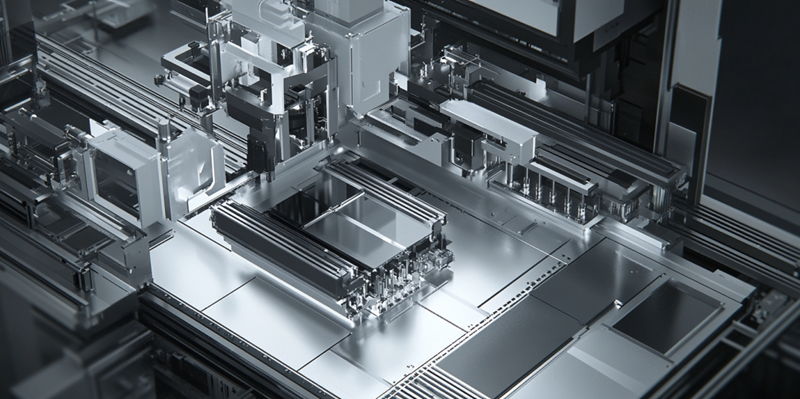

In a strategic move that underscores its commitment to maintaining a technological edge, Taiwan Semiconductor Manufacturing Company (TSMC) is poised to receive ASML’s high-NA EUV lithography equipment by the end of 2024. This equipment, particularly the Twinscan EXE:5000, boasts an 8nm resolution and a 13.5nm EUV light wavelength, enabling the production of smaller chips with significantly higher transistor densities. The adoption of this cutting-edge technology marks a pivotal transition for TSMC, specifically in its 1.4nm (A14) process, anticipated to enter mass production by 2027. This shift comes amid intense market competition with industry giants Samsung and Intel.

The high costs associated with the high-NA EUV lithography equipment, with each unit priced at approximately $350 million, highlight the significant financial investment required to stay at the forefront of semiconductor manufacturing. However, TSMC’s acquisition underscores the importance of maintaining a technological edge and balance within the industry. The unparalleled productivity of this equipment, making it a highly coveted asset in the semiconductor race, is indicative of its critical role in future chip manufacturing. Furthermore, Intel’s interest in acquiring multiple units signals a broader industry trend towards high-NA equipment as the next "holy grail" in chip production.

Competitive Landscape

TSMC’s forward leap is contextualized within the broader competitive landscape, where superior performance metrics are not just a goal but a necessity for market leadership. Achieving such performance metrics is critical in the backdrop of AI-driven demand and the future trajectory of semiconductor development. The overarching trend showcases a concerted push towards enhanced precision and efficiency in chip manufacturing. This narrative exposes the competitive spirit and strategic investments shaping the industry’s future, emphasizing TSMC’s ambitious plans to harness high-NA technology. Such investments are not just about maintaining the current market position but about defining the future landscape of semiconductor manufacturing.

The broader trend observed across leading semiconductor companies is to leverage advanced photolithography to meet the exponentially growing demand for powerful and efficient chips. High-NA equipment’s ability to boost productivity and precision aligns perfectly with these industry needs. As companies strive to outdo each other, the competition naturally propels technological advancements, particularly in the realm of high-NA EUV lithography. The significance of these advancements cannot be overstated, as they are poised to redefine the production capabilities and performance standards in the semiconductor industry.

Future Implications

In a strategic move highlighting its commitment to technological advancement, Taiwan Semiconductor Manufacturing Company (TSMC) is set to receive ASML’s high-NA EUV lithography equipment by late 2024. The Twinscan EXE:5000, with its 8nm resolution and 13.5nm EUV light wavelength, will enable the production of smaller, denser chips, marking a significant transition for TSMC. This technology will be integral to their 1.4nm (A14) process, expected to start mass production by 2027. This development occurs amid fierce competition with industry leaders Samsung and Intel.

The high-NA EUV lithography equipment comes with a hefty price tag of roughly $350 million per unit, underscoring the substantial financial commitment necessary to stay ahead in semiconductor manufacturing. Yet, TSMC’s investment highlights the importance of maintaining technological superiority in the industry. The unparalleled productivity of this equipment makes it a sought-after asset in the semiconductor race. Intel’s interest in acquiring multiple units reflects a broader industry shift toward high-NA equipment as the next pivotal innovation in chip production.