Unveiling the Strategic Push for UK AI and Cloud Dominance

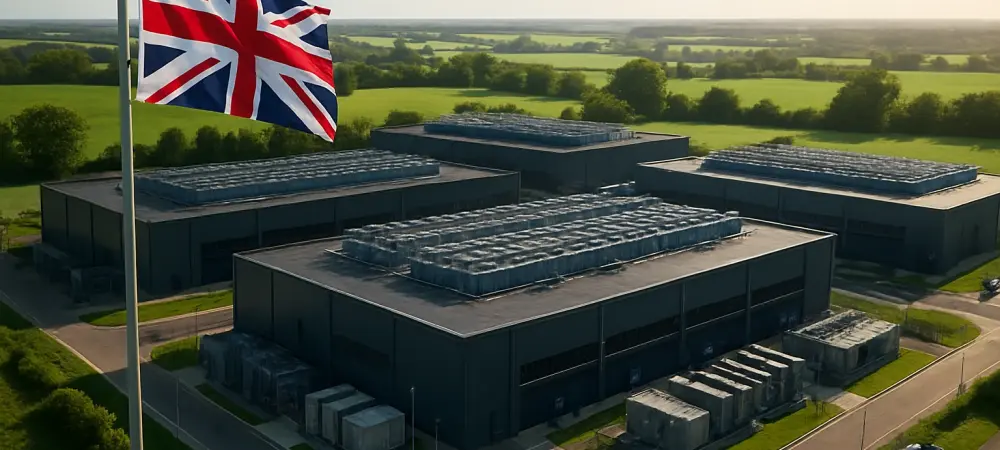

Imagine a world where artificial intelligence powers every facet of daily life, from healthcare diagnostics to financial forecasting, and the backbone of this revolution lies in vast, cutting-edge data centers. This vision drives tech giants Microsoft and Nvidia to channel billions of dollars into the United Kingdom, aiming to establish dominance in AI and cloud computing infrastructure. Their ambition is not merely about expanding physical facilities but about securing a pivotal role in shaping the future of technology on a global scale.

The UK stands out as a prime location for such massive investments due to its robust technological ecosystem, proximity to European markets, and a regulatory environment that balances innovation with data protection. Factors like cloud sovereignty needs and a skilled workforce further enhance its appeal as a hub for tech advancements. However, challenges loom large, including fierce competition from other regions and the complexity of aligning with stringent local policies on data privacy.

Navigating this competitive landscape requires strategic foresight, as both companies face hurdles such as escalating operational costs and the need for sustainable energy solutions to power these data-intensive facilities. Microsoft and Nvidia must also contend with geopolitical uncertainties that could impact long-term plans. Their focus remains on leveraging the UK’s unique advantages to outpace rivals in the race for AI supremacy.

Context and Importance of UK Data Center Investments

The global demand for AI and cloud services has surged dramatically, fueled by enterprises seeking scalable solutions for digital transformation. The UK emerges as a strategic hub in this context, offering a gateway to Europe while addressing critical concerns like data privacy and regulatory compliance. Its position is strengthened by a growing emphasis on cloud sovereignty, where data must reside within national borders to meet legal standards.

These investments hold immense significance for the UK economy, promising substantial job creation in tech and related sectors, alongside fostering innovation through research and development. The influx of capital positions the nation as a frontrunner in the global tech race, attracting talent and further investments. Beyond economics, the societal impact includes enhanced digital infrastructure that can support smarter cities and advanced public services.

Moreover, the UK’s role in this technological shift extends to influencing international standards for AI ethics and data governance. As Microsoft and Nvidia build out their infrastructure, they contribute to a broader dialogue on how technology can be harnessed responsibly. This dual focus on economic growth and societal benefit underscores the transformative potential of their commitments.

Investment Details, Outcomes, and Broader Impact

Investment Breakdown and Collaborative Efforts

Microsoft has committed an unprecedented $30 billion through 2028 to bolster cloud and AI infrastructure in the UK, with half of this sum allocated to capital expenditures for data centers and the remainder dedicated to AI research and model development. This financial pledge marks a significant escalation in their regional presence. Nvidia, meanwhile, is investing 11 billion pounds, equivalent to $15 billion, to deploy 120,000 Blackwell Ultra GPUs in collaboration with UK hyperscaler Nscale and US-based GPU cloud provider CoreWeave.

Partnerships form the cornerstone of these initiatives, as seen in joint efforts with entities like OpenAI to launch Stargate UK, an AI infrastructure project mirroring a US model. Additionally, a supercomputer facility in Loughton, near London, exemplifies how local expertise is harnessed through collaborations with Nscale. These alliances ensure that investments are not just financial but also strategically integrated with regional capabilities.

The methodology behind these commitments involves meticulous planning of capital expenditure, focusing on advanced hardware deployment and infrastructure scalability. Research funding aims to push boundaries in AI innovation, ensuring that the UK remains at the forefront of technological breakthroughs. Such structured approaches highlight a long-term vision for sustainable growth in the sector.

