The cryptocurrency landscape is undergoing a profound and quiet transformation, where the metrics that once defined a project’s potential are rapidly losing their relevance. For years, the path to success was paved with technical prowess, a relentless race to achieve higher transaction speeds, lower fees, and greater scalability. This engineering-first approach crowned champions and created immense wealth. However, as the market matures ahead of its next major cycle, that formula is proving to be outdated. Performance benchmarks like transactions per second have shifted from being revolutionary differentiators to mere table stakes. The new vanguard of high-growth assets will not be defined by incremental improvements in speed but by their ability to construct comprehensive ecosystems that effectively capture and retain users, cultivate a distinct and resilient culture, and attract capital rooted in conviction rather than fleeting speculation. The paradigm has shifted from processing power to participation power, demanding a new lens through which to identify the next generation of market leaders.

The Old Guard: Why Past Winners Face a New Reality

The Speed Race is Over: Solana’s Fully Priced Success

Solana (SOL) stands as a testament to the previous cycle’s dominant investment thesis, having achieved a monumental victory in the blockchain performance race. Its architecture, capable of handling tens of thousands of transactions per second, provided a solution to the network congestion that plagued older chains, making it a premier destination for decentralized finance (DeFi), non-fungible tokens (NFTs), and a variety of consumer-facing applications. This technical superiority allowed it to build a formidable ecosystem and attract a significant user base. However, this very success has fundamentally reshaped its investment profile. Solana is no longer an undiscovered asset with untapped potential; it has become a blue-chip crypto asset, deeply integrated into institutional portfolios and boasting massive liquidity. Its valuation now reflects its established position as a market leader, meaning its era of explosive, parabolic growth has likely concluded.

The market has effectively “fully priced” Solana’s technological innovations and its existing ecosystem, which means its future appreciation is now more closely tied to the steady, incremental growth of the broader digital asset market rather than a project-specific repricing event. For investors seeking the kind of asymmetric returns that characterized previous cycles—the “1000x” gains that create new wealth—the opportunity in an asset like Solana has significantly diminished. It has transitioned from a high-risk, high-reward venture into a more stable, mature component of a diversified portfolio. While it remains a critical piece of blockchain infrastructure, its role has shifted from that of a disruptive upstart to an incumbent powerhouse, a change that alters the calculus for new capital entering the space looking for exponential upside.

The Saturated Solution: Polygon’s Mature Market Position

Polygon (MATIC) carved out its dominant position by masterfully addressing one of the most pressing issues of the last bull market: Ethereum’s crippling congestion and high transaction fees. By offering a suite of scaling solutions, it became an indispensable layer for developers seeking to build applications with the security of Ethereum but without its performance limitations. This pragmatic approach led to widespread adoption, attracting a vast network of decentralized applications, enterprise partners, and major global brands looking to make their entry into Web3. Polygon’s success was a direct result of solving a critical technical problem at the right time, cementing its status as a key pillar of the blockchain infrastructure landscape and earning it a substantial market valuation that reflects this crucial role.

However, in solving this problem so effectively, Polygon has also reached a state of market saturation. Its value proposition is now well understood, and its upside potential has become intrinsically linked to the long-term, more measured expansion of the Ethereum ecosystem it supports. It has successfully moved past the discovery phase where early investors could capitalize on a “new wealth window.” The project has matured from a nimble, high-growth disruptor into a foundational infrastructure provider, a transition that fundamentally changes its risk-reward profile. For investors whose strategy revolves around identifying early-stage projects with the potential for exponential growth, Polygon now represents a different class of asset—one geared more toward stability and ecosystem longevity than explosive, market-redefining returns.

The New Playbook: Building for Conviction, Not Just Speed

Introducing a New Contender: The Diamond Hands Thesis

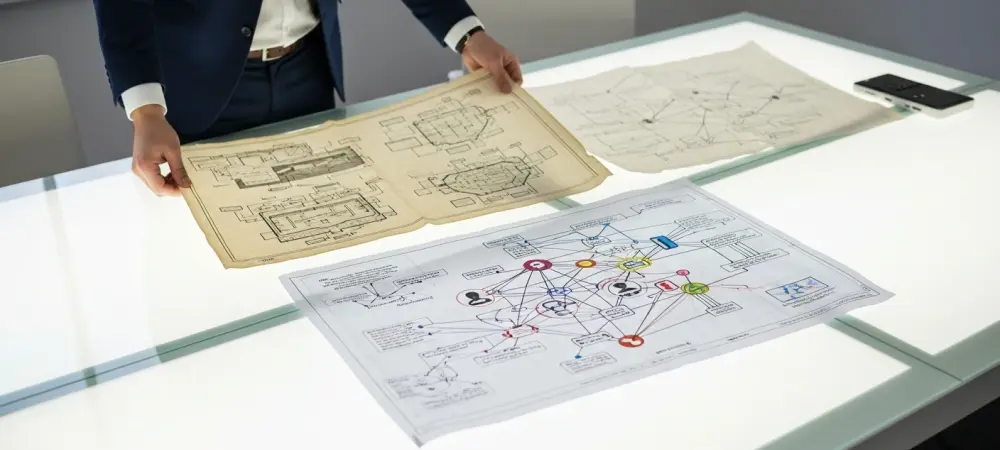

As the market evolves beyond the singular focus on technical performance, a new strategic model is taking shape, one exemplified by emerging projects such as Diamond Hands ($DH). This innovative approach deliberately sidesteps the technical arms race against established giants, focusing instead on a thesis rooted in behavioral economics and the cultivation of deep community conviction. The project’s strategy is designed in two distinct phases. It begins with a launch as a meme coin on the highly active Binance Smart Chain, a move intended to leverage the powerful cultural and viral dynamics of meme-based assets to rapidly build a large, passionate, and committed user base. This initial phase is not the end goal but rather a strategic launchpad designed to bootstrap a strong community from day one.

