In the intensely competitive on-demand delivery market, where customer expectations for speed and affordability are perpetually rising against a backdrop of increasing operational costs, Southeast Asian platform operator Grab has made a decisive move by acquiring robotics firm Infermove. This strategic decision to internalize robotics development is not merely a technological upgrade but a fundamental business strategy aimed at creating a more sustainable economic model. By bringing this advanced capability in-house, Grab is positioning itself to gain greater control over its efficiency, manage the relentless pressure on delivery margins, and secure a long-term advantage in a sector defined by logistical complexity and razor-thin profits. This acquisition signals a critical pivot from relying on external solutions to building integrated, proprietary systems designed to tackle the core economic challenges of last-mile logistics head-on.

The Economic Imperative for Automation

A central motivation for Grab’s acquisition is the urgent need to manage the escalating operational costs that challenge the profitability of the entire on-demand delivery industry. With labor expenses steadily increasing and delivery margins tightening, major operators are compelled to explore automation as a primary means of cost containment. For a company operating at Grab’s immense scale, where millions of deliveries are facilitated daily, even marginal gains in operational efficiency can translate into substantial, outsized financial effects. By internalizing robotics development, Grab seeks to create a more resilient and sustainable economic framework that can better absorb the shocks of rising wages, fluctuating fuel costs, and the potential for increased regulatory scrutiny. This move represents a proactive strategy to re-engineer the cost structure of its delivery network, ensuring it can continue to grow without sacrificing its financial health in an increasingly demanding market.

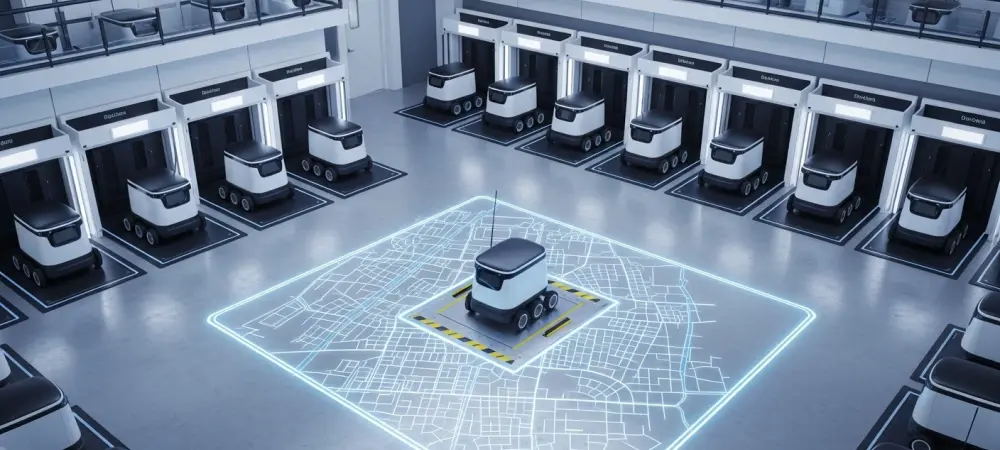

The selection of Infermove was a highly deliberate technological decision, reflecting a nuanced understanding of the challenges in urban logistics. Grab purposefully bypassed generic, off-the-shelf robotics systems in favor of Infermove’s specialized technology, which is engineered to learn and operate effectively within unstructured, real-world city environments. This distinction is critical to its potential success. Infermove’s robots are uniquely trained using vast amounts of real-world movement data, including information generated by Grab’s existing fleet of non-motorized delivery vehicles like scooters and bicycles. This innovative methodology allows the AI to learn from the intricate complexities of how humans actually navigate dense urban landscapes—including crowded pavements, unpredictable street crossings, and complex delivery points—rather than depending on the often-flawed and incomplete data derived from simulated environments. This real-world learning process is what equips the robots to handle the numerous “edge cases” that define urban logistics, a persistent challenge that simulations frequently fail to address adequately.

A Strategic Shift Toward Physical AI

The acquisition signifies a broader industry trend where large digital platforms are transitioning beyond using artificial intelligence merely as a software optimization layer and are now embedding it deep within their core physical operations. While the move into physical automation carries higher initial costs and operational risks, it promises more profound and structural gains in both efficiency and long-term resilience. By bringing this entire development process in-house, Grab gains direct and comprehensive control over the complete technology loop. This control is multifaceted, providing the company with direct influence over the pace of deployment, the precise operational scope of the robots, and the ability to make nuanced cost-trade-offs that align with its business objectives. Furthermore, it strategically diminishes long-term dependence on third-party vendors, whose priorities, regional focus, or economic models might not perfectly align with Grab’s specific needs and market dynamics in Southeast Asia.

Importantly, Grab’s strategy is not to wholly replace its extensive human workforce but rather to implement a complementary, hybrid model that augments the existing delivery network. The primary focus is on the selective deployment of automation in highly structured and repetitive segments of the delivery workflow, such as first-mile or last-mile logistics over short, predictable distances. In these controlled scenarios, robots can help manage significant operational challenges, such as smoothing out sudden demand spikes during peak hours, reducing delivery delays, and alleviating pressure on the human workforce, especially during periods of labor shortage. The organizational structure following the acquisition underscores this strategic focus, as Infermove will continue to operate as an independent entity. Its founder will report directly to Grab’s Chief Technology Officer, an arrangement designed to prioritize execution and continuity, allowing the robotics team to innovate without being encumbered by the immediate pressures of full-scale corporate integration.

A Calculated Investment in a Sustainable Future

This acquisition is best understood as a calculated, strategic investment in operational sustainability rather than a speculative venture into robotics as a new product category. The timing of this move is crucial, as the on-demand delivery market confronts a difficult equilibrium: customer expectations for faster and cheaper service are continually rising, while the costs to provide that service are increasing in parallel. Within this challenging context, automation is rapidly evolving from a technological novelty into a competitive necessity for any platform aiming to maintain high service levels without completely eroding profitability. By taking ownership of this technology, Grab is making a forward-looking bet on its ability to fundamentally improve the unit economics of its core business, preparing it for the next phase of industry competition where operational efficiency will be a key differentiator.

The decision to keep the technology and its associated data feedback loop entirely internal provided another significant advantage. Training effective physical AI systems requires massive volumes of real-world data, which Grab’s platform naturally generated through its daily operations. By controlling this entire loop, Grab could accelerate the iteration and improvement of its robotic systems and, crucially, avoid sharing sensitive operational data with any external partners. However, the path forward was understood to have significant limitations. Robots designed for pavements were not a panacea and would not replace human couriers across the entire network. Numerous real-world challenges, including adverse weather conditions, varying local regulations across different countries, and the critical factor of customer acceptance, continued to dictate where and how automation could be deployed effectively. The ultimate measure of success was not market-size forecasts but the tangible performance of these systems in live environments—specifically, their ability to lower the cost per delivery without introducing new points of failure into the logistics chain.