The explosive growth of artificial intelligence is unintentionally casting a long shadow over the consumer PC market, creating a battlefield where gamers and AI developers now compete for the same critical hardware. This intensifying rivalry for components has triggered a period of significant volatility, putting immense pressure on supply chains and challenging the long-held expectations of affordability in the technology sector. As market forces clash, manufacturers and consumers alike are navigating an unpredictable landscape where the next generation of innovation is directly tied to the availability of essential building blocks.

The Battlefield of Bits: A Look at the Pressured PC Component Market

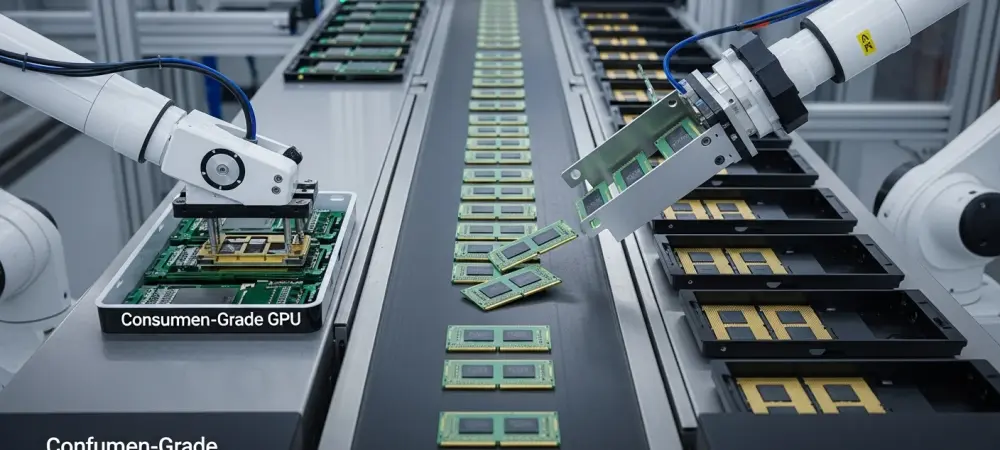

The modern PC hardware industry is defined by a fundamental tension between the ever-expanding consumer gaming sector and the exponentially growing, highly lucrative AI boom. On one side, millions of gamers demand powerful graphics cards for immersive experiences. On the other, the AI industry requires massive quantities of high-performance components for training complex models, creating a demand that has reshaped manufacturing priorities globally.

This competitive environment involves a complex web of key players. GPU titans like AMD and NVIDIA are at the center, designing the processors that power both gaming rigs and AI data centers. However, their production is critically dependent on major DRAM suppliers, who manufacture the high-speed memory essential for GPU performance. DRAM is a universal component, vital not just for graphics cards but also for pre-built PCs, laptops, and smartphones, making its scarcity a problem that echoes across the entire electronics industry.

Market Dynamics: Trends and Projections in the DRAM Crisis

The AI Ripple Effect: Tracing the Source of the Component Shortage

The primary driver of the current component crisis is the voracious appetite of the AI sector for high-bandwidth DRAM. This demand has not only outstripped supply but has also fundamentally altered the market’s direction. Major memory manufacturers are increasingly shifting their production lines and research focus away from the consumer business to serve the more profitable and predictable AI industry. This strategic pivot is a rational economic decision, yet it leaves the consumer segment facing the consequences of a shrinking supply pool.

This shift represents a significant evolution in market dynamics. Previously, the consumer sector was a primary driver of innovation and volume for memory makers. Now, it is secondary to the demands of enterprise-level AI development. As a result, the supply chain for consumer-grade components has become more fragile, subject to the overflow capacity and pricing strategies dictated by the needs of a more powerful industrial customer.

Reading the Market Signals: Price Projections and Supply Forecasts

Market data presents a clear and concerning picture: the prices for essential components, particularly DRAM, have been on a continuous upward trajectory. This trend is not a temporary spike but a sustained increase reflecting a fundamental imbalance between supply and demand. Analysts project that this price volatility will continue, making it difficult for manufacturers to maintain stable pricing for finished goods like graphics cards.

Looking ahead, the forecast for the consumer GPU market remains clouded by these challenges. The sustained demand from the AI industry suggests that supply constraints for consumer products will persist. Consumers should anticipate an extended period of unpredictable pricing and potential stock shortages for new and existing graphics card models, as the battle for a limited supply of critical memory chips rages on.

The Core Challenge: AMD’s Tough Math in an Era of Scarcity

For AMD, the central obstacle is a matter of what the company’s Vice President for Ryzen, David McAfee, terms “tough math.” The goal of building and selling affordably priced graphics cards becomes an immense challenge when the cost of a single, critical component like memory is at an extreme high. This environment forces difficult trade-offs between performance, price, and profit margins, complicating product roadmaps and marketing strategies.

The situation is further complicated by major shifts in the supply chain. The recent exit of one of the three major memory manufacturers from the consumer business has tightened the available supply for everyone. This development creates a shared struggle for both AMD and its chief competitor, NVIDIA, as both companies must now compete for a smaller pool of available DRAM. This scarcity amplifies the difficulty of securing the volume of memory needed to meet consumer demand.

Alliances Under Pressure: AMD’s Strategic Supply Chain Management

In response to these market pressures, AMD’s primary strategy revolves around its long-standing, strategic partnerships with the remaining DRAM manufacturers. These established relationships are crucial for navigating the crisis, as they allow the company to negotiate for supply and work toward more favorable economics than would be possible on the open market. This proactive supply chain management is a cornerstone of AMD’s effort to shield its GPU business from the worst of the market’s volatility.

Furthermore, AMD is engaged in a form of industry self-governance, working closely with its board partners who manufacture and sell the final graphics cards. This collaboration is aimed at finding ways to collectively absorb rising memory costs rather than passing them on entirely to the consumer. By managing the memory ecosystem from within, AMD and its partners hope to maintain a degree of price stability and ensure that their products remain accessible.

The Road Ahead: The Future of Consumer GPU Affordability

The future of the consumer GPU market appears set to be defined by the ongoing conflict between the needs of gamers and the insatiable demand of the AI industry. This competition for a finite supply of high-performance DRAM will likely continue to dictate pricing and availability for the foreseeable future. As long as AI remains the more profitable venture for memory suppliers, the consumer segment will have to adapt to being a secondary priority.

This prolonged period of scarcity could serve as a market disruptor, influencing future product development. GPU manufacturers may be forced to explore alternative memory technologies or design architectures that are less dependent on the most sought-after types of DRAM. However, such shifts require significant research and development, meaning that in the short to medium term, consumers will likely bear the brunt of the supply shortage through higher prices and limited product availability.

Final Verdict: A High-Stakes Gamble on Price Stability

In summary, the PC components market is navigating a period of profound disruption. The core findings of this analysis point to a structural shift in the DRAM industry, where the demands of the AI sector now overshadow the needs of the consumer market. This has created a persistent shortage and a sustained increase in component costs, directly impacting the affordability of consumer electronics.

AMD’s stated commitment to keeping GPU prices low stands in stark contrast to these powerful market realities. The company’s reliance on strategic partnerships and collaboration with board partners represents a significant effort to mitigate these pressures. However, these strategies are being tested against overwhelming economic forces, and the prospects for consumers remain uncertain. Ultimately, AMD’s ability to maintain price stability is a high-stakes gamble in a market that currently favors the industrial might of AI over the demands of the everyday gamer.