In an era where the demand for sustainable computing power is skyrocketing, Soluna, a trailblazer in AI and cryptomining data centers, has captured industry attention with a $100 million credit facility and the groundbreaking of Project Kati, a 166MW facility in Texas. This development comes at a critical juncture as businesses and tech leaders grapple with balancing high-performance computing needs against environmental impact. This roundup dives into diverse opinions and insights from industry stakeholders, financial analysts, and sustainability advocates to unpack what these milestones mean for the future of digital infrastructure and green technology. The aim is to provide a comprehensive view of Soluna’s strategic moves and their broader implications.

Financial Backing: A Game-Changer or a Gamble?

Industry Views on the $100 Million Credit Facility

The announcement of Soluna securing a $100 million credit line from Generate Capital has sparked varied reactions among financial analysts. Many see this as a transformative step, enabling the company to refinance existing projects like Dorothy 1A and 2 while funding ambitious new ventures. A segment of industry observers highlights the deal’s structure, including an initial draw of $12.6 million and a delayed draw of $22.9 million, as a model of capital efficiency that could inspire similar firms to pursue modular growth strategies.

On the flip side, some financial experts express caution about the potential risks of such substantial credit dependencies. Concerns linger over market volatility in the cryptomining and AI sectors, with a few analysts warning that over-leveraging could strain operations if demand fluctuates. Despite these reservations, the inclusion of warrants for four million shares and a board observer role for Generate Capital is often cited as a sign of deep trust and alignment in long-term goals.

A balanced perspective emerges from discussions around sustainable investment trends. Several thought leaders argue that partnerships like this one are essential for scaling innovative tech while maintaining fiscal discipline, though they stress the need for transparency in how funds are allocated to ensure investor confidence.

Strategic Implications for Expansion

Beyond the numbers, the credit facility is seen as a catalyst for Soluna’s broader expansion plans. Industry commentators note that refinancing key projects frees up resources to tackle larger initiatives, positioning the company as a serious contender in high-performance computing. This move is often praised for its timing, given the escalating need for robust data center infrastructure.

However, a differing opinion focuses on the competitive landscape, with some suggesting that while the funding is significant, it may not be enough to outpace larger players with deeper pockets. These voices advocate for Soluna to prioritize niche markets like AI hosting to carve out a distinct edge.

Another angle comes from smaller tech firms observing the deal, many of whom view it as a blueprint for securing capital without sacrificing equity. This perspective underscores a growing trend of strategic alliances in tech financing, potentially reshaping how emerging companies approach growth.

Project Kati: Texas as the New Tech Frontier

Mixed Reactions to the 166MW Facility

The groundbreaking of Project Kati in Willacy County, Texas, has generated buzz for its dual focus on Bitcoin hosting and AI infrastructure. Tech industry insiders are largely optimistic about the phased rollout, with the first 83MW phase expected to launch by early 2026. This initial stage, allocating capacity to both Galaxy and Soluna’s operations, is frequently cited as a practical approach to testing market demand.

Conversely, logistical challenges are a recurring concern among supply chain experts. Scaling to the full 166MW capacity could face hurdles like delays in equipment sourcing or regulatory approvals in Texas, a state known for its complex energy grid dynamics. These voices urge caution in projecting timelines too aggressively.

A third viewpoint emphasizes the project’s regional impact. Local business leaders and economic analysts in Texas see Project Kati as a potential boon for job creation and tech investment, though they question whether the benefits will trickle down evenly across communities or remain concentrated among larger stakeholders.

Opportunities and Challenges in the Texas Market

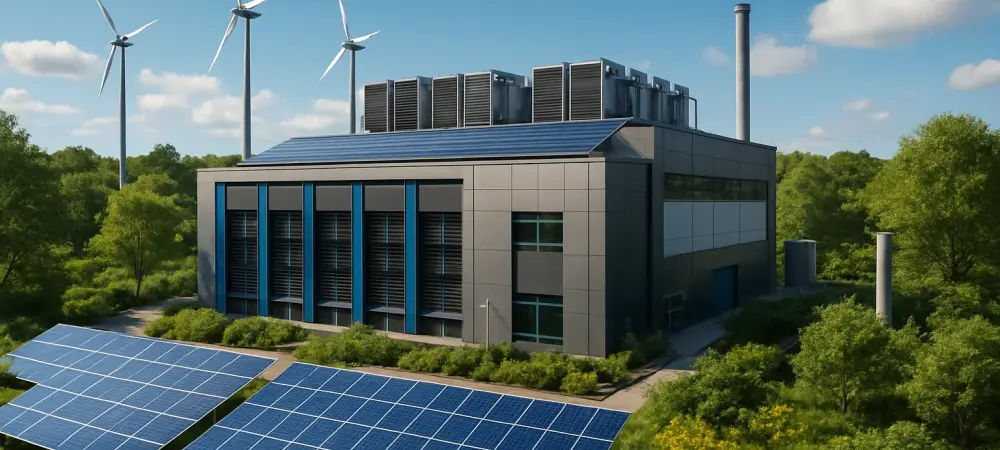

Drilling deeper into the Texas context, many industry watchers applaud Soluna’s choice of location due to the state’s abundant renewable energy resources and supportive business climate. The colocation model, pairing clean energy with computing power, is often highlighted as a competitive advantage that could attract diverse clients beyond cryptomining.

