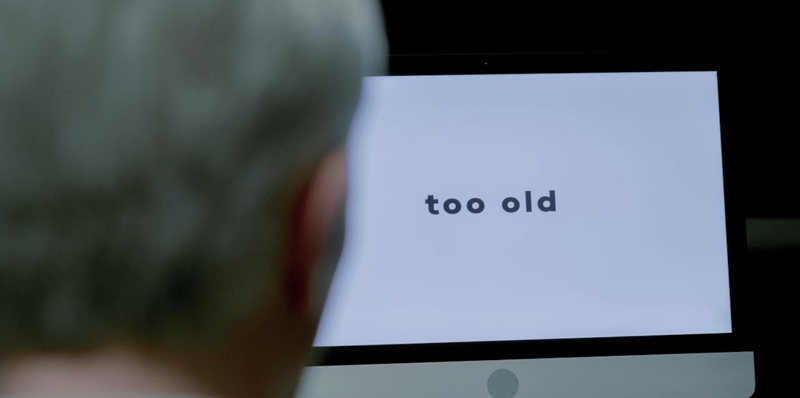

In a notable case that underscores the importance of fair employment practices, Cedar Point amusement park has agreed to settle for $50,000 over allegations of age discrimination. The U.S. Equal Employment Opportunity Commission (EEOC) brought the case to light after Cedar Point enforced a policy that restricted access to its below-market-rate seasonal employee housing based on age, particularly affecting workers aged 30 and over during the 2021 and 2022 seasons. The housing policy was not just a deterrent for older prospective employees due to financial reasons; it was also a stark example of how age can be misused as a criterion for employment benefits.

The case is a clear breach of the Age Discrimination in Employment Act (ADEA), designed to protect employees 40 years and older from workplace discrimination. Cedar Point’s settlement involves not only the compensation of former employees affected by the policy but also a consent decree lasting five years that seeks to prevent future age discrimination. The decree includes policy revisions and essential training on age discrimination laws for Cedar Fair and Magnum Management Corp. staff, sending a strong signal that exclusion based on age will not be tolerated.

Broadening the Fight against Workplace Ageism

The U.S. EEOC’s pact with Cedar Point underscores a nationwide crackdown on workplace ageism—a movement seeing action against companies in sectors from automotive to manufacturing. A Texas dealership and a Louisiana plant faced EEOC suits for allegedly firing older employees, and a Georgia senior living facility was similarly litigated for purported age-based staff termination. These cases signal a strengthening legal framework that protects aging workers’ rights, ensuring that they have equal employment opportunities. The EEOC’s efforts spotlight the importance of eradicating age biases to foster a diverse and equitable workforce. The settlement with the amusement park conveys a clear message that age discrimination, including in benefits like staff housing, is intolerable in today’s job market.