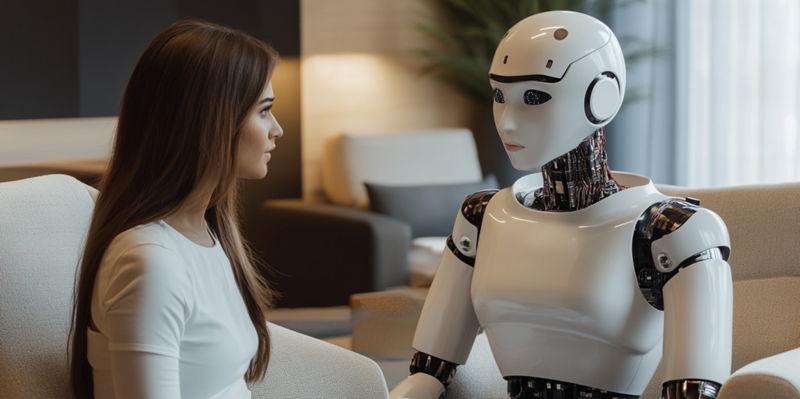

The new EU AI Act introduces comprehensive regulations impacting the deployment of artificial intelligence tools across various sectors, with human resources in global mobility being significantly affected. Addressing compliance considerations, the act categorizes AI applications into four distinct risk levels: unacceptable, high, limited, and minimal. This categorization aims to balance the innovations AI brings with the necessary safeguards to protect users and maintain ethical standards. One essential point highlighted by Zain Ali, CEO of Centuro Global, is that many AI tools used in HR can meet the criteria exempting them from being classified as high-risk. These criteria include AI systems designed to execute narrow procedural tasks, enhance outcomes of previous human activities, or identify decision-making patterns without directly replacing human judgment.

Balancing Innovation and Regulatory Compliance

The key to leveraging AI in HR while ensuring compliance lies in following the developer guidelines, implementing robust human oversight, and proactively reporting any arising issues. AI tools that enhance efficiency in global mobility and HR management are invaluable, and their proper use can lead to significant gains in productivity and accuracy. For instance, AI systems can help detect patterns in large datasets, predict employee attrition rates, and improve talent acquisition processes. However, adherence to the EU AI Act’s framework is crucial to prevent potential misuse or ethical breaches. Companies need to stay informed about evolving regulations, maintain transparency in AI-driven decisions, and ensure that AI implementations prioritize human welfare and fairness. Ultimately, the overarching goal is to maintain a careful balance between fostering innovation and adhering to regulatory requirements, allowing AI-driven HR tools to thrive while safeguarding ethical standards and user trust.