Enterprise Resource Planning (ERP) systems have significantly transformed accounting by integrating various financial operations into a single, cohesive platform. This integration not only streamlines workflows but also enhances data accuracy and provides real-time insights, enabling businesses to make informed decisions. By unifying financial data, automating repetitive tasks, and offering advanced analytics, ERP systems are reshaping how companies manage their finances. Let’s dive deeper into the various ways ERP systems are revolutionizing accounting processes and explore their numerous benefits for businesses.

Centralization of Financial Data

One of the most significant advantages of ERP systems is the centralization of financial data. Traditional accounting software often operates in silos, making it challenging to consolidate information from different departments. ERP systems, however, unify all financial operations, ensuring that data flows seamlessly across the organization. This centralization eliminates discrepancies and provides a single source of truth for financial information. By having all financial data in one place, businesses can easily track transactions, monitor cash flow, and generate accurate financial statements. This holistic view of financial health is crucial for strategic planning and decision-making. Moreover, centralized data reduces the risk of errors and ensures compliance with regulatory standards.

The centralization of data accelerates the consolidation process, enabling accountants to quickly close the books at the end of each period. This efficiency reduces the time spent on manual reconciliation and allows more time for analysis and strategic initiatives. Also, having a single source of truth means that all departments work with the same accurate data, fostering better collaboration and communication within the organization. This streamlined access to financial information supports timely and effective management actions, ultimately enhancing the overall financial health of the business.

Automation of Key Accounting Tasks

ERP systems automate many repetitive and time-consuming accounting tasks, such as invoicing, payroll processing, and expense management. Automation not only speeds up these processes but also minimizes the risk of human error. For instance, automated invoicing ensures that invoices are generated and sent out promptly, improving cash flow and reducing the likelihood of late payments. Payroll processing is another area where ERP systems excel. By automating payroll, businesses can ensure that employees are paid accurately and on time, while also maintaining compliance with tax regulations. Expense management is streamlined as well, with automated systems tracking and categorizing expenses, making it easier to monitor spending and adhere to budgets.

In addition to improving accuracy, automation frees up valuable time for accounting professionals, allowing them to focus on more strategic tasks such as financial analysis and planning. This shift from manual to automated processes not only boosts productivity but also enhances job satisfaction, as employees can engage in more meaningful work. Automation also enhances the transparency and traceability of financial transactions, which is essential for auditing and compliance purposes. By streamlining these critical activities, ERP systems help businesses maintain financial integrity while reducing operational costs.

Enhanced Financial Reporting and Analytics

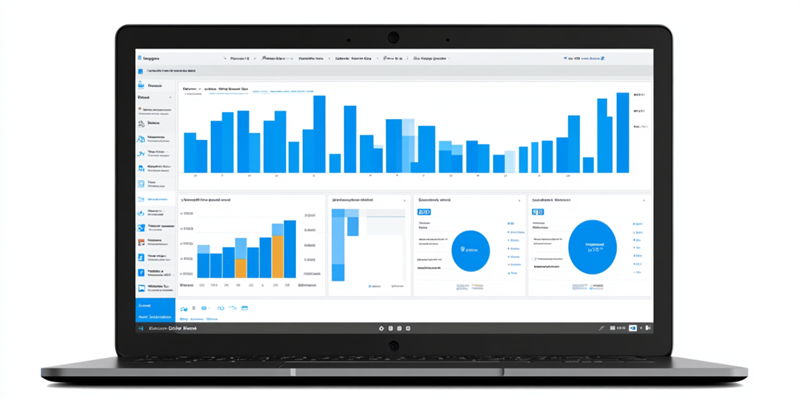

ERP systems offer advanced financial reporting and analytics tools that provide real-time insights into an organization’s financial performance. These tools enable businesses to generate custom reports, visualize financial data, and identify trends that can inform strategic decisions. Real-time analytics are particularly valuable for monitoring key performance indicators (KPIs) and assessing the financial impact of business activities. With ERP systems, businesses can create detailed financial reports that go beyond basic income statements and balance sheets. These reports can include cash flow analysis, budget variance reports, and profitability analysis, among others. The ability to generate comprehensive reports quickly and accurately is essential for effective financial management and planning.

Moreover, the graphical representation of financial data through dashboards and visual reports makes it easier for stakeholders to understand complex information at a glance. This visual insight supports quicker and more informed decision-making. Additionally, the predictive analytics capabilities of advanced ERP systems can forecast future financial trends, helping businesses anticipate challenges and opportunities. By leveraging these analytical tools, companies can stay ahead of the competition, optimize their financial strategies, and drive sustainable growth. The enhanced reporting and analytics features of ERP systems make them a powerful tool for any organization looking to elevate its financial management processes.

