The long-standing transactional relationship between banks and their customers is rapidly dissolving, replaced by a dynamic, experience-driven partnership demanding unprecedented levels of personalization and control. This profound paradigm shift marks a move away from a traditional, product-focused strategy, where success was measured by the number of accounts opened or loans issued. Instead, the new benchmark for success is the quality of the customer experience, a change fueled by consumers who now expect the same level of intuitive design, transparency, and personalization from their financial institutions as they receive from leading technology and retail platforms.

In this evolving landscape, Vietnam International Bank (VIB) has emerged as a compelling case study, demonstrating how a deliberate pivot to a customer-centric model can yield extraordinary results. The bank’s journey provides a clear blueprint for transforming core financial activities—spending, saving, and borrowing—into empowering experiences that foster deep, sustainable loyalty. This analysis will explore the measurable impact of VIB’s strategy, dissect its core philosophical pillars, and examine the broader implications of this trend for the future of the financial industry.

The Ascent of Experience-Led Banking

Measurable Impact: Growth Metrics and Adoption Rates

The commercial success of an experience-led banking model is best understood through its impact on customer behavior and market position. VIB’s performance metrics offer compelling evidence of this strategy’s effectiveness. Between 2018 and 2025, the bank’s total credit card spending experienced a monumental 17-fold surge, reaching nearly $5.4 billion. This dramatic increase is not merely a reflection of a growing customer base but a powerful indicator of high adoption and deep integration of the bank’s services into the daily financial lives of its clients.

Beyond the sheer volume of transactions, a more nuanced metric reveals the depth of customer loyalty cultivated by this approach. During the same period, the average monthly spending per cardholder doubled to approximately $571, a figure that stands 50 percent higher than the industry average. This demonstrates a significant behavioral shift; customers are not just using their cards for occasional purchases but are relying on them as a primary tool for managing their lifestyle spending. Such deepened engagement is a direct result of an experience that users find valuable, intuitive, and indispensable.

This enhanced loyalty and engagement have translated directly into significant market penetration. VIB successfully secured a top-three market share in card spending and surpassed the milestone of one million active cards, validating the commercial viability of its customer-centric model. These achievements underscore a critical point: prioritizing the customer experience is not a peripheral activity but a core driver of tangible business growth and a formidable competitive advantage in a crowded marketplace.

VIB’s Three Pillars of Customer Empowerment in Action

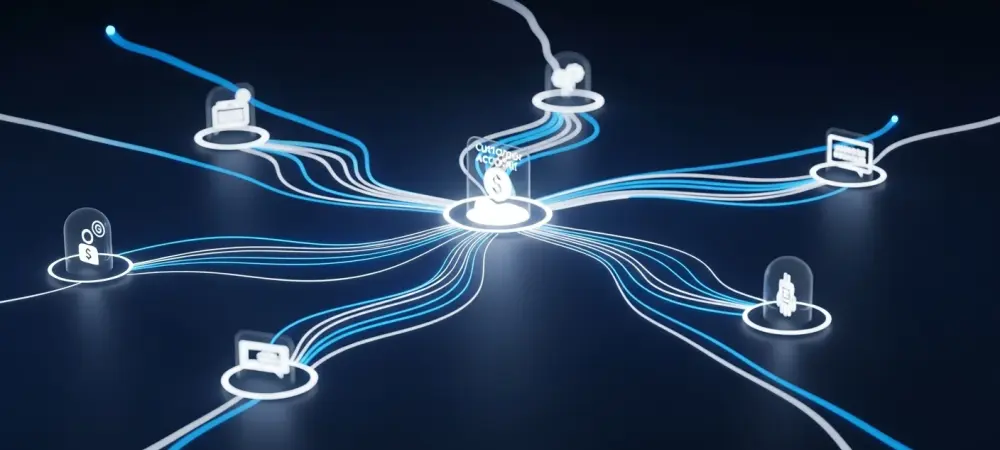

At the heart of VIB’s strategy is a framework built on three interconnected pillars designed to empower customers across their primary financial activities. The first pillar reimagines spending by positioning credit cards as a central touchpoint for personalization. Through the MyVIB digital banking application, which is powered by Generative AI, customers gain unprecedented control over their payment tools. They can customize everything from the card’s visual design to its reward structure, select preferred spending categories for enhanced benefits, and even adjust payment terms to align with their personal financial cycles.

