. The ERP transforms from a passive repository of historical data into a dynamic, strategic asset that actively enables growth. This architectural choice is what separates businesses that scale gracefully from those that are crushed by their own success.

Building a Future-Proof Revenue Engine: A Strategic Framework

The path toward sustainable growth was paved not by replacing the core ERP, but by enhancing it with a subscription-native intelligence layer. Organizations that successfully navigated this transition made a strategic decision to embed the logic of recurring revenue directly within their central financial system. This approach preserved the robust governance and control of the ERP platform while equipping it with the agility needed to manage the entire quote-to-value lifecycle. This foundational shift allowed administrative effort to remain stable even as commercial complexity and transaction volume grew. By establishing a single, authoritative contract framework within the ERP, these businesses created end-to-end visibility and a transparent audit trail. This unified system orchestrated everything from contract origination and usage management to complex billing and revenue recognition, restoring confidence in financial reporting. The transformation turned the finance function from a reactive cost center into a proactive partner in growth, providing leadership with the clear, reliable insights needed to steer the company forward. Ultimately, the decision to address the problem at an architectural level was what enabled durable scalability without sacrificing control.