ASML Holding, the preeminent Dutch chip equipment manufacturer, issued a strikingly optimistic forecast for the global semiconductor industry, predicting its value will surpass $1 trillion by 2030. This ambitious projection hinges heavily on booming demand from the AI sector. The role modern semiconductors play in powering AI accelerators and servers has made them indispensable to tech giants such as NVIDIA. These companies are substantially increasing their orders, driven by a rapidly escalating need for more advanced and efficient computing capabilities.

ASML’s bullish outlook is buoyed by its advancements in extreme ultraviolet (EUV) technology and an extensive lithography portfolio, which, according to CEO Christophe Fouquet, strategically position the company to capitalize on AI-driven opportunities. Fouquet confidently projects ASML’s revenue and profitability will see a significant boost, with equipment sales anticipated to reach approximately $46 billion by the end of the decade. This surge would be primarily driven by the expected proliferation of AI applications across various industries, necessitating the continuous development of cutting-edge semiconductor technology.

ASML’s Crucial Role in AI Hardware Development

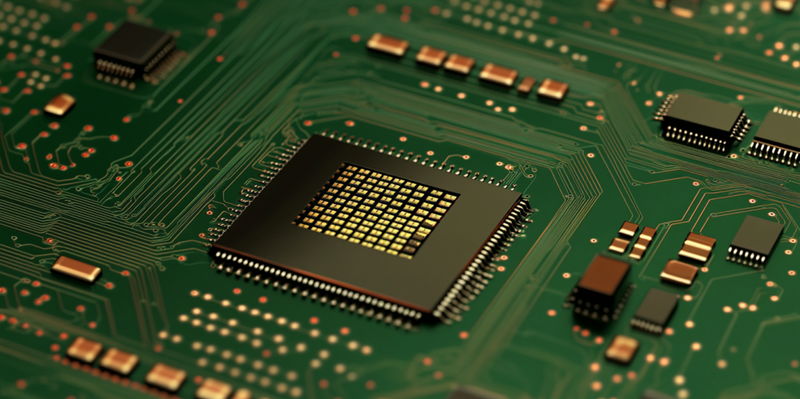

ASML is a cornerstone in the semiconductor supply chain, supplying essential chip-making equipment to leading semiconductor manufacturers like TSMC and Samsung. These firms, in turn, develop semiconductors integrated into AI hardware produced by tech behemoths such as NVIDIA and AMD. A notable highlight in ASML’s technological arsenal is its High-NA EUV equipment. Esteemed for its exceptional precision and capabilities, this advanced equipment is both highly exclusive and expensive, underscoring its paramount importance in producing the next generation of semiconductors.

However, ASML’s journey hasn’t been devoid of challenges. The company recently grappled with a weaker earnings report significantly impacted by several external factors. One of the most noteworthy setbacks was the imposition of US sanctions, which curtailed ASML’s ability to conduct business with China, a major market for semiconductor equipment. Despite these hurdles, ASML remains unwavering in its optimism about future growth. The company envisions the global semiconductor market will expand at an annual rate of approximately 9% between 2025 and 2030, driven by the ever-increasing demand for AI chips.

Projections and Future Outlook for the Semiconductor Industry

ASML Holding, the leading Dutch producer of chip-making equipment, has issued a remarkably positive forecast for the global semiconductor market, predicting that its value will exceed $1 trillion by 2030. This forecast relies heavily on the surging demand from the AI sector. Modern semiconductors, critical for powering AI accelerators and servers, have become essential to tech giants like NVIDIA. These companies are significantly boosting their orders due to the rapidly increasing need for advanced and efficient computing capabilities.

ASML’s optimistic outlook is bolstered by its breakthroughs in extreme ultraviolet (EUV) technology and a comprehensive lithography portfolio. CEO Christophe Fouquet claims these advancements strategically position the company to take full advantage of AI-driven opportunities. Fouquet anticipates a major increase in ASML’s revenue and profitability, with equipment sales projected to hit around $46 billion by the decade’s end. This growth is expected to be primarily driven by the proliferation of AI applications in various industries, necessitating ongoing development of state-of-the-art semiconductor technology.