The Alarming Surge of Deepfake Threats

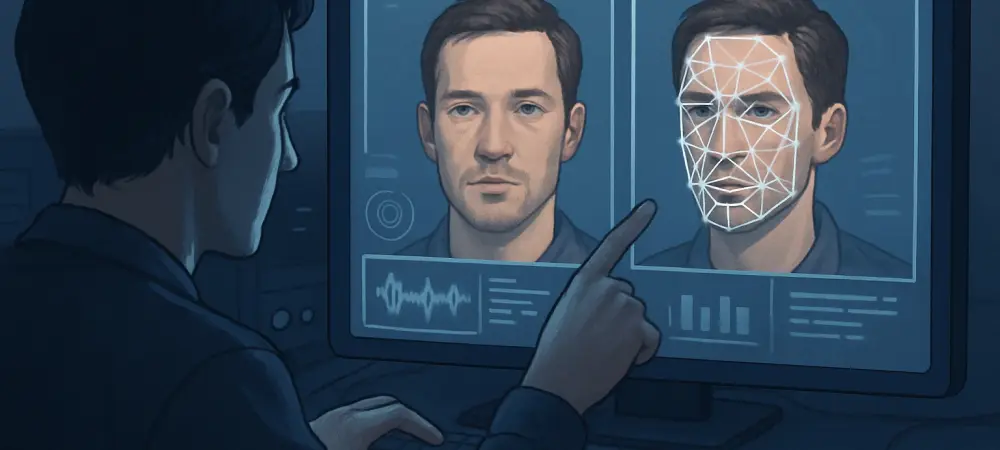

In an era where digital deception is rampant, a staggering projection estimates that 8 million pieces of deepfake content are circulating globally this year, posing an unprecedented challenge to trust and security in various sectors. This alarming statistic underscores a crisis that has infiltrated high-stakes industries like cryptocurrency, where the foundation of trust is paramount for market stability. The rapid proliferation of AI-generated fraud, particularly through voice-based phishing, has exposed vulnerabilities in traditional systems, urging a critical examination of how society can combat this menace. This analysis delves into the escalating threat of deepfake fraud, dissects the shortcomings of centralized detection mechanisms, and explores the transformative potential of decentralized solutions as a beacon of hope in restoring digital integrity.

The Growing Menace of Deepfake Fraud

Escalating Numbers and Sectoral Impact

The scale of deepfake fraud has intensified dramatically, with voice-based phishing attacks surging by 28% year-over-year in the third quarter of this year. Financial repercussions are equally staggering, as losses attributed to deepfake-enabled fraud reached $200 million in the first quarter alone, with an average annual cost of $14 million per organization. These numbers reflect not just monetary damage but a profound erosion of confidence across industries, signaling a dire need for robust countermeasures.

Particularly vulnerable is the cryptocurrency sector, where trust underpins every transaction and interaction. The manipulation of digital identities through deepfakes threatens to destabilize markets, as users grow wary of scams impersonating trusted figures. Industry reports indicate that the crypto space faces unique risks due to its decentralized nature, amplifying the impact of fraud on user sentiment and market dynamics, and necessitating urgent protective strategies.

High-Profile Cases and Global Reach

Notable instances of deepfake exploitation have targeted prominent cryptocurrency leaders like Changpeng Zhao and Vitalik Buterin, with fraudsters using fabricated videos to endorse sham investment opportunities. These incidents have not only tarnished individual reputations but also shaken the broader community’s faith in digital interactions. Such cases highlight the sophisticated tactics employed by attackers to exploit trust for financial gain.

Beyond crypto, the threat extends to other public figures, such as Robert Irwin, whose likeness has been misused on social media to deceive followers. This widespread misuse across platforms illustrates that no sector is immune, as attackers leverage accessible technology to craft convincing fakes. The global nature of this issue is further evidenced by enforcement actions, with authorities dismantling 87 deepfake scam operations in Asia during the first quarter of this year, revealing the extensive challenge of curbing such fraud internationally.

Shortcomings of Centralized Detection Approaches

Operational Weaknesses and Real-World Failures

Centralized systems, once heralded as reliable defenses against digital fraud, are proving inadequate in the face of evolving deepfake technology. While these systems achieve an 86% accuracy rate in controlled environments, their performance plummets to just 69% in real-world conditions, exposing a significant gap. This discrepancy arises from static update cycles that fail to match the agility of generative AI, leaving defenses outdated and ineffective.

