Embedded Finance

- Embedded Finance

The persistent mismatch between rigid bill due dates and the often-variable cadence of personal income has long been a source of financial stress for households, creating a gap that innovative financial tools are now rushing to fill. Among the most

- Embedded Finance

The persistent mismatch between rigid bill due dates and the often-variable cadence of personal income has long been a source of financial stress for households, creating a gap that innovative financial tools are now rushing to fill. Among the most

Popular Stories

- Embedded Finance

The persistent mismatch between rigid bill due dates and the often-variable cadence of personal income has long been a source of financial stress for households, creating a gap that innovative financial tools are now rushing to fill. Among the most

Deeper Sections Await

- Embedded Finance

In an era where convenience often trumps traditional caution, buy now, pay later (BNPL) services have swiftly become a popular alternative to conventional credit options. These services promise effortless purchases without immediate payment, making it easy for consumers, particularly young

- Embedded Finance

Since its inception in 2018, the UK’s Open Banking framework has set a global precedent, influencing other countries to adapt and expand the model to meet local needs. As the UK strives to maintain its leadership in Open Banking, it

Browse Different Divisions

- Embedded Finance

In an era where convenience often trumps traditional caution, buy now, pay later (BNPL) services have swiftly become a popular alternative to conventional credit options. These services promise effortless purchases without immediate payment, making it easy for consumers, particularly young

- Embedded Finance

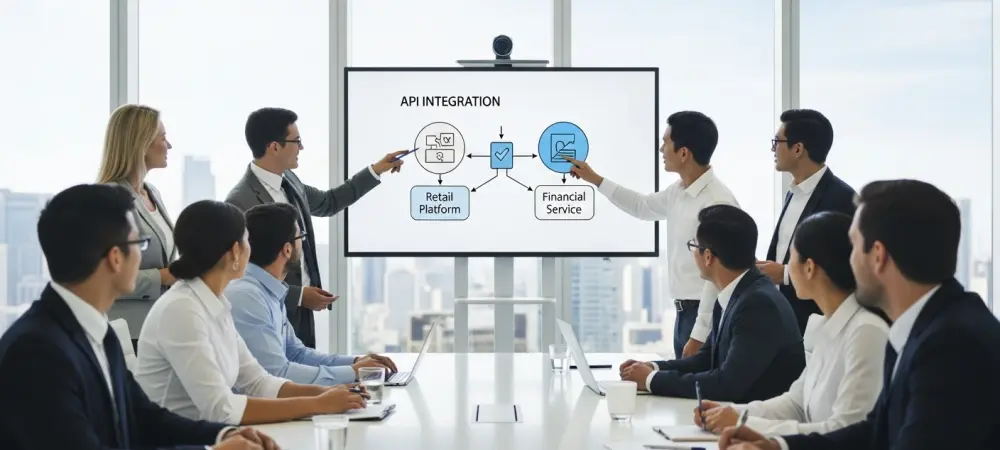

Embedded finance is revolutionizing the way nonfinancial businesses operate by integrating financial services directly into their platforms and applications. This seamless integration allows companies to offer a variety of financial products, such as lending, insurance, and payments, without needing to

- Embedded Finance

The financial services industry is undergoing a significant transformation driven by the rapid adoption of embedded payments software. This technology seamlessly integrates payment processing within software applications, allowing users to complete transactions without being redirected to external payment gateways. As

- Embedded Finance

Highnote, a US-based card issuance and program management company, has received a significant boost with the successful completion of a $90 million Series B funding round, led by Adams Street Partners. This remarkable funding round also attracted contributions from existing

- Embedded Finance

The recent ruling by the Consumer Financial Protection Bureau (CFPB) on Personal Financial Data Rights marks a significant milestone in the evolution of open banking. This ruling, derived from Section 1033 of the Dodd-Frank Wall Street Reform & Consumer Protection

- Embedded Finance

Since its inception in 2018, the UK’s Open Banking framework has set a global precedent, influencing other countries to adapt and expand the model to meet local needs. As the UK strives to maintain its leadership in Open Banking, it

Browse Different Divisions

Popular Stories

- Embedded Finance

- Embedded Finance

Uncover What’s Next