Embedded Finance

- Embedded Finance

The persistent mismatch between rigid bill due dates and the often-variable cadence of personal income has long been a source of financial stress for households, creating a gap that innovative financial tools are now rushing to fill. Among the most

- Embedded Finance

The persistent mismatch between rigid bill due dates and the often-variable cadence of personal income has long been a source of financial stress for households, creating a gap that innovative financial tools are now rushing to fill. Among the most

Popular Stories

- Embedded Finance

The persistent mismatch between rigid bill due dates and the often-variable cadence of personal income has long been a source of financial stress for households, creating a gap that innovative financial tools are now rushing to fill. Among the most

Deeper Sections Await

- Embedded Finance

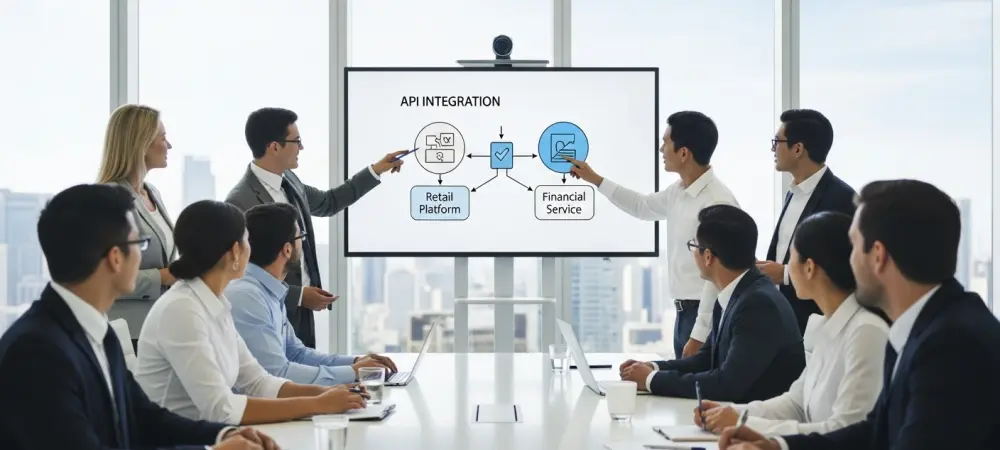

Open banking, more than a technological trend, is revolutionizing the financial landscape by altering the way financial data is shared and utilized. The concept may seem straightforward, implying that bank data is opened up to third parties, but this definition

- Embedded Finance

The transformative potential of digitization in financial operations is increasingly evident, particularly for small- to medium-sized businesses (SMBs). These enterprises often operate within limited and outdated ecosystems, leading to slower payments, higher fees, and inefficient administrative tasks. This article explores

Browse Different Divisions

- Embedded Finance

Open banking, more than a technological trend, is revolutionizing the financial landscape by altering the way financial data is shared and utilized. The concept may seem straightforward, implying that bank data is opened up to third parties, but this definition

- Embedded Finance

In today’s rapidly evolving financial landscape, businesses demand solutions that offer both speed and customization, setting the stage for the rise of white-label neobanking. This innovative approach allows companies to launch financial products under their own brand without the need

- Embedded Finance

The landscape of embedded payments is rapidly evolving, with projections indicating it will dominate the embedded finance market by 2030. As demands for swift transactions and enhanced customer experiences intensify, embedded payments emerge as the ultimate solution for software platforms

- Embedded Finance

Foreign exchange (FX) risk management is a critical aspect of global business operations, influenced by the forex market’s immense daily trading volume of over USD 7.5 trillion. The inherent volatility of this market exposes businesses to various forms of FX

- Embedded Finance

The integration of embedded finance solutions is revolutionizing various sectors within the travel industry, including airlines, surface travel modes, attractions, and wellness services. By enhancing financial experiences, these solutions significantly improve overall customer satisfaction across these travel verticals. Seamless payment

- Embedded Finance

The transformative potential of digitization in financial operations is increasingly evident, particularly for small- to medium-sized businesses (SMBs). These enterprises often operate within limited and outdated ecosystems, leading to slower payments, higher fees, and inefficient administrative tasks. This article explores

Browse Different Divisions

Popular Stories

Uncover What’s Next