Improved Compliance and Audit Trails

Compliance with industry-specific regulations and standards is a critical aspect of accounting. ERP systems are designed to support compliance by maintaining accurate records, providing audit trails, and generating necessary documentation. This capability is particularly important for businesses operating in highly regulated industries, such as healthcare, finance, and manufacturing. Audit trails in ERP systems track every financial transaction, ensuring transparency and accountability. This feature is invaluable during audits, as it allows auditors to trace transactions back to their source and verify their accuracy. Additionally, ERP systems can generate compliance reports that demonstrate adherence to regulatory requirements, reducing the risk of penalties and fines.

The automated compliance features of ERP systems also help businesses stay up-to-date with changing regulations, ensuring continuous adherence to legal standards. This proactive approach to compliance minimizes the risk of regulatory breaches, which could otherwise result in costly fines and damage to the company’s reputation. Furthermore, the ability to quickly generate detailed compliance reports streamlines the auditing process, saving time and resources. By ensuring that all financial activities are transparent and traceable, ERP systems not only facilitate regulatory compliance but also build trust with stakeholders and investors. The robust compliance and audit capabilities of ERP systems make them indispensable for businesses aiming to uphold the highest standards of financial integrity.

Integration with Other Business Processes

Unlike traditional accounting software, ERP systems integrate accounting functions with other business processes, such as inventory management, procurement, and human resources. This integration ensures that financial data is consistently updated across all departments, leading to improved operational efficiency and better decision-making. For example, integrating accounting with inventory management allows businesses to track the financial impact of inventory levels and movements in real time. Similarly, integration with procurement ensures that purchase orders and supplier payments are accurately recorded, reducing the risk of discrepancies. By aligning accounting with other business processes, ERP systems provide a comprehensive view of the organization’s operations and financial health.

The seamless integration between different business functions also enhances collaboration and communication across departments. For instance, sales teams can access real-time inventory data to inform their order commitments, while finance teams can rely on up-to-date procurement information to manage budgets effectively. This holistic approach enables companies to operate more cohesively and respond agilely to market fluctuations and internal demands. Moreover, the integration of HR processes with financial data helps in accurate payroll management and aligns compensation strategies with organizational goals. By creating a unified platform for all business activities, ERP systems pave the way for smarter, data-driven decision-making that drives efficiency and growth.

Scalability and Flexibility

ERP systems are designed to grow with the business, offering scalability and flexibility to meet changing needs. As businesses expand, they can add new modules and features to their ERP system, ensuring that it continues to support their operations effectively. This scalability is particularly important for businesses experiencing rapid growth or entering new markets. Flexibility is another key advantage of ERP systems. Businesses can customize their ERP system to suit their specific requirements, whether it’s adapting to industry-specific regulations or integrating with other software solutions. This adaptability ensures that the ERP system remains relevant and valuable, regardless of how the business evolves.

The modular structure of ERP systems allows companies to implement features incrementally, minimizing disruption and spreading out costs. For example, a company can start with core financial modules and gradually expand to include inventory management, customer relationship management, and other functionalities as needed. This approach provides flexibility in managing resources and time, making it easier to adjust to shifting business landscapes. Additionally, the cloud-based deployment options available in modern ERP systems offer scalability without the need for significant upfront capital investment in IT infrastructure. This accessibility ensures that even small and medium-sized enterprises can benefit from the powerful capabilities of ERP systems, fostering innovation and competitive advantage.

Cost Reduction and Efficiency Gains

Enterprise Resource Planning (ERP) systems have revolutionized the field of accounting by consolidating various financial tasks into a single, unified platform. This centralization not only simplifies workflows but also improves data accuracy and provides real-time insights, which help businesses make well-informed decisions. By unifying financial data, automating repetitive tasks, and offering sophisticated analytics, ERP systems are transforming how companies handle their financial processes.

The integration of various financial operations means that businesses can access comprehensive data from all departments in one place, reducing the risk of errors and enhancing efficiency. Manual data entry and other repetitive tasks are greatly minimized, freeing up time for accountants to focus on more strategic activities. Additionally, ERP systems enable the generation of detailed reports and financial statements quickly and accurately, aiding in compliance with regulatory requirements. Let’s delve into the multiple ways ERP systems are overhauling accounting processes and explore the numerous advantages they offer to businesses.