Setting the Stage for a Digital Powerhouse

In an era where data drives everything from artificial intelligence to global business operations, the announcement of Aker Nscale’s plan to build a 250MW data center in Narvik, Norway, signals a seismic shift in the digital infrastructure landscape. With global data consumption projected to grow exponentially—fueled by AI workloads and cloud computing—the demand for hyperscale facilities has never been higher. This project, situated on a site in Korgen previously owned by Nordkraft, positions Aker Nscale, a joint venture between investment firm Aker and former cryptomining entity Nscale, at the forefront of meeting this insatiable need. The facility, pending power allocation approval from Statnett, Norway’s power system operator, underscores the critical intersection of energy resources and technological advancement.

This market analysis aims to dissect the implications of Aker Nscale’s latest venture within the broader context of the data center industry. By examining current trends, strategic partnerships, and regional advantages, the focus is on understanding how such developments shape investment opportunities and competitive dynamics. The significance lies not just in the scale of this 250MW project but in what it reveals about the future of sustainable, high-performance computing infrastructure on a global stage.

Diving Deep into Market Trends and Projections

Norway’s Emergence as a Data Center Hotspot

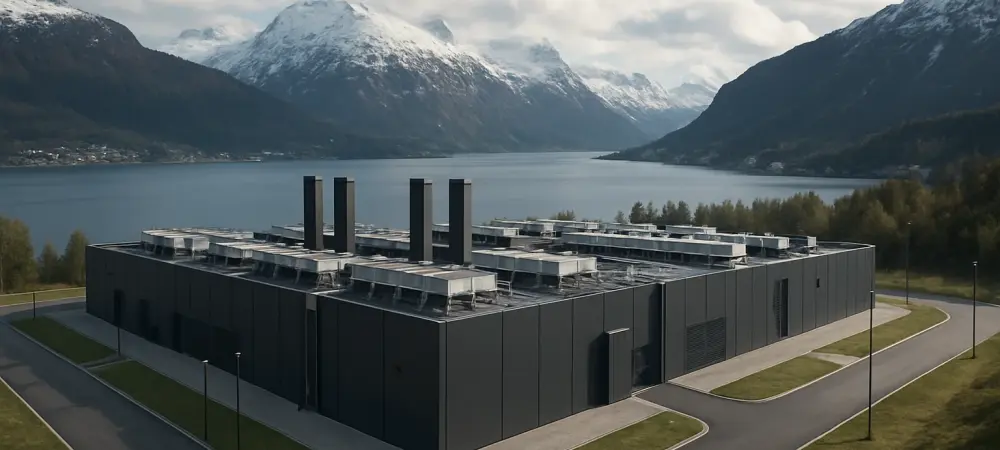

Norway has rapidly become a prime destination for data center investments, thanks to its cool climate and abundant renewable energy, primarily hydropower. These natural advantages significantly lower cooling costs—a major expense for data centers—and align with the industry’s push for sustainability. Aker Nscale’s decision to locate its 250MW facility in Narvik capitalizes on these benefits, reinforcing a growing trend where tech firms prioritize regions with green energy profiles. Market data suggests that Northern Europe, with Norway at the helm, could see a 15% annual growth in data center capacity over the next five years, driven by both environmental and economic incentives.

Beyond natural advantages, Norway’s infrastructure supports the immense power demands of modern facilities. The country’s grid stability and access to clean energy make it a standout compared to other regions struggling with fossil fuel dependency. However, challenges loom as the scale of projects like Narvik’s raises concerns about grid capacity. Industry observers note that balancing energy allocation with environmental oversight will be critical for sustained growth in this market segment.

Aker Nscale’s Strategic Positioning and Financial Backing

Aker Nscale, formed as a spinoff from cryptomining firm Arkon Energy in 2024, has quickly carved out a significant presence in the data center sector. Already operating a 30MW facility in Glomfjord Industrial Park with plans to expand to 60MW, the company demonstrates agility in scaling operations. Bolstered by a $1.1 billion Series B funding round led by Aker in late 2025, Aker Nscale benefits from robust financial support. Aker itself reported a 7.43% year-on-year increase in net asset value in the second quarter of this year, climbing to NOK 66.5 billion ($6.5 billion), highlighting its capacity to fuel ambitious projects like the one in Narvik.