Attackers capitalize on these structural limitations, continuously refining their methods to bypass traditional safeguards. Bureaucratic delays in updating centralized protocols exacerbate the problem, creating windows of vulnerability that fraudsters exploit with ease. As deepfake techniques become more sophisticated, the inability of centralized mechanisms to adapt in real time poses a growing risk to digital security across multiple domains.

Expert Critiques on Systemic Flaws

Industry leaders have voiced increasing concern over the inherent flaws of centralized detection frameworks. Ken Jon Miyachi, co-founder of BitMind, has emphasized that such systems are structurally incapable of addressing the dynamic nature of AI-driven fraud, pointing to their slow response times as a critical weakness. This perspective resonates with many in the tech and crypto spaces who see the need for more agile solutions.

Professionals across these sectors argue that the erosion of trust caused by ineffective detection mechanisms presents systemic risks, especially in industries reliant on user confidence. There is a growing consensus that without adaptive, real-time tools, the battle against deepfake fraud will remain a losing one, prompting calls for innovative approaches to safeguard digital ecosystems from escalating threats.

Emerging Potential of Decentralized Detection Networks

Overcoming Challenges with Innovative Frameworks

Decentralized detection networks offer a compelling alternative by addressing the core deficiencies of their centralized counterparts. These systems encourage competition among developers through financial incentives, driving the creation of cutting-edge algorithms capable of near-perfect accuracy in identifying deepfakes. Unlike static centralized models, decentralized approaches adapt swiftly to new threats, providing a dynamic shield against fraud.

Regulatory developments, such as the EU AI Act’s emphasis on transparency and auditable security measures, further bolster the case for decentralization. These frameworks align with mandates for accountable technology, positioning them as a forward-thinking solution in the fight against digital deception. By fostering innovation and adaptability, decentralized networks promise to redefine how industries tackle the deepfake crisis.

Building Collaborative Defenses

Implementing decentralized detection involves practical steps like embedding real-time verification tools into platform interfaces and user onboarding processes. Such integration ensures that users can authenticate content seamlessly, reducing the risk of falling victim to scams. Platforms must prioritize these features to enhance security without compromising user experience, creating a robust first line of defense.

Partnerships between Web2 social media giants and Web3 crypto exchanges are essential to establish a unified front against deepfake fraud. Collaborative efforts can standardize detection protocols across digital spaces, amplifying their effectiveness. Additionally, key opinion leaders play a vital role in promoting these solutions, educating their audiences on verification practices to foster a culture of vigilance and trust.

Looking Ahead at Decentralized Detection Innovations

Speculation on the future of decentralized detection points to groundbreaking advancements, including AI-driven tools that could achieve flawless identification of deepfakes. Such progress would not only restore user trust but also stabilize markets, particularly in cryptocurrency, by ensuring the integrity of digital interactions. However, challenges like regulatory compliance and the cost of widespread adoption remain hurdles to overcome.

Broader implications extend beyond immediate fraud prevention, as enhanced security could set new benchmarks for trust verification in various industries facing AI-driven threats. Yet, risks such as over-reliance on technology without sufficient user education persist, potentially leaving gaps for fraudsters to exploit. The ongoing cat-and-mouse game with attackers suggests that continuous innovation will be necessary to maintain an edge.

This trend of decentralization could reshape digital security paradigms, influencing sectors far beyond crypto by establishing a model for combating AI-generated risks. As industries grapple with these evolving challenges, the adoption of decentralized systems may become a cornerstone of modern trust mechanisms, paving the way for safer online environments. Balancing technological reliance with informed user behavior will be critical to long-term success.

Reflecting on a Path Forward

Looking back, the analysis of deepfake fraud revealed a pressing crisis that demanded immediate attention, as financial losses mounted and trust eroded across key sectors. The failure of centralized systems to keep pace with AI advancements stood out as a pivotal concern, while decentralized detection networks emerged as a viable solution with transformative potential. The urgency to act was evident in every statistic and case study discussed.

Moving forward, platforms, regulators, and industry leaders must prioritize collaboration to integrate decentralized tools swiftly into digital ecosystems. A concerted effort to educate users on verification practices could complement technological solutions, ensuring a holistic defense against fraud. By embracing innovation and fostering partnerships, stakeholders have the opportunity to safeguard financial systems and rebuild confidence in an increasingly deceptive digital landscape.