In the complex world of global trade, companies constantly grapple with varying tariff rates, compliance regulations, and ever-fluctuating costs. Navigating these challenges efficiently requires a robust system designed to manage, track, and optimize tariff rates proactively. Microsoft Dynamics 365 emerges as a solution providing comprehensive tools to manage these aspects strategically, leveraging automation and real-time analytics to streamline operations and improve financial accuracy.

Warehouse Optimization and Compliance

Expanding Warehouse Networks

One significant strategy to mitigate high tariff costs involves expanding warehouse networks or partnering with third-party logistics providers. This approach can help distribute goods across multiple regions, thereby reducing the tariff impacts by aligning with local regulations. Dynamics 365 Business Central plays a crucial role here by seamlessly integrating with multiple warehouse locations. It ensures compliance with regional tariffs and optimizes inventory management. By having a distributed network, businesses can respond promptly to regional demand, thereby reducing lead times and associated costs.

Another advantage of expanding warehouse networks is the potential reduction in transportation costs. By strategically positioning warehouses closer to key markets, companies can minimize long-haul freight expenses. Business Central’s advanced inventory and logistics modules facilitate efficient stock keeping and timely replenishments. These functions contribute to lowering operational costs while maintaining high service levels. The visibility offered by the system allows managers to make informed decisions about stock placement and movement, further reducing unnecessary expenditures related to tariffs.

Third-Party Logistics Integration

Partnering with third-party logistics (3PL) providers is another effective strategy to manage high tariff costs. These providers bring a wealth of expertise in navigating international trade regulations and can handle complex tariff structures. Dynamics 365 seamlessly integrates with 3PL systems, allowing for real-time updates on tariff changes and logistics operations. This integration reduces compliance risks and ensures that all necessary documentation is handled correctly.

Leveraging 3PLs also allows companies to benefit from economies of scale, as these providers often negotiate lower rates with carriers due to their volume of shipments. This cost advantage can be significant in reducing overall shipping expenses. Moreover, the integration with Business Central ensures that all tariff-related data is centralized, providing a clear audit trail and enhancing transparency. This centralized data simplifies the process of reconciling costs and ensures that businesses remain compliant with varying international regulations.

Automation and Real-Time Analytics

Automating Tariff Classification

Automation has become an indispensable tool in modern tariff management, significantly reducing manual errors and operational inefficiencies. One of the crucial processes that can be automated using Dynamics 365 is tariff classification. By implementing automation rules within Business Central, goods can be classified based on predefined criteria and historical data, ensuring consistency and accuracy. This reduction in errors prevents costly fines and shipment delays, which can occur when incorrect tariff codes are used.

In addition, automated tariff classification frees up valuable human resources, allowing staff to focus on more strategic tasks. Automated processes ensure that classifications are updated in real-time, adapting to any changes in trade regulations promptly. This dynamic system ensures that businesses stay ahead of any potential compliance issues. Furthermore, automation can be integrated with existing supply chain processes, creating a seamless flow of information and enhancing overall operational efficiency.

Leveraging Power BI for Analytics

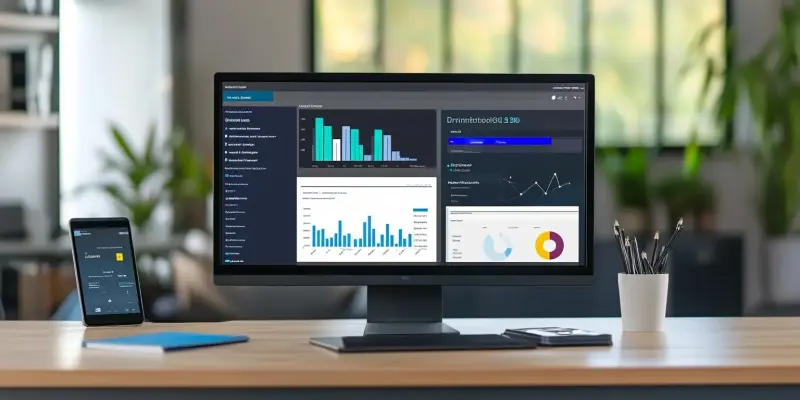

Real-time analytics are essential for effective tariff management, providing actionable insights and aiding in strategic decision-making. Dynamics 365 integrates with Power BI to deliver robust analytics capabilities that monitor fluctuating tariff costs. With this integration, businesses can generate detailed reports that provide visibility into past, present, and future trends. These insights are vital for enhancing forecasting, budgeting, and decision-making processes related to import and export expenses.

