The persistent gap between issuing an invoice and successfully collecting payment often represents one of the most significant points of friction in modern financial operations. In a business environment that prioritizes speed and accuracy, the practice of managing an Enterprise Resource Planning (ERP) system in isolation from payment processing platforms introduces unnecessary delays, manual errors, and security vulnerabilities. Integrating a payment gateway directly into Microsoft Dynamics 365 Business Central is therefore not merely a technical upgrade but a critical strategic pivot. This connection transforms disjointed financial tasks into a fluid, automated workflow, directly impacting operational efficiency, financial health, and customer relationships. This analysis will dissect the profound operational, financial, and customer-facing advantages of creating a fully integrated financial ecosystem.

Beyond Manual Entry: Redefining Financial Operations in the Digital Age

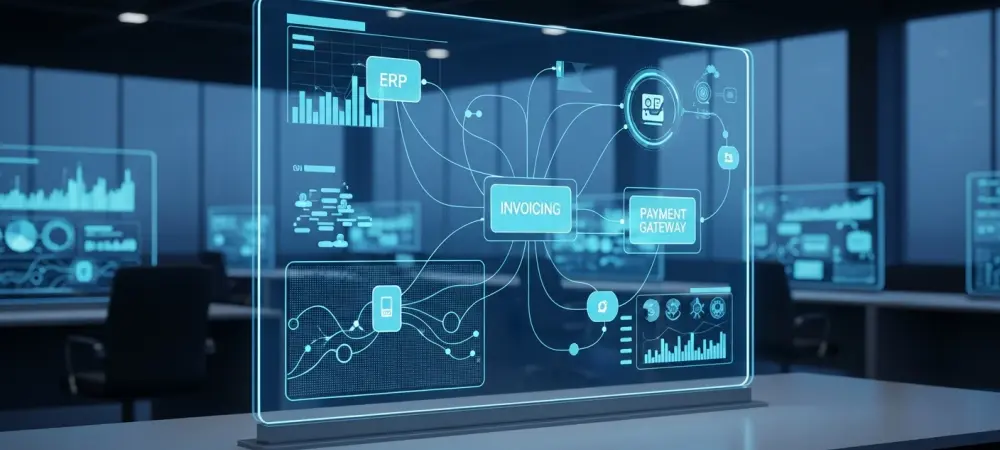

In the current digital landscape, an ERP system like Business Central serves as the financial heart of an organization, managing everything from general ledger entries to supply chain logistics. However, when this core system operates separately from the mechanisms that handle incoming and outgoing payments, it creates an operational silo. This separation forces finance teams to rely on manual processes for reconciling payments, updating customer accounts, and managing cash flow. Such manual intervention is not only time-consuming but also a breeding ground for costly data entry errors, which can lead to inaccurate financial reporting and strained customer relationships over disputed invoices.

Connecting financial management directly with payment processing is a fundamental shift toward a more agile and responsive operational model. This integration eliminates the need for redundant data entry and manual reconciliation, creating a single source of truth for all transaction-related data. When a payment is made, it is instantly and automatically reflected within Business Central, providing stakeholders with real-time visibility into the company’s financial status. Consequently, this move transcends a simple IT project; it becomes a strategic initiative that enhances decision-making, strengthens internal controls, and frees up valuable human resources to focus on higher-value activities such as financial analysis and strategic planning.

This article will navigate the compelling reasons behind this integration, starting with the tangible benefits of automating the order-to-cash cycle. From there, it will explore the different architectural approaches to integration, address the practical realities of implementation—including costs and compliance—and examine how to select the right gateway partner. Ultimately, it provides a clear blueprint for businesses to leverage this technology not just for efficiency gains but as a cornerstone for building a more resilient and competitive financial foundation.

Deconstructing the Integration: From Core Value to Strategic Execution

Revolutionizing the Order-to-Cash Cycle: The Tangible Gains of Automation

The integration of a payment gateway directly into Business Central fundamentally transforms the order-to-cash cycle, collapsing the timeline between invoicing a customer and settling the funds. By embedding a “Pay Now” link within an electronic invoice, businesses empower customers to remit payment instantly using their preferred method, be it a credit card or an ACH transfer. This simple automation drastically reduces payment latency, directly accelerating cash flow and improving the organization’s liquidity position. The system automatically applies the payment to the correct invoice and customer ledger, eliminating the manual, and often delayed, process of matching bank statement entries to outstanding receivables.

