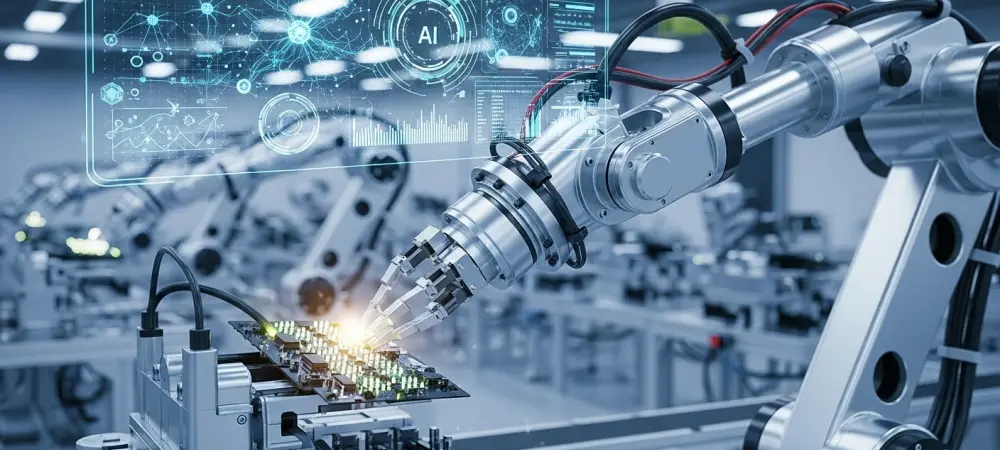

The global industrial robotic arm market is undergoing a profound transformation, evolving from a specialized tool into a foundational asset for competitive global enterprises. This shift is powered by the convergence of Industry 4.0 strategies, the need for resilient supply chains, and rapid technological advancements. At the forefront of this evolution is artificial intelligence, which, combined with human-robot collaboration, is reshaping the landscape of advanced manufacturing and logistics, making automation an indispensable part of modern industry.

A Decade of Explosive Growth

The market’s robust health is underscored by its valuation of USD 18.49 billion in 2025, reflecting widespread adoption across key sectors like automotive, electronics, and aerospace. Projections indicate a sustained and powerful expansion over the next decade, with the market expected to more than double to USD 45.41 billion by 2035. This growth, driven by a compound annual growth rate of 9.4% from 2026 to 2035, is fueled by the global push toward fully automated production environments and the integration of robotic arms into the fabric of the modern smart factory. These robotic systems, which encompass a variety of designs such as articulated, SCARA, and collaborative robots, are now considered integral components of advanced manufacturing, where they are instrumental in enhancing efficiency, improving product quality, and promoting sustainable operational practices.

A closer look at the market’s composition reveals specific segments poised for significant leadership by 2035. Articulated robots are set to dominate, capturing an estimated 48.5% of the total revenue share due to their exceptional versatility and dexterity. Their multi-axis design, which mimics the human arm, allows for a wide range of motion, making them suitable for complex tasks like high-precision assembly, automated welding, and sophisticated material handling. In parallel, the lightweight payload category, specifically arms carrying payloads below 5 kg, is projected to command over 30.8% of the revenue. This segment’s growth is directly linked to the burgeoning electronics industry, which requires delicate handling of small components, and the expanding market for collaborative robots, or cobots, designed for safe interaction alongside human workers.

A Global Look at Regional Leadership

North America is anticipated to maintain a strong and highly competitive market position, capturing over 27.2% of the total global revenue share by 2035. The primary driver of this growth is a strategic push by manufacturers in the United States and Canada to leverage automation as a tool for strengthening domestic supply chains. By investing heavily in robotics, companies are not only enhancing their operational resilience but also advancing onshoring or “reshoring” initiatives aimed at bringing critical manufacturing capabilities back to the continent. This strategic focus positions the region as a key player in the next generation of advanced, localized manufacturing, reducing reliance on overseas production and creating more agile industrial ecosystems.

In contrast, Europe is pursuing significant growth through a dual-pronged strategy of modernization and diversification. Industrial powerhouses like Germany, France, and Italy are actively upgrading their aging manufacturing infrastructure with advanced robotics, particularly within their world-class automotive sectors. Concurrently, there is a notable expansion of robotic arm usage into other key industries, including pharmaceuticals, food and beverage processing, and heavy machinery, where automation can drive new efficiencies and maintain a competitive edge. Meanwhile, the Asia Pacific region is projected to experience the most rapid growth during the forecast period. This accelerated expansion is underpinned by its status as a global manufacturing hub, with robust industrial activity in China, Japan, and South Korea, where robotics adoption is a central pillar of national industrial policy.

The Innovations Redefining Robotics

The most significant trend shaping the evolution of the industrial robotic arm market is the deep integration of artificial intelligence, machine vision, and advanced data analytics into robotic systems. This fusion of technologies is transforming robotic arms from pre-programmed machines into intelligent, autonomous agents capable of real-time decision-making, adaptive control in dynamic environments, and predictive maintenance to maximize uptime. AI-powered robots are delivering unprecedented levels of operational intelligence and efficiency in tasks ranging from precision assembly and quality defect inspection to complex warehouse automation. These smart systems can learn from their environment, adjust their actions based on sensory input, and optimize processes without human intervention, marking a pivotal shift toward fully autonomous production.

Building on this intelligent foundation, human-robot collaboration and a focus on sustainability are becoming equally transformative forces. Collaborative robots, or cobots, continue to gain significant market traction by augmenting human capabilities rather than replacing them. These robots are designed to operate safely in shared workspaces, performing repetitive, strenuous, or ergonomically challenging tasks, thereby freeing human workers to focus on more complex, value-added activities. Simultaneously, a growing emphasis on sustainability is driving the design of robotic arms that are more energy-efficient, modular for easier repairs, and reusable to support circular manufacturing principles. This focus allows manufacturers to reduce their environmental footprint while gaining the flexibility to rapidly reconfigure production lines, a crucial capability for navigating today’s volatile supply chain landscape.

A Landscape Forged by Strategic Moves

Recent corporate developments have underscored the market’s dynamic and competitive nature, reflecting a period of intense innovation and strategic positioning. Partnerships for advancing technology were a key theme, as seen in the collaboration between Dexterity and HIWIN Technologies to produce sophisticated AI-enabled dual-arm robotic systems aimed at revolutionizing warehouse applications. At the same time, established players like ABB demonstrated a commitment to broadening their market reach by launching new heavy-duty industrial robot arms designed for high-payload applications. Strategic investments also played a crucial role, with Yaskawa Electric’s announcement of an expanded robotics campus in Wisconsin signaling a strong commitment to bolstering manufacturing capacity and serving the vital North American market. These moves collectively painted a picture of an industry focused on pushing technological boundaries and solidifying regional footholds.