The United States’ sanctions on exporting advanced semiconductor products to China have had far-reaching consequences for companies like Nvidia. As one of the leading manufacturers of technology products, Nvidia has been particularly hard-hit by these regulations. This article explores the challenges that Nvidia faces in complying with these sanctions and the implications this has for the company’s future.

Background on US-China relations

The relationship between the United States and China has been complicated in recent years, with AI development becoming a contentious issue. The United States is wary of China’s growing capabilities in artificial intelligence and seeks to prevent China from acquiring advanced semiconductor products that could be used to further their AI efforts. This has led to strict sanctions that prohibit US companies from exporting such products to China.

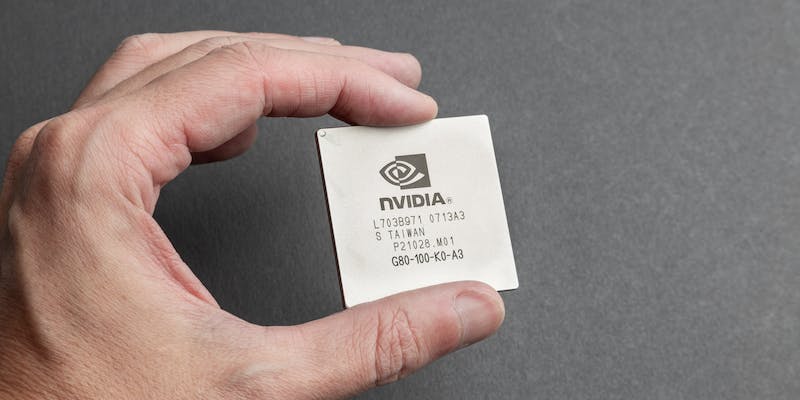

Nvidia’s situation

Among the companies affected by these sanctions, Nvidia finds itself in a precarious position. As a leading manufacturer of graphics processing units (GPUs) and other technology products, Nvidia’s products have applications in a wide range of industries, including AI development. The United States, therefore, closely scrutinizes Nvidia’s dealings with China to prevent any potential acquisition of technology that could benefit China’s AI capabilities.

Denial Without Naming

An anonymous source or government official recently made a comment that seemed to call out Nvidia without explicitly mentioning the company by name. The comment insinuated that certain companies were not complying with regulations and indirectly implicated Nvidia. This further highlights the level of scrutiny that Nvidia faces in its dealings with China.

Stricter scrutiny

The US government has made it clear that even if a company manufactures a new product to comply with the sanctions, that product will also receive scrutiny. This means that Nvidia’s attempts to modify existing products to adhere to the regulations do not guarantee a free pass. The company has to navigate a challenging landscape in order to stay in compliance while still meeting the demands of its customers.

Openness of Nvidia’s approach

Despite the challenges posed by the sanctions, Nvidia has been open and transparent about its efforts to comply with the regulations. The company understands the importance of not only adhering to the law but also ensuring that its customers are aware of its compliance measures. Nvidia is not attempting to hide its actions or deceive anyone regarding its commitment to following the sanctions.

The rumored RTX 4090 D

The most recent illustration of the cat-and-mouse game Nvidia is playing with US sanctions is the rumored RTX 4090 D. It has come to light that the standard RTX 4090 was banned from being exported to China in October. Nvidia’s response to this ban is said to be the development of a new product, the RTX 4090 D, specifically designed to comply with the sanctions while still meeting the demands of the Chinese market.

Historical Bank Examples

This ban on exporting advanced semiconductor products is not the first time Nvidia has faced such restrictions. In August of this year, the US announced a ban on Nvidia’s H100 and A100 (Hopper and Ampere) AI accelerators. These bans have further fueled speculation about the future implications of US-China sanctions on Nvidia and its broader business strategy.

The challenges faced by Nvidia due to US-China sanctions have significant implications for the company’s future. These regulations not only hinder Nvidia’s ability to tap into the Chinese market, but they also raise questions about the global reach and growth potential of the company. How Nvidia navigates these challenges will shape its relationship with China and impact its strategic direction moving forward.

In this era of heightened geopolitical tensions, companies like Nvidia find themselves caught in the crossfire between powerful nations. The struggle to comply with US-China sanctions is a reminder of the complex dynamics companies face while operating in a global marketplace. As the tech industry continues to evolve, Nvidia’s experiences shed light on the broader challenges and considerations that companies must confront when international politics intersect with business operations.