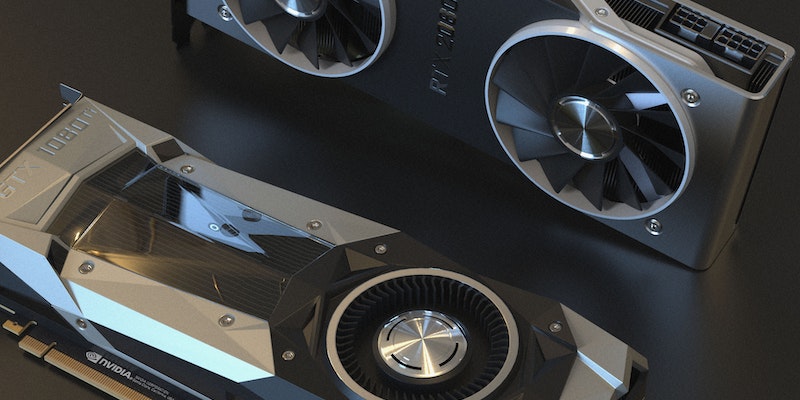

The demand for NVIDIA’s cut-down AI GPUs in China has reached unprecedented levels, resulting in astonishing price tags as high as 500,000 yuan (US $69,000). This surge in demand has caused a shortage in the Chinese market and led to significant inflation, leaving industry experts intrigued about the underlying factors driving this trend.

The High Demand for AI GPUs in China

In recent years, companies like Alibaba and ByteDance have been acquiring large volumes of AI GPUs to fuel their ambitious projects. Their need for powerful processing units to enhance machine learning capabilities and drive advanced artificial intelligence applications has catapulted the demand to an all-time high in China. The remarkable growth of these tech giants, along with other innovative startups, has spurred a race for cutting-edge AI hardware.

NVIDIA’s Strategy to Bypass US Sanctions

To circumvent US sanctions, NVIDIA has started selling cut-down variants of its popular H100 and A100 GPUs in China. This strategic approach ensures that China maintains access to state-of-the-art AI technology amidst stringent global trade restrictions. By offering modified versions of their flagship products, NVIDIA can continue catering to the Chinese market and supporting the nation’s burgeoning artificial intelligence industry.

Skyrocketing Prices in the Chinese Market

The scarcity of AI GPUs, exacerbated by the increased demand, has pushed prices to unprecedented levels. The A800 and H800 GPUs from NVIDIA are now being sold for staggering amounts, with some reaching nearly 500,000 yuan. The supply and demand dynamics, coupled with the limited availability of these AI powerhouses, have created a seller’s market, driving prices to astronomical heights.

Pricing Based on Client Relationships

In this unique market scenario, NVIDIA has taken a pricing approach tailored to client relationships. Acquiring significant orders from the company requires cultivating a close association with NVIDIA’s CEO, Jensen Huang. The strength of the relationship with the company influences the final price negotiated, creating a system where personal connections hold significant sway over business transactions.

Determining Price Based on Connection Extent

The extent of the connection with NVIDIA’s top executives plays a crucial role in determining the prices companies will pay for AI GPUs. While establishing a connection with Jensen Huang is crucial, the depth of the relationship and the level of influence one holds within the organization further impact the pricing. This mechanism has caused a significant power imbalance, favoring companies with strong connections and potentially excluding others from acquiring GPUs at a reasonable price.

NVIDIA’s Monopoly and Lack of Competitors

NVIDIA’s dominance over the AI GPU market has created a virtual monopoly, leaving little room for competition. Its cutting-edge technology, robust product portfolio, and strong brand reputation have positioned the company as an unrivaled leader in the industry. With no direct competitors in the market, NVIDIA has exerted immense control over AI GPU pricing, further driving up costs and limiting alternatives for Chinese buyers.

Potential Challenges and Evolving Industry

While NVIDIA’s monopoly has proven lucrative thus far, the industry is constantly evolving. As technology advances and market demands shift, new competitors may emerge, challenging NVIDIA’s stronghold. The current pricing bubble could burst at any moment, especially with the potential entry of rival companies offering comparable AI GPU solutions at more competitive prices. This industry evolution could foster healthy competition and benefit customers by driving down prices and expanding options.

The soaring prices of NVIDIA’s AI GPUs in China have caught industry experts by surprise, driven by a combination of unprecedented demand, supply shortages, and strategic market maneuvers. With its unique pricing strategy based on client relationships and the absence of competitors, NVIDIA has established a temporary monopoly over the industry. However, the rapidly evolving nature of the AI GPU market and the potential emergence of new players pose a significant challenge to NVIDIA’s dominance and pricing power in the long run.