Payroll

- Payroll

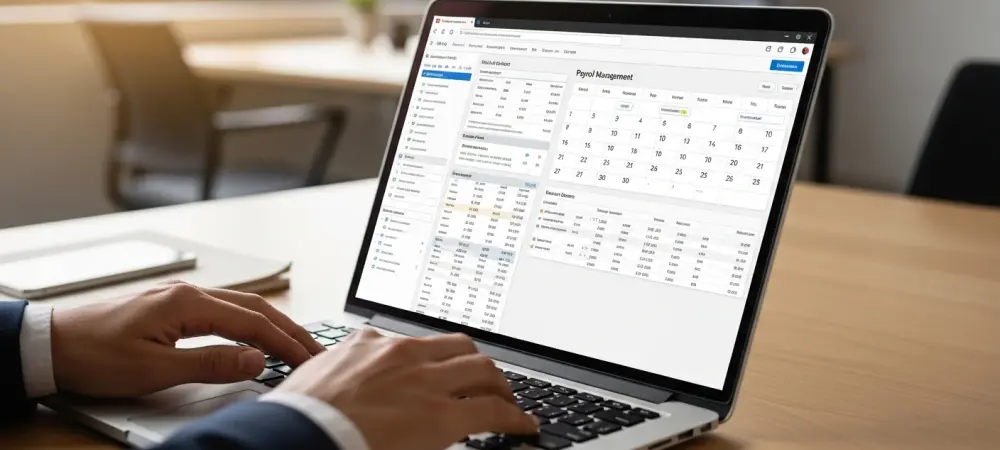

The intersection of regulatory shifts, technological disruption, and evolving employee expectations has transformed compensation from a back-office function into a cornerstone of strategic human resources. As organizations prepare for Equal Pay Day on March 4, the focus has shifted beyond

- Payroll

The intersection of regulatory shifts, technological disruption, and evolving employee expectations has transformed compensation from a back-office function into a cornerstone of strategic human resources. As organizations prepare for Equal Pay Day on March 4, the focus has shifted beyond

Popular Stories

- Payroll

The modern financial landscape has reached a tipping point where waiting two weeks for a paycheck feels like an outdated relic of a pre-digital civilization. As instant gratification becomes the standard for every other aspect of consumer life, the rigid

Deeper Sections Await

- Payroll

The federal government of Canada is making significant strides in improving its HR and pay systems for public servants. Through Public Services and Procurement Canada (PSPC), the government is focusing on increasing the efficiency and capacity of the Pay Centre,

- Payroll

The ongoing financial difficulties faced by UK businesses, exacerbated by a sudden surge in employer tax hikes, are becoming ever more apparent. A notable 50% increase in the number of UK companies experiencing “critical financial distress” was observed between September

Browse Different Divisions

- Payroll

The federal government of Canada is making significant strides in improving its HR and pay systems for public servants. Through Public Services and Procurement Canada (PSPC), the government is focusing on increasing the efficiency and capacity of the Pay Centre,

- Payroll

Despite significant legislative efforts aimed at achieving pay equity in the United States, disparities based on sex, race, and other protected characteristics continue to persist. Tracing the origins back to Lilly Ledbetter’s landmark lawsuit and her subsequent impact on equal

- Payroll

To boost employee retention and satisfaction, you must provide your workers with accurate and timely payments—automating your payroll via a reputable service that can ensure prompt, accurate payments and help you comply with local, state, and federal tax laws. Most

- Payroll

The recent End of Service Gratuity Reform in the UAE has stirred significant advancements in employee benefits and retirement planning, particularly for private sector and free zone employees. This transformative change marks a shift from the traditional gratuity model to

- Payroll

Smartphone financing has emerged as a pivotal factor in boosting economic stability and entrepreneurial opportunities for working mothers in Mexico. According to PayJoy’s report titled “Unlocking Economic Mobility: Smartphone Finance and the Rise of Mexico’s Working Mother Micro-Entrepreneurs,” access to

- Payroll

The ongoing financial difficulties faced by UK businesses, exacerbated by a sudden surge in employer tax hikes, are becoming ever more apparent. A notable 50% increase in the number of UK companies experiencing “critical financial distress” was observed between September

Browse Different Divisions

Popular Stories

Uncover What’s Next