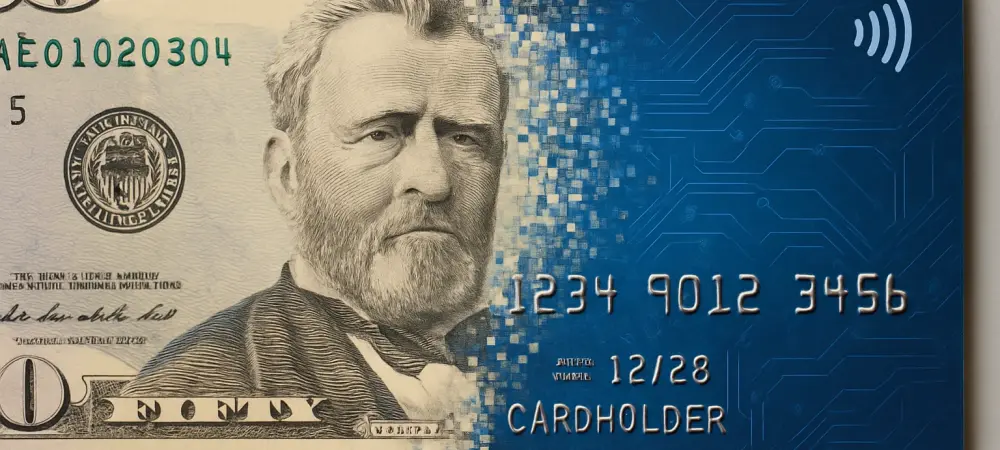

A Tipping Point in Credit Operations

The credit industry is experiencing a pivotal transformation as compelling statistics reveal the dramatic shift underway. A surprisingly rapid integration of artificial intelligence (AI) technologies has prompted an industry-wide overhaul, leaving traditional credit processes at a crossroads. With AI-driven systems predicted to manage over half of credit evaluations in just a few years, industry stakeholders are prompted to rethink their operational strategies.

The Crucial Role of AI in Modern Credit Services

AI is becoming a cornerstone in the credit sector, streamlining operations and enhancing service delivery. Its application ranges from data analysis to real-time customer interactions, significantly influencing economic and consumer behavior trends. As AI continues to evolve, its importance in addressing industry challenges like fraud prevention and creditworthiness assessment becomes increasingly evident, signaling a paradigm shift with widespread economic implications.

Pioneering Change: Areas of AI Impact

The rise of sophisticated AI chatbots marks a revolutionary turn in customer service. These intelligent systems have evolved beyond basic tasks, utilizing natural language processing to engage in meaningful interactions that enhance user experiences. Consequently, financial institutions are redefining how they communicate with customers, offering unprecedented support and guidance. In credit analysis and scoring, AI’s ability to process unstructured data has ushered in more nuanced and accurate credit evaluations. By analyzing diverse datasets, such as social media activity and purchase history, AI offers a more comprehensive picture of an individual’s financial reliability. This capability allows credit institutions to make more informed lending decisions, although it raises questions about regulatory compliance and data privacy.

Moreover, personalized loyalty programs are benefiting from AI’s data-driven insights. By tailoring rewards based on consumer behavior and preferences, financial institutions can boost customer loyalty and increase engagement. AI analyzes vast amounts of transaction data to design bespoke incentives, a strategy proving highly effective in retaining customers in an increasingly competitive market.

Insights and Thoughts from Industry Leaders

Experts like Ben Danner from Javelin Strategy & Research highlight the transformative impact of AI on credit industry operations. He underscores how generative AI is poised to advance card issuance and improve credit assessments while cautioning about the inherent risks, such as algorithmic bias and transparency issues. Industry leaders emphasize the need for careful implementation, highlighting potential pitfalls and showcasing examples where AI has successfully enhanced credit processes.

Essential Strategies for Navigating the AI Landscape

Integrating AI into credit operations demands a strategic approach. Institutions must develop frameworks to address regulatory compliance, mitigate bias, and maintain transparency in AI decision-making processes. Implementing AI responsibly involves setting clear ethical guidelines and ensuring continual oversight to avoid unintended consequences. Establishing trust in AI-driven systems is key to leveraging their full potential, requiring institutions to balance innovation with responsibility.

Charting a Path Forward

Reflecting on AI’s impact, the credit sector stands on the brink of profound change. Industry leaders are poised to embrace this transformation by addressing technological and ethical challenges. By prioritizing transparency, fostering consumer trust, and ensuring equitable access, the credit industry, guided by AI’s potential, is set to redefine consumer finance services. Through strategic planning and foresight, opportunities will be harnessed to navigate this new landscape successfully, adapting to the evolving digital age with resilience and innovation.