Artificial intelligence has officially moved from a supporting role to become the central economic pillar of the cloud, igniting an investment boom of historic proportions that is fundamentally restructuring the industry. This trend is not merely accelerating cloud usage; it is redefining investment priorities, reshaping competitive dynamics, and expanding the economic scale of the entire sector. This analysis delves into the data driving this transformation, examines the strategic pivot in infrastructure investment, explores the resulting market challenges, and provides a long-term outlook for the evolving cloud industry.

The AI-Fueled Boom: Quantifying the Cloud’s New Growth Trajectory

The scale of AI’s impact on cloud infrastructure is best understood through the staggering financial figures that now define the market. This symbiotic relationship between AI development and cloud expansion has created a self-reinforcing cycle of investment and growth, pushing both sectors into a new economic stratosphere and fundamentally changing where capital is being allocated.

A Trillion-Dollar Symbiosis: Market Projections and Spending Statistics

The global expenditure on AI, which includes software, hardware, and services, is on track to surpass an astounding $2.5 trillion. This monumental spending directly fuels the cloud computing market, which itself is approaching a $1 trillion valuation. The correlation is clear: as businesses integrate AI into their core operations, their demand for powerful, scalable cloud infrastructure explodes, creating a powerful economic feedback loop.

This trend is further validated by the capital spending of the world’s largest technology firms. Credible industry reports show that capital expenditures from these giants are forecasted to exceed $600 billion this year, with a significant and growing portion of these funds being allocated directly to AI and cloud infrastructure build-outs. This massive flow of capital underscores a consensus among market leaders that AI is not just a growth area but the primary engine of future technological and economic expansion.

The Great Investment Pivot: From General Services to Specialized AI Hardware

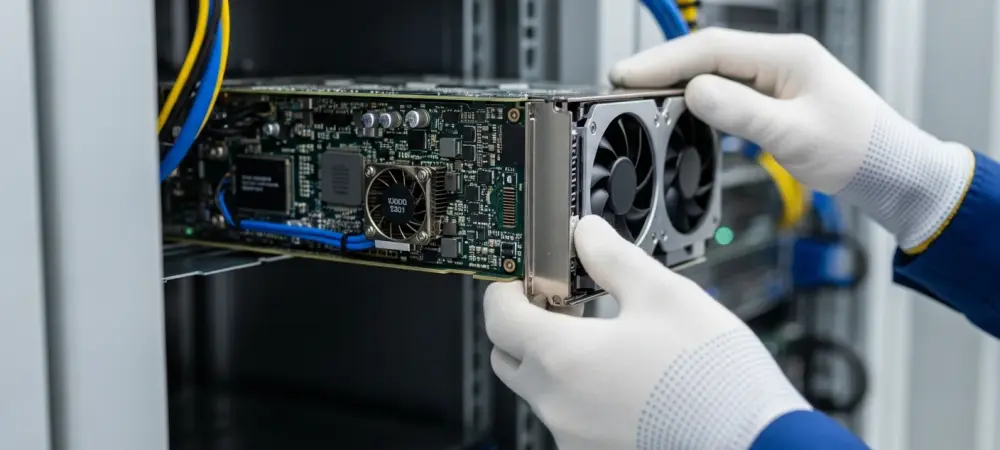

The nature of this investment marks a radical departure from the cloud’s earlier growth phases. Capital is no longer primarily directed toward general-purpose services like basic data storage or website hosting. Instead, the focus has shifted decisively toward building dense, high-performance computing environments architected specifically for the immense demands of AI and machine learning workloads. This pivot involves constructing new data centers and, more critically, procuring specialized hardware like advanced GPUs at an unprecedented scale.

Case studies from market leaders vividly illustrate this strategic shift. Companies like Microsoft and Alphabet are channeling enormous sums into bolstering their AI capabilities. Meta provides a particularly striking example, with its capital investment in data centers and AI infrastructure projected to exceed $115 billion. This concentration of spending highlights a clear industry-wide move away from generalized expansion toward highly targeted investments in the specialized, powerful, and expensive infrastructure required to train and deploy sophisticated AI models.

Expert Analysis: Navigating the New High-Stakes Competitive Landscape

The immense capital required to compete in the AI infrastructure race is fundamentally altering the market’s economics. The high cost of specialized hardware, such as advanced GPUs, has created a formidable barrier to entry, concentrating power in the hands of a few dominant players. This shift is not just financial but also architectural, as the industry’s focus pivots from broad flexibility to raw computational power.

There is a clear industry consensus that the strategic priority has moved from infrastructure agility to sheer computational speed and performance. This new paradigm necessitates different architectural and operational models designed to handle the massive, parallel processing demands of large AI models. Consequently, the immense financial requirements are driving significant market consolidation, solidifying the dominance of the few technology titans with the capital and scale to build and maintain this next-generation infrastructure.

Future Outlook: A Consolidated Market and the Rising Cost of Innovation

Looking ahead, the cloud market is defined by a high-stakes race for computational superiority that overwhelmingly favors large, well-capitalized incumbents. This new competitive landscape presents significant hurdles for smaller entities, who face an uphill battle to secure the necessary resources to remain relevant in an industry increasingly defined by massive scale.

The immense pressure on smaller cloud providers is one of the most significant consequences of this trend. These companies struggle to afford the prohibitively expensive advanced hardware and find it increasingly difficult to raise the vast sums of capital required for large-scale AI infrastructure projects. This dynamic creates a challenging environment where innovation could become concentrated within a handful of major corporations.

Furthermore, the trend is solidifying new business practices that favor established leaders. Longer-term contracts for massive allotments of computing capacity are becoming standard, as enterprises seek to secure the resources needed for their AI ambitions. This practice further entrenches the market position of the major providers, locking in customers and revenue streams for years to come and potentially stifling the competitive landscape for new entrants.

Conclusion: AI as the New Bedrock of Cloud Economics

The integration of AI into the global economy proved to be a revolutionary force that reshaped the entire cloud industry. It demanded a new class of powerful, specialized, and costly infrastructure, which in turn escalated cloud spending into an entirely new economic tier defined by trillion-dollar market projections and hundred-billion-dollar corporate budgets. This transformation confirmed that AI was not an incremental addition to the cloud but its new foundational layer.

This profound market consolidation and the strategic pivot toward high-performance computing were the defining characteristics of this new era. The trend heavily favored large, well-capitalized technology firms and presented significant challenges for smaller competitors, leading to a more concentrated and high-stakes market.

Ultimately, the AI-driven evolution has set the trajectory for the technology sector for the foreseeable future. The massive investments and strategic realignments that occurred have cemented AI’s role as the primary engine of infrastructure development, ensuring its influence will continue to shape the digital landscape for years to come.