Key Outcomes and Trends

The outcomes of these investments are transformative, with significant expansion of data center capacities across the UK, enabling faster and more efficient cloud services. Cutting-edge AI infrastructure, powered by state-of-the-art GPUs, positions the region as a leader in computational power. These developments align with global hyperscaler spending trends, evidenced by a 43% year-over-year increase to $158 billion in data center investments in the second quarter of this year, as reported by Dell’Oro Group.

Data-driven projections further underline the urgency of such initiatives, with Gartner forecasting a 50% spike in AI spending to $1.5 trillion by the end of this year. This rapid growth reflects an insatiable demand for AI solutions across industries, driving companies like Microsoft and Nvidia to accelerate their infrastructure buildouts. The UK’s role in this trend is pivotal, as it captures a significant share of global tech investments.

Emerging patterns also show a ripple effect, where initial investments catalyze further growth in related technologies and services. The enhanced capacity supports not just current needs but also future innovations in machine learning and big data analytics. This momentum establishes a feedback loop of technological advancement and economic gain for the region.

Implications for the UK and Beyond

Practically, these investments fortify the UK’s tech ecosystem by creating a robust foundation for digital services, attracting additional commitments from giants like Amazon and Google Cloud. Regulatory compliance, a key concern, is addressed through localized data storage solutions that adhere to strict guidelines. This strengthens trust among stakeholders and ensures seamless integration into the broader European market.

On a theoretical level, the influx of capital and technology reshapes global AI and cloud market competition, positioning the UK as a counterweight to other tech hubs like the US and Asia. The societal benefits are equally profound, with improved digital infrastructure paving the way for advancements in education, healthcare, and governance. Such impacts extend beyond borders, influencing global standards for technology deployment.

Furthermore, these developments prompt discussions on policy frameworks surrounding data privacy and sovereignty, potentially leading to harmonized international regulations. The UK’s enhanced capabilities could serve as a model for other nations seeking to balance innovation with security. This broader influence underscores the far-reaching implications of Microsoft and Nvidia’s strategic moves.

Reflections on Challenges and Opportunities

Reflection on Investment Strategies

Executing investments of this magnitude involves navigating a maze of regulatory hurdles, from compliance with data protection laws to environmental standards for energy-intensive data centers. Local partnerships, while beneficial, require careful coordination to align with global objectives. Microsoft and Nvidia must balance their expansive ambitions with regional priorities, ensuring that investments yield mutual benefits.

Strategic collaborations have been instrumental in overcoming these obstacles, as seen in prior commitments like Microsoft’s earlier $3.2 billion pledge for UK cloud facilities. Phased investment approaches allow for adaptability, addressing immediate needs while planning for future expansions. This calculated methodology mitigates risks associated with rapid scaling in a dynamic regulatory landscape.

The complexity of these endeavors also lies in managing stakeholder expectations, from government bodies to local communities concerned about environmental impacts. Both companies have demonstrated resilience by leveraging their experience in global markets to tailor solutions for the UK context. Such adaptability is key to sustaining momentum amid evolving challenges.

Future Directions

Looking ahead, potential expansions could see new data center projects in underrepresented UK regions, further democratizing access to advanced technology. Building on current partnerships, novel AI initiatives might emerge, focusing on sector-specific applications like healthcare or renewable energy. These developments could redefine how technology integrates into everyday life.

Unanswered questions persist about the long-term sustainability of such heavy capital expenditures, especially concerning energy consumption and environmental impact. The evolving role of government policies in shaping tech investments also remains a critical area of exploration. How these factors interplay will determine the trajectory of the UK’s tech landscape.

Additionally, the scalability of these projects to other European nations presents an opportunity for regional collaboration, potentially creating a unified tech corridor. Monitoring how Microsoft and Nvidia adapt their strategies in response to global trends will offer valuable insights into the future of infrastructure investment. These considerations highlight the dynamic nature of their ongoing efforts.

Summarizing the Tech Giants’ Bold Move and Its Significance

The colossal investments by Microsoft and Nvidia in UK data centers reflect a strategic blend of economic ambition and technological foresight, driven by the urgent need to lead in AI and cloud computing. These commitments, totaling over $45 billion, capitalize on the UK’s advantageous position as a tech hub, bolstered by regulatory alignment and market access. Economically, they promise growth through job creation and innovation, while technologically, they cement the nation’s status as a global contender.

Reflecting on the journey, the scale of collaboration and capital deployed marks a historic push that reshapes the UK’s digital landscape. Moving forward, actionable steps should include fostering public-private partnerships to address sustainability concerns, ensuring that energy demands of data centers align with green initiatives. Additionally, policymakers should consider incentives for tech investments that prioritize regional equity, while industry leaders explore cross-border collaborations to amplify impact, setting a precedent for global tech synergy.