By leveraging Power BI, businesses can set up dashboards to track key performance indicators (KPIs) relevant to tariff management. These dashboards enable managers to quickly identify any anomalies or trends that require attention. Additionally, predictive analytics can forecast potential cost increases or savings based on historical data and market trends. This predictive capability allows businesses to proactively manage their finances, ensuring that they optimize their tariff strategies to minimize costs and maximize profitability.

Integration and Custom Workflow Automation

Global Trade Management Integration

Integrating Dynamics 365 with Global Trade Management (GTM) systems is another powerful strategy to enhance tariff management. GTM solutions provide automated updates on tariff changes, duty calculations, and compliance tracking. This integration ensures that businesses stay current with evolving trade regulations, thereby reducing the risk of non-compliance and associated penalties. Dynamics 365 facilitates seamless communication between Business Central and GTM systems, automating the entire process of tariff management.

The comprehensive integration with GTM solutions also simplifies the handling of complex trade agreements and customs procedures. By automating these processes, businesses can reduce processing times and administrative workloads. GTM integration streamlines operations, making it easier to manage international trade activities. It also provides detailed documentation and reporting, essential for regulatory audits and strategic planning. This holistic approach enhances efficiency and reduces the likelihood of costly disruptions in the supply chain.

Custom Workflow Automation

Creating custom workflows within Dynamics 365 is an effective way to streamline tariff-related tasks. Workflows can automate tasks such as document approvals, notifications for tariff changes, and compliance checks. This automation reduces the risk of processing errors and decreases the administrative burden on employees. Custom workflows can be tailored to fit specific business needs, ensuring that all relevant activities are accounted for and managed efficiently.

Additionally, custom workflows enhance collaboration across different departments by ensuring that everyone has access to the same information and follows the same processes. For example, a workflow can be designed to automatically route tariff-related documents to the appropriate personnel for review and approval. This ensures accountability and provides a clear audit trail. Workflow automation also allows businesses to adapt quickly to changes in trade regulations, as processes can be updated easily within the system.

Landed Cost Tracking and Training

Accurate Landed Cost Calculation

Using the Landed Cost Validator app in conjunction with Dynamics 365, businesses can accurately calculate landed costs. This includes tariffs, freight, insurance, and other fees that contribute to the total cost of goods. Accurate landed cost tracking is critical for precise financial planning and profitability analysis. By incorporating all relevant costs, businesses can ensure that their pricing strategies reflect the true cost of goods, thereby maintaining profitability.

Incorporating landed cost tracking into Business Central also facilitates better inventory valuation and cost allocation. This comprehensive approach allows businesses to make more informed decisions regarding purchasing and pricing. Furthermore, accurate cost tracking helps in identifying areas where cost reductions can be achieved, thereby enhancing overall financial performance. The visibility provided by the system ensures that businesses can quickly respond to any changes in cost components, maintaining operational efficiency.

Training and Support for Effective Utilization

Investing in customized training programs is essential to ensure that teams can effectively utilize Dynamics 365 for tariff management. Proper training ensures that employees are familiar with the system’s capabilities and can use them to their full potential. Training programs should focus on both the technical aspects of the system and the strategic use of its features for tariff management. This dual approach ensures that employees are not only adept at using the software but also understand how to leverage its capabilities for optimum results.

Supporting employees with ongoing training and resources also enhances their ability to adapt to any system updates or changes in trade regulations. This continuous learning approach ensures that businesses remain compliant and efficient in their operations. Additionally, providing access to expert support can help address any challenges that arise, ensuring that the system is used effectively at all times. By investing in training and support, businesses can maximize the return on their investment in Dynamics 365.