The company’s strategic partnerships further amplify its market position. Collaborations with tech giants like OpenAI and Microsoft underscore its role in supporting AI and cloud computing demands. For instance, a $6.2 billion, five-year deal to provide computing power to Microsoft, alongside supplying 116,000 GB300 GPUs across facilities in Texas and Portugal, positions Aker Nscale as a key player in hyperscale infrastructure. Such alliances not only drive revenue but also signal investor confidence in the company’s ability to meet future computational needs.

Global Expansion and Competitive Dynamics

Aker Nscale’s ambitions extend well beyond Norway, reflecting a broader industry trend toward globalized data center networks. In the UK, a £2.5 billion (approximately $3 billion) commitment to build a facility in Loughton, Essex, alongside involvement in the Stargate UK project with OpenAI, showcases its international footprint. The deployment of up to 31,000 GPUs across UK facilities highlights the scale of operations targeting AI workloads. Similarly, the European Stargate project in Kvandal, Norway, with a planned capacity of 230MW expandable to 290MW, targets 100,000 Nvidia GPUs by the end of 2026, illustrating a forward-looking approach to market demands.

Comparatively, Aker Nscale faces stiff competition from other data center operators expanding in similar regions. Companies leveraging modular designs and edge computing are gaining traction, posing potential challenges to fixed facilities. Yet, Aker Nscale’s ability to secure multi-billion-dollar contracts and align with industry leaders provides a competitive edge. Market projections indicate that hyperscale data centers will dominate investment flows through 2027, with annual spending expected to surpass $300 billion globally, a trend that Aker Nscale is well-poised to exploit despite risks like fluctuating energy costs and geopolitical uncertainties.

Regulatory Impacts and Sustainability Pressures

The regulatory landscape is a pivotal factor shaping the data center market, particularly in Norway. Since July 1 of this year, the Norwegian government has mandated that data centers register detailed operational data, including energy consumption, to ensure responsible growth. This move reflects a global push for sustainability amid concerns over the sector’s massive power usage. While Norway’s renewable energy resources offer an advantage, the scale of projects like the 250MW Narvik facility tests the limits of grid infrastructure, prompting debates on long-term capacity planning.

Sustainability pressures are reshaping market expectations, with investors increasingly favoring operators who prioritize energy efficiency. Innovations such as liquid cooling and advanced power management systems are gaining traction as solutions to reduce environmental footprints. For Aker Nscale, navigating these regulations while scaling operations will be crucial. Market analysis suggests that proactive collaboration with policymakers could mitigate risks, positioning compliant companies as leaders in a sector under growing scrutiny.

Reflecting on Market Insights and Strategic Pathways

Looking back, the analysis of Aker Nscale’s 250MW data center project in Narvik reveals critical dynamics in the digital infrastructure market, from Norway’s unique advantages to the competitive edge of strategic partnerships with tech giants like OpenAI and Microsoft. The examination of global expansion efforts and regulatory challenges paints a comprehensive picture of an industry at a crossroads, balancing unprecedented demand with sustainability imperatives. These findings underscore the transformative potential of hyperscale facilities in driving AI and cloud computing advancements.

Moving forward, stakeholders are advised to consider strategic investments in regions with renewable energy profiles, mirroring Norway’s model, to capitalize on cost efficiencies and environmental benefits. Companies need to prioritize scalable, energy-efficient designs to stay ahead of regulatory curves and market expectations. For Aker Nscale and similar players, forging deeper collaborations with technology leaders and policymakers emerges as a vital step to secure power resources and market share. Ultimately, the path ahead hinges on innovating operational models to ensure that the digital revolution remains both profitable and sustainable for the long term.