The second pillar focuses on automated wealth generation, a solution designed to address the common inefficiency of idle cash sitting in current accounts. VIB’s suite of products, including Super Account, Hi-Depo, and iDepo, automatically activates these dormant funds to generate optimal returns. Each solution is tailored to different liquidity needs, with Super Account catering to daily transactional funds, Hi-Depo for short-term weekly optimization, and iDepo for longer-term savings. This automated system empowers individuals, regardless of their financial expertise, to make their money work for them effortlessly.

Finally, the third pillar humanizes the lending process by redesigning it around the customer’s life journey. VIB leverages advanced data analytics to provide home loan approvals in as little as four to eight hours, a significant reduction from industry norms. More importantly, the bank offers highly flexible and transparent repayment structures, such as a plan allowing customers to “borrow VND1 billion, repay VND1 million per month” or packages that include penalty-free early repayment options. This empathetic approach transforms lending from a rigid transaction into a supportive partnership aligned with the customer’s financial reality.

Expert Insight: The Philosophy of Empowerment Over Convenience

According to Deputy CEO Tuong Nguyen, the strategic foundation of VIB’s model is deliberately architected to deliver empowerment, a concept that goes far beyond simple convenience. While convenience streamlines transactions, empowerment grants customers genuine control over their financial destinies, covering the full spectrum of spending, saving, and borrowing. This distinction is crucial, as it shifts the bank’s role from a mere service provider to an enabler of financial well-being.

The core belief driving this philosophy is that lasting loyalty and trust are not built on fleeting promotions or marginal ease of use. Instead, they are cultivated when customers consistently feel they are “in the driver’s seat,” making informed decisions that best suit their needs. This sense of agency is fostered through a continuous series of positive and meaningful interactions, where technology serves not as a barrier but as a tool for personalization and control.

This strategic direction is a direct and thoughtful response to the modern, digitally native consumer. Having grown accustomed to the hyper-personalized ecosystems of leading technology and retail companies, today’s customers carry those same expectations to their banking relationships. They demand flexibility, transparency, and a tailored experience that reflects their unique circumstances. VIB’s success demonstrates that meeting this demand is no longer optional for financial institutions seeking to build resilient and profitable relationships.

The Future Trajectory of Personalized Banking

The trend toward deeply personalized banking is set to accelerate, driven by further advancements in technology. Future developments will likely involve a more profound integration of artificial intelligence and virtual assistants, such as VIB’s “Vie,” to transition from reactive customer support to proactive financial guidance. These AI-driven advisors could offer personalized budgeting advice, identify savings opportunities, and alert customers to potential financial risks, acting as a genuine partner in wealth management. Furthermore, the expansion of fully digital, instant loan products will continue to eliminate friction, removing paperwork and waiting times from the borrowing process entirely.

While the benefits of this model are clear—sustainable growth fueled by exceptional customer loyalty and higher engagement—the path to implementation is not without its challenges. The most significant hurdles include the substantial capital investment required for cutting-edge technology and robust data infrastructure. Moreover, it necessitates a profound cultural shift within the organization, moving from product-centric silos to integrated teams focused on the end-to-end customer journey. Navigating complex data privacy concerns and maintaining customer trust will also be paramount to long-term success.

The broader implications for the financial industry are transformative. The customer-centric model is rapidly becoming the new standard for success, placing immense pressure on traditional banks to overhaul their legacy operations and mindsets or risk becoming obsolete. The future of banking lies in creating a seamless, omnichannel experience where physical branches and digital platforms are fully integrated. This ecosystem will not merely facilitate transactions but will support a holistic, personalized, and empowering journey for every customer.

Conclusion: Forging a New Standard for Banking Success

The analysis of customer-centric banking models has made it clear that this shift represents a fundamental, market-driven evolution rather than a temporary trend. Consumer expectations, reshaped by digital experiences in every other aspect of life, have permanently altered the definition of success in the financial sector. Institutions can no longer compete solely on products or rates; the battlefield has moved to the realm of experience.

The success of Vietnam International Bank served as a powerful testament to this new reality. By strategically leveraging personalization across the core pillars of spending, saving, and borrowing, VIB has not only achieved remarkable growth in key metrics but has also cultivated a deeply loyal customer base. This case has demonstrated that when customers are empowered with control and transparency, their relationship with their bank transforms from a transactional necessity into a trusted partnership.

Ultimately, the evidence has shown that the financial institutions that will thrive in the years to come are those that have placed customer empowerment at the absolute center of their business model. The future of banking was forged not in the scale of assets, but in the strength of relationships built on a foundation of trust, personalization, and a shared commitment to the customer’s financial well-being.