E-Commerce

- E-Commerce

Nicholas Braiden is a titan in the blockchain and fintech space, having spent years guiding startups through the labyrinth of digital finance. His work revolves around the intersection of technology and international trade, making him a primary voice on how

- E-Commerce

Nicholas Braiden is a titan in the blockchain and fintech space, having spent years guiding startups through the labyrinth of digital finance. His work revolves around the intersection of technology and international trade, making him a primary voice on how

Popular Stories

- E-Commerce

The sheer velocity of the modern digital sports economy leaves no room for generic consumer interactions, especially for an enterprise processing billions in merchandise sales across a fragmented global audience. Fanatics, a powerhouse that has redefined the intersection of sports

Deeper Sections Await

- E-Commerce

The integration of India’s Unified Payments Interface (UPI) Autopay into international e-commerce platforms is fundamentally altering the landscape of global digital commerce. UPI Autopay’s adoption by companies like EBANX, in partnership with YES BANK, signifies a strategic evolution that merges

- E-Commerce

As the digital economy in the Philippines continues to flourish, the Department of Trade and Industry (DTI) is set to unveil guidelines for a new e-commerce trustmark. This initiative aims to reinforce consumer trust and mitigate fraudulent activities within the

Browse Different Divisions

- E-Commerce

The integration of India’s Unified Payments Interface (UPI) Autopay into international e-commerce platforms is fundamentally altering the landscape of global digital commerce. UPI Autopay’s adoption by companies like EBANX, in partnership with YES BANK, signifies a strategic evolution that merges

- E-Commerce

In a constantly evolving financial landscape, UK shoppers are increasingly turning to digital wallets to navigate the complexities of modern-day economic pressures. With living costs continuously climbing, these technological tools are gaining traction across various demographics as a preferred method

- E-Commerce

In an era marked by rapid technological advancement and globalization, the demand for easier, safer, and more efficient international money transfers has grown substantially. As people and businesses increasingly operate beyond borders, traditional transfer services often fall short, offering limited

- E-Commerce

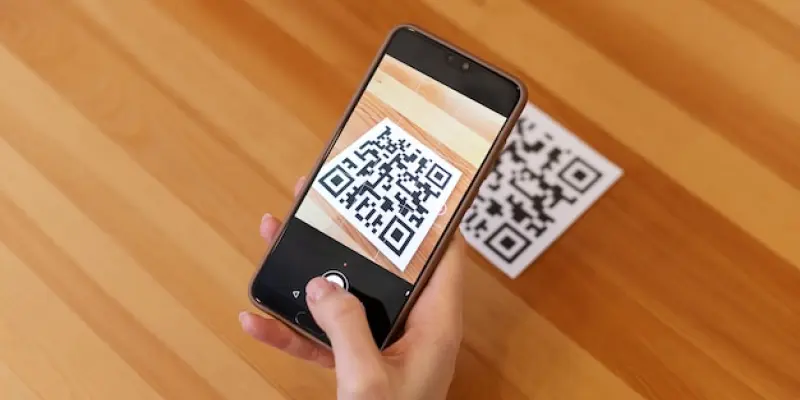

In the ever-evolving landscape of e-commerce, payment methodologies have taken center stage as critical facilitators of transactions between merchants and consumers. The introduction of QR code payments has emerged as a transformative force in this domain, promising to revolutionize the

- E-Commerce

In a rapidly evolving landscape where cashless transactions are becoming a hallmark of contemporary commerce, Zoho Payments emerges as a formidable force aimed at transforming financial operations for businesses. The platform, tailored primarily for mid-sized companies and large enterprises, positions

- E-Commerce

As the digital economy in the Philippines continues to flourish, the Department of Trade and Industry (DTI) is set to unveil guidelines for a new e-commerce trustmark. This initiative aims to reinforce consumer trust and mitigate fraudulent activities within the

Browse Different Divisions

Popular Stories

Uncover What’s Next