This community-building effort serves as the foundation for the project’s primary objective: a carefully planned evolution into a purpose-built Layer-2 ecosystem known as the “Diamond Hands Chain.” This hybrid model represents a significant innovation in project development, blending the explosive, culturally driven growth potential of a meme coin with the long-term, sustainable utility of a foundational blockchain infrastructure. By starting with culture and community first, the project aims to create a user base that is emotionally and financially invested in its long-term success. This approach flips the traditional model on its head, positing that a project’s most valuable asset is not its code, but the unwavering belief of its community, which then becomes the driving force behind the adoption and growth of its future technical utility.

Architecture for a Diamond Handed Community

The foundational principle of the Diamond Hands project is an architecture meticulously engineered to incentivize long-term holding and actively discourage the short-term, speculative behavior that often destabilizes new assets. Its tokenomics are built to foster and protect community value through several key features. A fixed total supply immediately establishes a principle of scarcity, creating a deflationary pressure that can reward holders over time. This is complemented by integrated anti-dump mechanisms, which are smart contract functions designed to mitigate the price impact of large-scale selling, thereby protecting the asset’s value for the broader community and disincentivizing premature exits by so-called “whales.” These technical features are not just code; they are carefully designed instruments of behavioral economics aimed at shaping a resilient and committed investor base.

Further reinforcing this foundation is a deep commitment to on-chain transparency and security, which are critical for building lasting trust. The project demonstrates this commitment through measures like locked liquidity pools, ensuring that foundational capital cannot be arbitrarily removed, and publicly accessible team wallets, allowing the community to verify actions and hold developers accountable. This ethos of trust is bolstered by proactive security measures, such as the completion of a comprehensive smart contract audit by the reputable firm Coinsult before the public launch. By favoring a community-led governance model over a traditional venture capital-driven path, the project seeks to ensure that its development roadmap remains aligned with the interests of its users, creating a powerful sense of collective ownership and shared destiny that is essential for long-term success.

From Meme to Mainstream: The Layer-2 Utility Roadmap

The ultimate vision for Diamond Hands extends far beyond its meme coin origins, with a detailed roadmap centered on the development of the “Diamond Hands Chain.” This planned Layer-2 ecosystem is designed to provide tangible, long-term utility, transforming the $DH token from a speculative cultural asset into the native currency of a thriving and functional on-chain economy. This future infrastructure will be specifically optimized to serve as a hub for meme-native applications, creating a dedicated environment where the culture and mechanics of meme-based projects can flourish with tailored support. It will also be engineered to seamlessly integrate cultural assets like NFTs and interactive gaming models, including Play-to-Earn and Tap-to-Earn mechanics, positioning the chain as a vibrant center for crypto culture and entertainment.

This focus on cultural applications is supported by a robust suite of decentralized finance tools intended to foster a self-sustaining ecosystem. The roadmap includes the development of a native Decentralized Exchange (DEX), which will provide a liquid and secure venue for trading assets within the ecosystem, and a community launchpad designed to empower new projects to build and launch directly on the Diamond Hands Chain. This creates a powerful flywheel effect, where new innovations attract more users and liquidity to the platform. Critically, the ecosystem will feature integrated staking and loyalty rewards programs, which are specifically designed to benefit long-term holders while penalizing short-term speculators, or “weak hands.” This entire structure is being built to create and sustain a self-reinforcing cycle of user participation, value creation, and long-term growth.

The Asymmetric Bet: Why Timing is Everything

In the world of cryptocurrency investing, the most significant financial opportunities have historically been concentrated in a project’s earliest stages—the “ignition phase” marked by high uncertainty but equally high potential for exponential returns. During this period, before widespread market adoption and institutional validation, assets can experience transformative repricing events. Established market leaders like Solana and Polygon have long since navigated this phase, and their growth trajectories have matured accordingly. In stark contrast, Diamond Hands is positioned squarely within this critical early window, presenting an opportunity for the kind of asymmetric upside that defines early-stage investing. Its presale and whitelist access are not merely marketing tactics; they represent a finite opportunity to engage with a project built on a new thesis for success.

This early investment phase is crucial because it allows participation before the project’s value proposition is fully recognized and priced in by the broader market. As a project gains traction, attracts a larger community, and delivers on its roadmap, the potential for exponential returns naturally diminishes. The initial BNB giveaways and other early-adopter incentives are structured to reward the conviction of those who recognize the potential in this new model—one that prioritizes community and culture as the bedrock of long-term utility. For investors seeking to position themselves ahead of the next market cycle, the argument is that the most promising opportunities will not be found in the established winners of the past but in projects like $DH that are architected from the ground up for a new era of ownership and participation.