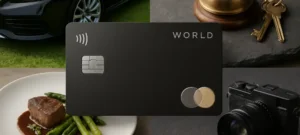

Imagine a digital economy where transactions happen in the blink of an eye, yet the infrastructure behind these seamless payments is a complex web of innovation and regulation. In Europe and the UK, the payment processing industry stands at a pivotal moment, with card acquiring services becoming the backbone of commerce for digital platforms. This dynamic landscape, driven by rapid