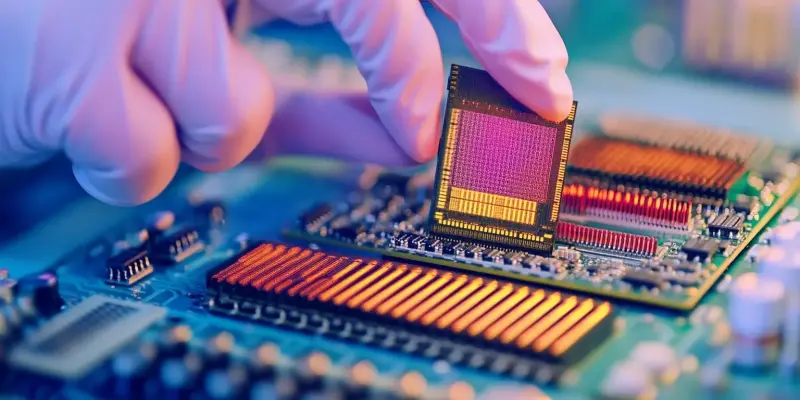

The CHIPS Act, introduced during President Biden’s tenure, sought to reclaim America’s dominance in the semiconductor industry by providing $280 billion in grants.Of this amount, $52 billion was specifically allocated for federal investments and tax breaks aimed at enhancing domestic semiconductor research, design, and manufacturing. This ambitious effort saw major companies like Intel, TSMC, and Samsung committing to establishing new facilities in the U.S., which bolstered hopes for revitalizing the sector. However, recent criticism from the Trump administration has cast doubt on the future of the CHIPS Act, raising concerns among industry stakeholders.

Trump Administration’s Critique

Former President Donald Trump and his administration have voiced significant criticism regarding the CHIPS Act, arguing it allocates considerable funds to corporations without delivering sufficient tangible benefits. This sentiment has been echoed by several policymakers, leading to increased scrutiny and debate over the effectiveness and efficiency of the CHIPS Act.A recent report by the Korean media outlet Chosun has intensified these concerns, suggesting that the act might soon be phased out. This development follows the resignation or layoff of over 120 employees from the Commerce Department’s Chip Program Office (CPO), including Dan Kim, the former Vice President of SK hynix, signaling potential dismantling of these incentives.

The Trump administration’s critique centers around perceptions of inefficiency and misplaced priorities. The argument posits that despite the large financial incentives provided to companies, there has been a lack of observable progress or substantial returns on investment. This has led to calls for a reassessment of the strategy to ensure better allocation and utilization of resources, focusing more keenly on delivering measurable outcomes. Additionally, there are debates about the regional impact of the funding and whether it adequately addresses the needs of the U.S. semiconductor landscape.

Uncertain Future for Semiconductor Incentives

The future of the CHIPS Act appears increasingly uncertain as discussions within federal circles suggest various potential outcomes, including scaling down subsidies or completely eliminating the program.This uncertainty is compounded by the restructuring efforts led by Elon Musk’s DOGE division, which aims to overhaul federal spending initiatives. These efforts have led to significant workforce reductions and have further fueled speculation about the possible termination of the CHIPS Act.

Trump’s statements imply a reduced focus on South Korean firms like SK hynix and Samsung, raising questions about the broader implications for the incentives intended to bolster domestic semiconductor production.The possible withdrawal or reduction of support for these international companies could jeopardize the intended benefits of the CHIPS Act, namely boosting U.S. semiconductor manufacturing capabilities through collaborations and investments. The wavering commitment to the CHIPS Act has prompted stakeholders to re-examine the future strategy for maintaining competitive advantage in the global semiconductor industry.Overall, the trends observed indicate a significant shift in federal policy regarding the support and incentives provided to the semiconductor industry. The current trajectory suggests a move away from the expansive support initially envisioned under the CHIPS Act, focusing instead on a more scrutinized and perhaps restrained approach. The uncertainty surrounding this shift has created anxiety and calls for clarity among technology firms and policymakers invested in the semiconductor sector.

Key Takeaways and Future Considerations

The CHIPS Act, introduced during President Biden’s presidency, aimed to reclaim the United States’ dominance in the semiconductor industry by offering $280 billion in grants.Of this substantial amount, $52 billion was earmarked for federal investments and tax breaks to boost domestic research, design, and manufacturing in the semiconductor field. This bold initiative encouraged major players like Intel, TSMC, and Samsung to commit to building new facilities within the United States, raising hopes for the revival of the sector. However, recent criticism from the Trump administration has clouded the future of the CHIPS Act, causing uncertainty among industry stakeholders.The concerns raised question the ongoing support and effectiveness of the Act, leading to debates about the best way forward for the U.S. technology industry and its global competitiveness. The ongoing contention suggests that the path to restoring America’s semiconductor supremacy may be more complex and politically fraught than initially anticipated.