Yet, skepticism persists among some energy sector analysts who point to Texas’s history of grid instability as a risk factor for energy-intensive projects. They argue that while partnerships with EDF Renewables and Masdar bolster credibility, unforeseen power disruptions could undermine operational efficiency.

A more forward-looking take comes from tech innovators who see Project Kati as a testing ground for diversifying service offerings. Expanding into AI and HPC hosting in the second phase is viewed as a smart pivot, potentially positioning Soluna at the forefront of emerging computing trends if execution remains on track.

Sustainability: Core Strength or Marketing Ploy?

Debating Soluna’s Green Tech Approach

Soluna’s commitment to converting wasted renewable energy into computing power is a focal point of discussion among sustainability advocates. Many in the green tech space commend the company’s portfolio of 11 data center sites and a 2.8GW project pipeline as evidence of a genuine push toward eco-friendly innovation, setting a benchmark for others.

However, a critical perspective questions whether sustainability is being prioritized over profitability. Some industry skeptics argue that the high costs of maintaining green operations could limit scalability unless paired with significant government incentives or breakthroughs in energy efficiency.

Bridging these views, a number of environmental consultants suggest that Soluna’s model challenges outdated notions of sustainability as a financial burden. They point to a growing industry shift toward integrating energy and digital infrastructure, predicting that such approaches could redefine efficiency standards if adopted more widely.

Long-Term Viability of the Model

Looking at the bigger picture, renewable energy experts often frame Soluna’s strategy as a litmus test for the viability of green data centers. Success in projects like Kati could inspire broader adoption of similar models, especially as global pressure mounts to reduce carbon footprints in tech.

In contrast, some market analysts remain pragmatic, noting that consumer and investor demand for sustainable solutions must grow to justify the upfront investments. They caution that without clear metrics demonstrating cost savings, the model risks being seen as niche rather than mainstream.

An additional insight from tech policy circles focuses on regulatory tailwinds. With increasing governmental focus on clean energy, Soluna’s approach could benefit from future subsidies or favorable policies, though navigating compliance across multiple regions remains a noted challenge.

Collaborative Power: Partnerships Driving Growth

Diverse Opinions on Strategic Alliances

Soluna’s alliances with Generate Capital, Spring Lane Capital, and renewable energy giants like EDF Renewables and Masdar draw significant commentary. Many industry leaders view these collaborations as a cornerstone of the company’s credibility, providing not just capital but also operational expertise to navigate complex projects.

A contrasting opinion from smaller competitors highlights a potential downside: over-reliance on a few key partners could limit flexibility. These voices suggest that diversifying alliances might better insulate Soluna from risks tied to any single collaborator’s performance or strategic shifts.

Another layer of analysis comes from investment advisors who see these partnerships as a signal to the market. Strong backing from established players is often interpreted as a vote of confidence, likely to attract additional funding or clients, though maintaining alignment across varied interests is flagged as an ongoing task.

Shaping the Future of AI and HPC Hosting

Exploring the broader impact, tech trend analysts predict that Soluna’s collaborative approach could influence how AI and HPC hosting evolve. By leveraging partner networks, the company is seen as well-positioned to tap into emerging demands, potentially outmaneuvering peers who lack such robust support systems.

Differing from this optimism, some market researchers caution that the AI hosting space is becoming crowded, with giants already dominating. They argue that while partnerships provide a foothold, Soluna must innovate uniquely to avoid being overshadowed by larger incumbents.

A final perspective from industry forums focuses on knowledge sharing. Collaborations with renewable energy leaders are expected to yield insights into optimizing energy use in data centers, offering a ripple effect that could benefit the sector as a whole if best practices are disseminated.

Key Takeaways from the Roundup

Reflecting on the myriad perspectives, it’s evident that Soluna’s recent $100 million credit facility and the launch of Project Kati have stirred significant debate across financial, operational, and sustainability dimensions. Industry opinions converged on the potential of these milestones to redefine sustainable computing, though concerns about financial risks, logistical challenges, and market competition tempered the enthusiasm. The role of strategic partnerships stood out as a unifying strength, widely recognized as pivotal to scaling innovation. Looking ahead, stakeholders can take actionable steps by exploring investments in renewable-powered data centers to align with growing eco-conscious trends. Forming alliances with energy and tech firms offers another pathway to build scalable infrastructure. For those keen to delve deeper, staying informed on AI and HPC hosting developments or engaging with clean tech initiatives can provide a competitive edge in this rapidly evolving landscape.