Embedded Finance

- Embedded Finance

The persistent mismatch between rigid bill due dates and the often-variable cadence of personal income has long been a source of financial stress for households, creating a gap that innovative financial tools are now rushing to fill. Among the most

- Embedded Finance

The persistent mismatch between rigid bill due dates and the often-variable cadence of personal income has long been a source of financial stress for households, creating a gap that innovative financial tools are now rushing to fill. Among the most

Popular Stories

- Embedded Finance

The persistent mismatch between rigid bill due dates and the often-variable cadence of personal income has long been a source of financial stress for households, creating a gap that innovative financial tools are now rushing to fill. Among the most

Deeper Sections Await

- Embedded Finance

The integration of embedded payments presents software providers with great opportunities for growth. As the embedded finance market is projected to reach $800 billion by 2030, embracing this technology is not just an option but also a necessity. In this

- Embedded Finance

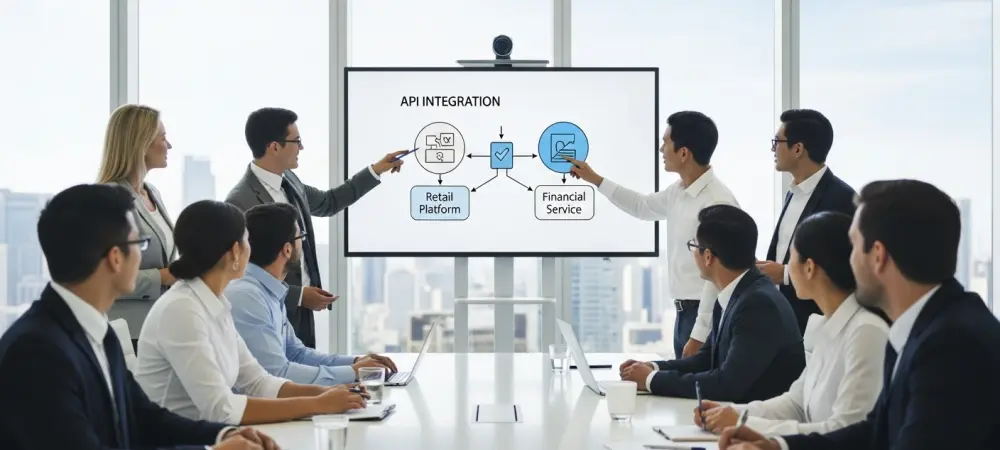

In an evolving digital landscape, embedded finance has emerged as a transformative concept, allowing agile fintech players and platforms like Shopify to seize ownership of the customer relationship. This shift has urged traditional financial institutions to reassess their positions, as

Browse Different Divisions

- Embedded Finance

The integration of embedded payments presents software providers with great opportunities for growth. As the embedded finance market is projected to reach $800 billion by 2030, embracing this technology is not just an option but also a necessity. In this

- Embedded Finance

Over the past decade, regulatory changes have sparked a radical transformation in the financial landscape, giving rise to banking-as-a-service (BaaS) providers. Initially hailed as drivers of innovation, BaaS has also been responsible for some of fintech’s most notable challenges. As

- Embedded Finance

HSBC and Tradeshift have recently joined forces in an announcement made today. The collaboration aims to launch a jointly-owned business that will focus on the development of embedded finance solutions and financial services apps. This strategic partnership between HSBC, the

- Embedded Finance

The world of fintech is witnessing a seismic shift as Buy Now Pay Later (BNPL) payments gain unprecedented popularity. Companies like Block, owner of Afterpay, and PayPal are reporting sharp increases in the volume of BNPL transactions. The leaders at

- Embedded Finance

In a move to enhance its digital offerings and improve working capital flow across supply chains, HSBC has invested $35 million in supply chain finance company Tradeshift. This investment is part of a larger funding round that is expected to

- Embedded Finance

In an evolving digital landscape, embedded finance has emerged as a transformative concept, allowing agile fintech players and platforms like Shopify to seize ownership of the customer relationship. This shift has urged traditional financial institutions to reassess their positions, as

Browse Different Divisions

Popular Stories

- Embedded Finance

- Embedded Finance

Uncover What’s Next