Beyond speed, the elimination of manual data entry yields quantifiable improvements in accuracy and operational efficiency. Every keystroke saved is a potential error avoided, preventing the cascading problems that arise from incorrect payment applications, such as misstated account balances and flawed financial reports. With an integrated solution, payment information flows seamlessly from the gateway to the ERP, ensuring data integrity and providing a real-time, accurate view of the company’s financial health. This heightened visibility allows for more precise cash forecasting and empowers leadership to make more informed strategic decisions based on up-to-the-minute financial data.

Furthermore, this integration significantly elevates data security. Manually handling credit card information, even for phone orders, exposes a business to substantial PCI DSS compliance risks and potential data breaches. Modern payment gateways are engineered with robust, PCI-compliant security protocols, using technologies like tokenization to replace sensitive card details with a non-sensitive equivalent. By offloading payment processing to a certified gateway, businesses protect sensitive customer data, reduce their compliance burden, and build trust with their clientele, all while securing their financial transactions within a protected environment.

Charting the Course: Selecting the Right Integration Architecture for Your Scale

The path to integrating a payment gateway with Business Central is not one-size-fits-all; the optimal architecture depends heavily on a company’s scale, complexity, and strategic goals. For many small to mid-sized businesses (SMBs), pre-built extensions from Microsoft’s AppSource marketplace offer the most direct route. These solutions are typically certified, easy to deploy, and cost-effective, providing core functionality out of the box. An SMB needing to quickly enable credit card payments on invoices would find an AppSource extension to be an efficient and sufficient solution, minimizing implementation time and upfront investment.

In contrast, enterprises with unique business logic or high transaction volumes may find pre-built solutions too restrictive. For these organizations, custom API development provides the ultimate flexibility. By building a direct connection between Business Central and the payment gateway’s API, a company can tailor the workflow to its exact specifications, such as implementing complex split-payment logic or integrating with proprietary internal systems. While this approach demands a greater investment in development resources and time, it delivers a perfectly fitted solution that can scale and adapt with the business, making it ideal for organizations with complex operational requirements.

A third option, middleware platforms, serves as a strategic bridge for businesses with a complex technology stack. These Integration Platform as a Service (iPaaS) solutions connect Business Central not only to a payment gateway but also to other systems like a CRM or an eCommerce platform. A company managing sales through multiple channels, for instance, could use middleware to synchronize payment and order data across all systems seamlessly. This approach centralizes integration logic, simplifies maintenance, and offers superior scalability. Although it introduces an additional subscription cost, the long-term benefit is a more agile and future-proofed IT architecture that can easily accommodate new applications and evolving business needs.

Confronting Implementation Realities: Navigating Costs, Compliance, and Common Hurdles

Successfully implementing a payment gateway requires a clear-eyed assessment of the complete cost of ownership. This extends beyond the initial implementation fees to include recurring costs that impact the long-term budget. Businesses must account for the gateway’s transaction fees, which are typically a percentage plus a fixed amount per transaction, as well as any monthly platform fees or charges for additional services like fraud protection. Separating these operational costs from the one-time setup expenses associated with custom development or the subscription fees for an AppSource extension is crucial for accurate financial planning and calculating the true return on investment.

For US-based businesses, several mission-critical considerations must be addressed during implementation. Adherence to the Payment Card Industry Data Security Standard (PCI DSS) is non-negotiable to protect cardholder data and avoid severe penalties. The integration must also seamlessly handle state and local sales tax calculations, ensuring that correct amounts are collected and recorded. Furthermore, for B2B transactions, the ability to efficiently manage and reconcile Automated Clearing House (ACH) payments is vital. A robust solution will automate the reconciliation of bank deposits against payments recorded in Business Central, accounting for batch settlements and processing fees.

Even with careful planning, integrations can encounter common points of failure that require proactive mitigation. Data synchronization errors, where a payment is processed by the gateway but fails to post in Business Central, can disrupt financial records if not managed with robust error-handling and notification systems. Processing refunds and chargebacks can also introduce complexity, as the workflow must ensure that financial entries are correctly reversed in the general ledger and inventory levels are adjusted if applicable. Proactive strategies, such as thorough sandbox testing of all transaction types and establishing clear reconciliation procedures, are essential to identify and resolve these potential hurdles before they impact live operations.

