OpenAI, the renowned company behind ChatGPT, has set its sights on developing its own artificial intelligence chips, signaling a significant move in the technology landscape. In addition, the company has been evaluating potential acquisition targets to bolster its chip capabilities. This article delves into the importance of AI chips for OpenAI, the driving forces behind their pursuit, the costly nature of running ChatGPT, and the potential challenges and benefits of venturing into chip development.

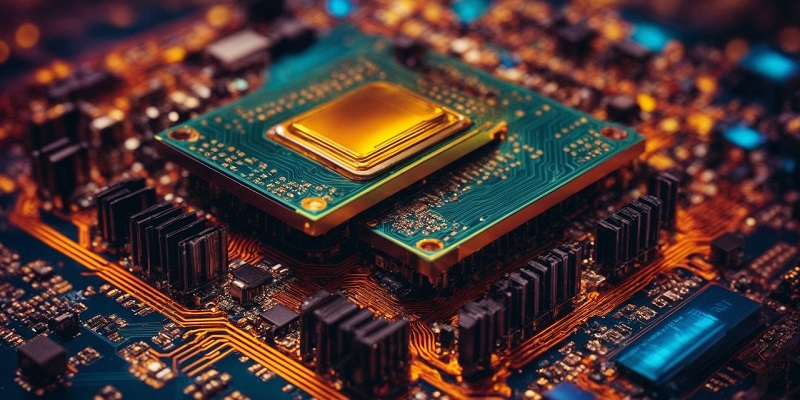

The Importance of AI Chips

AI chips serve as the backbone of OpenAI’s software and operations, enabling advanced processing capabilities vital to their machine learning algorithms. However, there are two primary concerns driving OpenAI’s interest in developing its own chips: a scarcity of the advanced processors required to power their software, and the substantial costs associated with maintaining the necessary hardware infrastructure.

Acquisition of AI Chips

OpenAI’s CEO, Sam Altman, has made it clear that acquiring more AI chips is a top priority for the company. Altman recognizes that the limited availability of these chips hampers OpenAI’s ability to scale its operations effectively. Furthermore, the exorbitant expenses incurred by running ChatGPT emphasize the urgency of finding a sustainable and cost-effective solution.

The operation of ChatGPT can be costly

The operational costs of running ChatGPT pose a significant financial burden for OpenAI. Massive computational power and hardware infrastructure are required to support the complex processes involved in natural language processing and generating responses based on input data. Therefore, developing their own AI chips could potentially alleviate these high operational costs.

Joining the tech giants

By venturing into AI chip development, OpenAI positions itself among a select group of technology giants such as Google and Amazon. These industry leaders have recognized the importance of designing their own chips specific to their businesses. Controlling the chip design not only enables enhanced performance but also affords greater flexibility and adaptability as technology evolves.

Uncertainty about OpenAI’s plan

While OpenAI is actively exploring the possibility of developing its own custom chip, the company has not yet decided on a concrete plan of action. Various factors, such as technological feasibility, cost-effectiveness, and long-term sustainability, are likely influencing this decision. However, the potential benefits of owning their own chip could yield significant advantages in terms of performance, cost reduction, and resource optimization.

Accelerating the process through acquisition

To expedite the development of OpenAI’s own chip, the company has been evaluating potential acquisition targets in the chip manufacturing domain. Acquiring an established chip company could provide OpenAI with the necessary infrastructure, expertise, and resources to fast-track chip development and achieve their goals more efficiently.

Long-term dependence on commercial providers

Even if OpenAI proceeds with its plans for a custom chip, including acquisition, the chip development process is anticipated to take several years. Consequently, during the interim period, OpenAI will continue to rely on commercial providers like Nvidia and AMD for their AI chip requirements. Maintaining strong partnerships with these providers will be crucial to ensure uninterrupted operations.

Mixed results in custom chip development

Some prominent tech companies that embarked on their own processor development journey have encountered mixed results. The intricacies and complexities involved in designing and manufacturing custom chips can pose significant challenges. However, OpenAI’s strong technological expertise and focused research endeavors provide a promising foundation for success in this domain.

Increased demand for AI chips

Since the introduction of ChatGPT, the demand for specialized AI chips has witnessed a remarkable surge. OpenAI’s cutting-edge language model has gained widespread recognition and adoption, leading to an increased need for powerful AI processing. This spike in demand further justifies OpenAI’s exploration into developing their own chips, as it would enable them to cater to their growing user base more efficiently.

As OpenAI explores the development of its own AI chips and assesses acquisition targets, the company enters a dynamic and influential realm within the technology industry. The significance of AI chips for OpenAI’s operations, coupled with CEO Sam Altman’s emphasis on acquiring more chips, underscores the company’s commitment to achieving self-sufficiency in chip design. However, the path to chip development presents challenges and uncertainties. Nevertheless, by embracing this endeavor, OpenAI demonstrates its determination to push the boundaries of artificial intelligence and shape the future of machine learning.