In the current landscape of Malaysia’s telecommunications sector, the impact of 5G technology and over-the-top (OTT) services is becoming increasingly evident. By examining current trends, 5G is poised to dominate mobile subscriptions in Malaysia, comprising an impressive 84% of subscriptions. This represents a marked shift from traditional 4G networks, driven by substantial investments and government initiatives aimed at improving 5G infrastructure across the country. This expansion has already achieved significant coverage, reaching over 82.4% of populated areas. The dual-network model, illustrated by U Mobile’s deployment of its 5G infrastructure alongside Digital Nasional Berhad (DNB), highlights the competitive drive within the telecom sector to enhance network capabilities substantially.

Telecom operators and industry stakeholders project Malaysia’s mobile services revenue to rise significantly over the coming years. The forecasted increase from $5.1 billion to $6.1 billion represents a compound annual growth rate (CAGR) of 3.5%. This positive trajectory is primarily attributed to the heightened demand for mobile data driven by widespread 5G adoption and a growing affinity for OTT services. However, mobile voice revenue is anticipated to decline as users increasingly shift to digital communication platforms. Average monthly data consumption is also expected to more than double, fueled by increased streaming and social media use—an evolution enabled by enhanced 5G access and innovative data-centric plans from telecom providers.

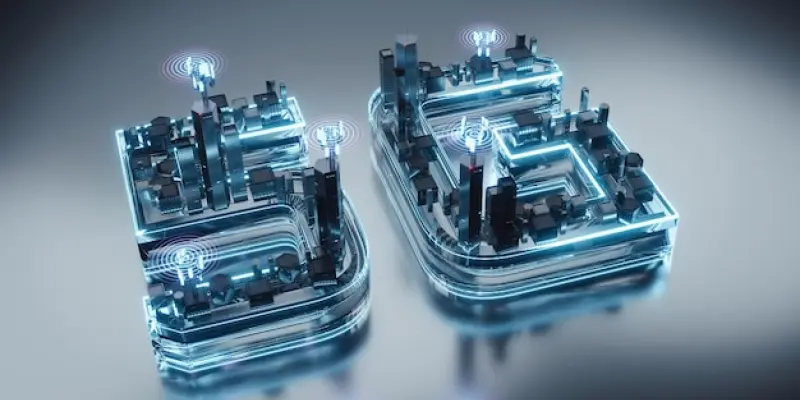

Driving Growth and Opportunities with 5G

The transition to 5G is not just an inevitable technological upgrade; it marks a significant leap forward for both consumers and businesses in Malaysia. As coverage expands, the enhanced speed and reliability of 5G networks promise to transform user experiences. This shift will allow consumers seamless access to high-bandwidth applications like video streaming, video conferencing, and augmented reality experiences without the buffering and delays typically associated with slower networks. For businesses, 5G provides the backbone for innovations in areas such as the Internet of Things (IoT) and machine-to-machine (M2M) communications. This advancement will enable enterprises to develop and implement more sophisticated solutions in automation, smart manufacturing, and asset tracking, greatly enhancing operational efficiencies.

Telecommunications companies are at the heart of this transformation, actively investing in infrastructure enhancements and network expansion to meet growing consumer and business demand for data. The introduction of dual 5G networks further ignites a competitive spark within Malaysia’s telecom industry, breaking away from the previous monopoly held by state-run DNB. This change fosters a market where innovation and competitive pricing policies prevail, encouraging operators to expedite their 5G rollout strategies while promoting customer-centric services. The resultant accelerated deployment of 5G infrastructure not only promises to cater to existing consumer needs but also sets the stage for novel digital experiences and applications that could redefine how Malaysians engage with technology.

Shaping Consumer Preferences with OTT Services

Over-the-top services play a pivotal role in shaping the future of Malaysia’s mobile landscape, especially as consumer behavior continues to evolve. With the increasing prevalence of high-speed 5G networks, OTT platforms gain prominence in delivering diverse content directly to users, bypassing traditional service providers. This shift significantly impacts the revenue streams of telecom operators, as users migrate from conventional mobile voice services to OTT communication solutions and streaming platforms for their content consumption needs. The result is a dynamic market where the demand for rich, on-demand content and instant communication options are at an all-time high, challenging operators to innovate to retain customer engagement.

OTT services are instrumental in driving data consumption as users gravitate toward platforms offering expansive libraries of video, music, and gaming content. This shift represents a fundamental change in how Malaysians engage with media, embracing OTT delivered through smartphones and smart devices. Mobile operators are responding by crafting flexible, data-driven packages tailored to cater to this growing demand. Offering diverse, content-rich mobile plans is essential not only for customer retention but also in tapping into the revenue potential tied to increased data requirements. This shift towards OTT platforms encourages a more vibrant entertainment ecosystem in Malaysia, with content providers and telecom operators collaborating to deliver premium, localized content that caters to the cultural tastes of the Malaysian populace.

Future Considerations in Malaysia’s Mobile Sector

In Malaysia’s telecommunications sector, the influence of 5G technology and over-the-top (OTT) services is increasingly apparent. With current trends pointing towards 5G making up about 84% of mobile subscriptions, this represents a significant shift from 4G networks. This transformation is spurred by strong investments and government efforts to enhance 5G infrastructure nationwide, already achieving coverage in over 82.4% of populated areas. U Mobile’s 5G infrastructure deployment alongside Digital Nasional Berhad (DNB) underscores the competitive drive to boost network capabilities. Telecom operators and stakeholders anticipate a key rise in mobile services revenue, projected to grow from $5.1 billion to $6.1 billion—indicating a compound annual growth rate (CAGR) of 3.5%. This growth is largely due to increased demand for mobile data with 5G adoption and rising OTT service usage. However, as users pivot to digital communication, mobile voice revenue is predicted to decrease. Average monthly data usage is expected to more than double, hastened by streaming and social media, thanks to better 5G access and data-centered plans by providers.