The Partner Ecosystem: Aligning a Gateway’s Strengths with Your Business Model

Choosing a payment gateway is not just a technical decision; it is a strategic partnership that should align with a company’s specific business model. A comparative analysis reveals that leading gateways cater to distinct use cases within the Business Central ecosystem. For example, Stripe is often the preferred choice for subscription-based SaaS companies and modern eCommerce platforms due to its powerful API, robust recurring billing engine, and extensive multi-currency support. Its developer-centric tools allow for deep customization, making it an ideal fit for businesses that view payment processing as an integral part of their product offering.

In contrast, PayPal offers a different set of advantages, primarily centered on its widespread brand recognition and user trust. For B2C businesses or organizations transitioning from simpler accounting systems, offering PayPal as a payment option can reduce friction at checkout and appeal to a broad customer base. Its platform is adept at handling standard eCommerce transactions and provides straightforward tools for invoicing, making it a strong contender for companies that prioritize customer convenience and familiarity over complex, custom-built payment workflows.

Ultimately, the one-size-fits-all approach to selecting a gateway is ineffective. The decision should be driven by industry-specific demands and strategic objectives. A wholesaler might prioritize a gateway with strong Level 3 data processing capabilities to lower interchange fees on B2B transactions, while a global retailer would require one with extensive international payment methods and dynamic currency conversion. By carefully matching a gateway’s features—such as subscription management, in-person payment hardware, or advanced fraud detection—to core business needs, the right partnership can move beyond a simple utility and become a true competitive differentiator that enhances the customer experience and supports growth.

From Strategy to Action: A Practical Blueprint for Flawless Implementation

Transitioning from strategic intent to a successful launch requires a methodical and disciplined approach. Business leaders should begin by creating a clear, actionable checklist that distills the project’s critical requirements. This checklist must cover everything from defining the required payment types (credit card, ACH, digital wallets) and outlining the desired customer payment experience to specifying the necessary financial reporting and reconciliation capabilities. This document serves as a foundational guide for evaluating potential solutions and partners, ensuring that key business needs remain at the forefront throughout the implementation process.

A best-practice guide for implementation follows a logical, step-by-step progression. The first step is to conduct a thorough audit of current payment and invoicing workflows to identify inefficiencies and define clear objectives for the integration. Next, selecting a certified implementation partner with proven expertise in both Business Central and payment systems is paramount to navigating technical complexities. Once a partner and solution are chosen, the most critical phase is rigorous testing in a sandbox environment. This pre-launch validation should simulate all possible transaction scenarios—including successful payments, declines, refunds, and partial payments—to ensure the system behaves as expected before it impacts real customers and financial data.

After a successful launch, the work is not complete; ongoing monitoring is essential to maintain system health and data integrity. This involves regularly reviewing synchronization logs to catch and resolve any API communication errors between the gateway and Business Central. It also means establishing a routine reconciliation process to verify that bank deposits match the transactions recorded in the ERP system. By adopting a proactive stance on post-launch monitoring, businesses can ensure the long-term reliability of their integrated payment solution, cementing the operational gains and securing the return on their investment.

The Final Ledger: Securing a Lasting Competitive Advantage Through Integration

The decision to integrate a payment gateway with Business Central is ultimately a transformative business initiative, not merely an IT project confined to the finance department. This strategic move directly reshapes core operational processes, replacing manual, error-prone tasks with automated, secure, and efficient workflows. The result is an organization that operates with greater agility, capable of responding more quickly to market demands and customer expectations. By creating a seamless flow of data from payment to reconciliation, businesses unlock real-time financial insights that are crucial for sound and timely decision-making. This integration yields a lasting and compounding impact on both customer satisfaction and financial resilience. Offering a convenient and secure payment experience strengthens customer relationships and encourages prompt payment, while the acceleration of the order-to-cash cycle directly enhances the company’s cash flow and working capital. In an increasingly competitive market, the operational efficiency and financial clarity gained from a fully integrated system provide a distinct and sustainable advantage. It allows a business to scale without a proportional increase in administrative overhead, ensuring that growth is both profitable and manageable.

This analysis reinforces that businesses should view this integration as a foundational step toward future-proofing their financial operations. In a digital-first economy, the ability to transact seamlessly is no longer a luxury but a baseline expectation. By connecting the central nervous system of their finances—Business Central—with the circulatory system of payments, companies build a more robust, intelligent, and resilient enterprise. The final ledger shows that the investment pays dividends not just in saved time and reduced errors, but in the creation of a competitive edge that will endure for years to come.