The once-distinct line separating everyday banking from complex investment activities has all but disappeared, fundamentally reshaping how consumers interact with their finances. Embedded finance represents a significant advancement in the financial services sector, moving sophisticated capabilities out of standalone applications and directly into the platforms people use daily. This review explores the evolution of embedded investment platforms, their key features, and the impact they have on traditional institutions like credit unions. The purpose of this review is to provide a thorough understanding of the technology, its current capabilities, and its potential future development.

Understanding Embedded Investment Technology

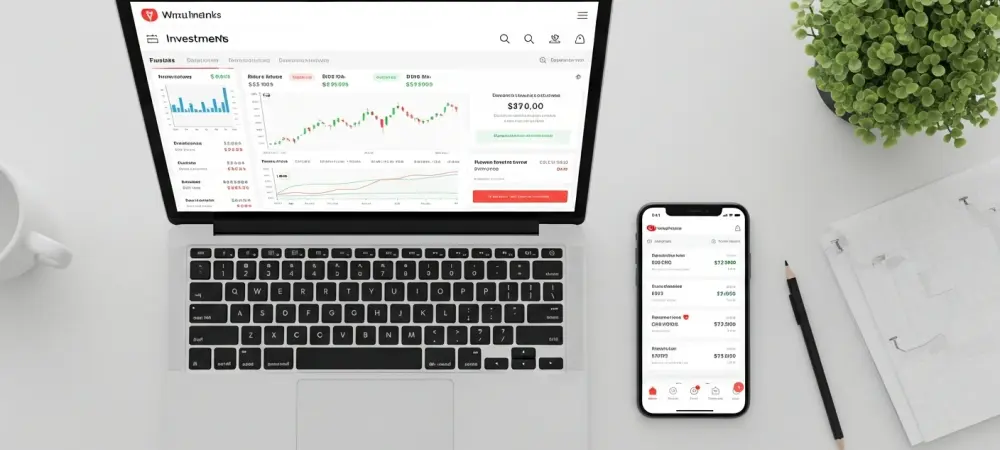

Embedded investment technology is centered on the core principle of integrating sophisticated financial tools directly into existing non-investment applications. For a credit union, this means placing a full-service investment suite within its online banking portal, allowing members to manage their checking, savings, and investment portfolios from a single, familiar interface. This seamless integration eliminates the friction of using multiple apps and providers for different financial tasks.

This technology is far more than a convenience; it is a critical strategic tool for traditional financial institutions. In an ecosystem dominated by agile fintech applications, embedded solutions allow credit unions and community banks to compete effectively by enhancing customer value. By offering modern investment capabilities, these institutions can meet the evolving expectations of their members, deepen relationships, and prevent asset outflow to third-party platforms.

Core Features of an Integrated Investment Solution

Diverse and Accessible Investing Options

A primary function of leading platforms, such as the one offered by InvestiFi, is providing a dual approach to investing that caters to different comfort levels. The first component is a robo-advisory service, often branded as “Guided Investing,” which creates personalized portfolios based on an individual’s risk tolerance and financial goals. This automated approach democratizes professional-grade portfolio management for the everyday investor. Alongside guided options, these platforms typically provide a self-directed trading solution for more hands-on members. This allows individuals to trade thousands of stocks and ETFs directly from their primary checking accounts. Moreover, many platforms have expanded to include digital assets, offering access to a curated selection of cryptocurrencies and stablecoins, thereby providing a comprehensive range of modern investment choices.

Integrated Financial Education and Support

A crucial differentiator for embedded platforms is the inclusion of built-in educational resources. By providing financial literacy materials, articles, and explainers directly within the investment interface, these services help members understand market dynamics and invest more confidently. This educational component transforms the platform from a simple transactional tool into a resource for financial empowerment.

This integrated support model positions the service as a more secure and responsible alternative to many standalone investment apps. While third-party apps often prioritize rapid, gamified trading, embedded solutions within a trusted institution like a credit union tend to emphasize guided, long-term wealth building. The availability of support and educational content helps mitigate risk and fosters a more sustainable investment journey for members.

Current Trends in Fintech Adoption by Financial Institutions

The adoption of embedded investment technology by U.S. financial institutions is not a niche experiment but a rapidly growing trend. Partnerships like the one between Day Air Credit Union and InvestiFi are becoming increasingly common as traditional institutions recognize the need to modernize their digital offerings. This movement is driven by the desire to retain member assets and attract a new generation of digitally native consumers.

Evidence of this broader shift can be seen in the numerous deals being secured by fintech providers with credit unions and banks nationwide. These collaborations signal a strategic pivot for community-focused institutions, which are moving away from simply referring members to external brokers and toward owning the entire financial relationship. This integration is key to providing a cohesive and holistic member experience.

Case Study Day Air Credit Unions Strategic Integration

The real-world application of this technology is exemplified by Day Air Credit Union’s partnership with InvestiFi. As a not-for-profit institution with 54,000 members and $870 million in assets, Day Air is leveraging the platform to provide a more cohesive financial experience. By integrating a full suite of investment solutions, the credit union enables its members to invest without leaving the security of their online banking environment. This strategic integration is designed to achieve several key objectives: modernizing the credit union’s offerings, retaining members who might otherwise turn to external fintech apps, and reinforcing its role as a primary financial partner. According to Day Air’s leadership, the move provides a more secure and educational alternative to standalone apps, which often lack the robust guidance and support that a community-focused institution can offer.

Challenges and Market Obstacles

Despite the clear benefits, implementing embedded investment technology presents several challenges. From a technical standpoint, ensuring a seamless and secure integration with legacy core banking systems can be a significant hurdle. A clunky user experience can deter adoption and undermine the very convenience the platform is meant to provide. Furthermore, institutions must navigate a complex web of regulatory and compliance standards associated with offering investment products. Beyond these technical and legal obstacles lies the market challenge of competing with established third-party applications. Many members may already use and trust standalone investment apps, making it essential for credit unions to effectively communicate the superior security, convenience, and support of their integrated offering.

Future Outlook for Embedded Finance

The trajectory for embedded finance points toward even deeper and more intelligent integration. Future developments will likely include an expansion of available asset classes, potentially incorporating alternative investments that have traditionally been inaccessible to retail investors. The use of artificial intelligence is also expected to grow, enabling hyper-personalization of financial advice and portfolio recommendations based on a member’s complete financial picture.

In the long term, this technology is poised to fundamentally reshape the role of community-focused institutions. As they integrate more financial services—from investing and insurance to budgeting and lending—credit unions and local banks are positioned to become comprehensive, all-in-one financial hubs for their members. This evolution will allow them to strengthen their community ties while competing on a technological par with the largest players in the industry.

Concluding Assessment

Embedded investment platforms are a transformative force for the traditional banking sector. They provide a powerful mechanism for institutions to enhance member value by delivering modern, accessible, and integrated investment tools. The technology addresses the dual needs of fostering financial literacy through built-in education and competing effectively in an increasingly digital landscape. By embracing such solutions, credit unions and community banks are not just updating their technology; they are fundamentally redefining their value proposition for a new era.