FinTech Insurance

- FinTech Insurance

The long-held assumption that digital-first financial services must remain confined to the cloud is being dismantled by a new wave of hybrid insurance strategies. While the initial surge of insurtech focused almost exclusively on removing the human element to cut

- FinTech Insurance

The long-held assumption that digital-first financial services must remain confined to the cloud is being dismantled by a new wave of hybrid insurance strategies. While the initial surge of insurtech focused almost exclusively on removing the human element to cut

Popular Stories

- FinTech Insurance

Introduction The integration of high-fidelity property intelligence into digital workflows represents a fundamental shift in how insurance carriers validate complex commercial assets before committing to a policy. This partnership between Cytora and The Warren Group serves as a pivotal answer

Deeper Sections Await

- FinTech Insurance

In an age where digital storefronts are as critical as physical ones, a startling revelation highlights a pervasive security gap affecting the majority of a nation’s top retailers, posing a direct threat to core economic sectors. The question is no

- FinTech Insurance

The insurance industry is drowning in a sea of unstructured data, from complex medical records to lengthy legal reports, creating a critical need for innovation as claim volumes rise and experienced adjusters become scarcer. A new trend is emerging not

Browse Different Divisions

- FinTech Insurance

In an age where digital storefronts are as critical as physical ones, a startling revelation highlights a pervasive security gap affecting the majority of a nation’s top retailers, posing a direct threat to core economic sectors. The question is no

- FinTech Insurance

With over 25 years of experience spanning every corner of the industry—from the established halls of RSA Insurance Group to the data-driven labs of insurtech Cytora—Dan McNally has a unique 360-degree view of the challenges facing small businesses. His recent

- FinTech Insurance

In an era where economic headwinds are gathering strength and business insolvencies are on an alarming upward trajectory, commercial insurers find themselves at a critical crossroads. The traditional methods of risk assessment, reliant on static, point-in-time data checks, are proving

- FinTech Insurance

Amid persistent public concern over the escalating cost of motor insurance, a government-led taskforce has delivered its final report, presenting a comprehensive action plan aimed at stabilizing and ultimately reducing premiums for motorists. The Motor Insurance Taskforce, a collaboration between

- FinTech Insurance

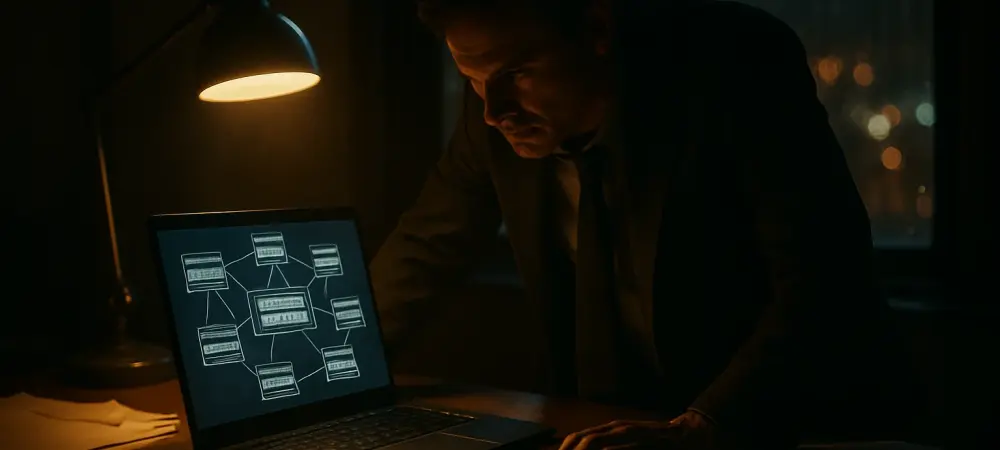

Despite leading many sectors in artificial intelligence experimentation, the insurance industry faces a significant and persistent hurdle in transitioning innovative pilot programs to full-scale, value-generating deployment. Industry analysis paints a stark picture of this challenge; a recent study found that

- FinTech Insurance

The insurance industry is drowning in a sea of unstructured data, from complex medical records to lengthy legal reports, creating a critical need for innovation as claim volumes rise and experienced adjusters become scarcer. A new trend is emerging not

Browse Different Divisions

Popular Stories

- FinTech Insurance

- FinTech Insurance

Uncover What’s Next