Decentralized exchange KyberSwap recently disclosed a devastating cyberattack that occurred on November 22, resulting in the loss of nearly $55 million in users’ funds. The attack highlights the growing threat posed to the crypto industry by sophisticated hackers and underscores the need for stronger security measures within decentralized finance (DeFi) platforms.

Details of the Attack

The attack on KyberSwap was carried out on November 22, leading to a staggering loss of approximately $55 million in users’ funds. Out of this amount, around $54.7 million was exploited by the attackers. This incident left the platform’s users and the company itself in a state of shock and urgency to mitigate the consequences.

Response and Recovery Efforts

In response to the attack, KyberSwap swiftly took action by pausing deposits, launching an extensive investigation, and notifying relevant parties affected by the breach. Furthermore, the company initiated negotiations with the attackers in an attempt to recover as much of the exploited funds as possible, offering a 10% bounty as an incentive for their return.

Analysis of the Attack

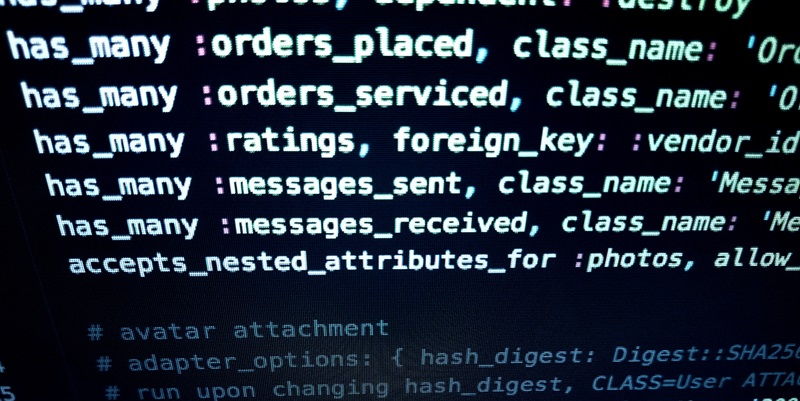

According to decentralized finance expert Doug Colkitt, who detailed the attack in a comprehensive thread on the social media platform X, the cyberattack was specifically targeted at KyberSwap’s implementation of concentrated liquidity. This highly sophisticated technique exhibited the attackers’ remarkable skill and specialized knowledge in the realm of DeFi platforms. Such attacks emphasize the need for increased security measures within the crypto industry.

Recovery Progress

KyberSwap demonstrated resilience by contacting the owners of frontrun bots responsible for extracting approximately $5.7 million worth of funds from KyberSwap pools on Polygon and Avalanche during the attack. Through negotiations, the company managed to secure the return of 90% of these funds, marking a small but significant victory in the recovery process.

Strengthening Defense and Security Measures

In response to the attack, KyberSwap has significantly bolstered its security measures to prevent future breaches. These measures include conducting internal smart contract checks and engaging the services of trusted security firms like 100proof and ChainSecurity. Additionally, the company invited community developers to participate in Sherlock’s audit competition to identify potential vulnerabilities.

The cyber-attack on KyberSwap serves as a stark reminder of the relentless and evolving threats faced by the DeFi industry. With the loss of $55 million, the attack highlighted the need for robust security measures and constant vigilance within decentralized exchanges. By taking swift actions to halt the attack, negotiate the return of funds, and enhance security protocols, KyberSwap endeavors to restore the trust of its users and fortify the platform against future cyber threats. The incident emphasizes the imperative role of effective security practices in safeguarding the burgeoning DeFi space and protecting investors’ funds.