What happens when the digital revolution hinges not on code or gadgets, but on the raw energy and physical structures that fuel it? Across Europe, a seismic shift is underway, transforming the continent into a powerhouse of artificial intelligence (AI) through an unexpected focus: data centers and electricity. This isn’t about the latest app or sleek hardware; it’s about the gritty, essential infrastructure that keeps AI’s insatiable appetite for power fed and its vast data stores humming. Dive into how Europe is staking its claim in the global AI race, not with software, but with the very foundations that make innovation possible.

The significance of this trend cannot be overstated. As AI technologies demand unprecedented amounts of energy and storage, the companies behind power grids and data facilities are emerging as the unsung heroes of the tech era. Europe’s strategic pivot toward these sectors is redefining investment landscapes, outpacing traditional markets, and positioning the region as a critical player in a multi-billion-dollar industry. This story matters because it reveals how the future of AI rests on tangible, often overlooked resources, and why Europe’s unique approach could reshape global tech dynamics.

Why Europe Drives the AI Revolution

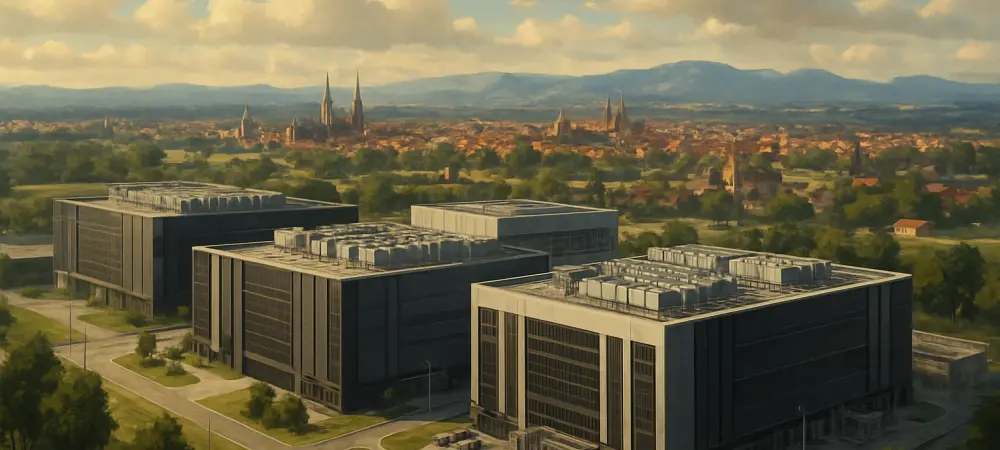

Europe’s ascent in the AI arena stems from a deliberate focus on the backbone of technology rather than its flashier components. Unlike other regions fixated on algorithms or consumer-facing innovations, the continent has zeroed in on the energy and infrastructure needed to sustain AI’s growth. Data centers, consuming vast amounts of electricity to process complex models, have become central to this strategy, with European nations investing heavily to meet global demand.

This emphasis aligns with a broader recognition of AI’s resource intensity. Training a single large-scale AI model can emit as much carbon as several cars over their lifetimes, spotlighting the urgent need for efficient power solutions. European policymakers and businesses are responding by prioritizing sustainable energy sources and grid enhancements, setting the stage for a model that balances technological progress with environmental responsibility.

The Critical Role of Infrastructure in Europe’s AI Surge

At the heart of Europe’s AI boom lies a network of physical systems that keep digital advancements alive. Data centers, often sprawling complexes packed with servers, require constant cooling and immense power—sometimes equivalent to the energy needs of a small city. This reality has elevated industries like power generation and transmission to pivotal roles, as they ensure AI operations remain uninterrupted across the continent.

Investment in these sectors is soaring, reflecting their newfound importance. A select group of 10 European companies tied to AI infrastructure has seen a collective stock rise of 23% this year, surpassing the broader Stoxx Europe 600 Index’s gain of 12%. This financial momentum underscores a profound shift: the digital economy increasingly depends on the robustness of physical assets, a trend Europe is uniquely positioned to exploit.

Moreover, the focus on infrastructure extends beyond mere functionality. It represents a strategic advantage in a world where energy security and data sovereignty are growing concerns. By building and controlling these critical systems, European nations are not only supporting AI but also safeguarding their technological independence amid global competition.

Key Sectors and Companies Shaping Europe’s AI Landscape

Several industries are driving Europe’s infrastructure-led AI expansion, each playing a distinct part in this complex ecosystem. Power generation leads the charge, with firms like Siemens Energy AG achieving a remarkable 111% stock increase this year by linking advanced grids to data center needs. Their role in stabilizing energy supply for AI operations has made them indispensable to the sector’s growth.

Industrial suppliers are equally vital, meeting the hardware demands of sprawling data facilities. Companies such as Prysmian, with a 41% stock uptick, and Legrand SA, up 52%, provide essential components like cables and cooling systems. Meanwhile, telecom giants like Orange SA, managing over 70 data centers with expansion plans, and Nokia Oyj, a key provider of network switches, are capitalizing on both market needs and a regional preference for European vendors over foreign alternatives.

This convergence of sectors forms a powerful synergy, fueling Europe’s AI ambitions. The diversity of contributors—from energy to telecom—illustrates how deeply embedded infrastructure is in the AI narrative. As these companies grow, they signal a robust foundation for sustained technological advancement across the region.

Investor Perspectives on Europe’s AI Infrastructure Growth

Market confidence in Europe’s AI infrastructure is palpable, backed by insights from prominent financial voices. Helen Jewell of BlackRock has highlighted power systems and grid reliability as “central to Europe’s AI story,” distinguishing it from other regions’ software-centric focus. This perspective emphasizes the continent’s unique angle on tech investment, prioritizing the unseen yet essential elements of progress.

Fund managers echo this enthusiasm, pointing to long-term potential in related industries. Ben Lambert of Ninety One and Alexandra Sentuc of JPMorgan Asset Management have identified significant opportunities in industrials and telecoms linked to data center expansion. Xiadong Bao of Edmond de Rothschild Asset Management likens the investment trajectory to a “marathon, not a sprint,” suggesting that patience will yield substantial gains as infrastructure scales up over time.

Global endorsements further validate this trend, with actions like Nvidia’s establishment of technology hubs in countries such as the UK and France signaling international trust in Europe’s capabilities. These developments reflect a broader consensus: the region’s focus on power and data facilities is not just a niche strategy, but a cornerstone of the global AI landscape.

Opportunities and Hurdles in Europe’s AI Infrastructure Journey

Navigating Europe’s AI infrastructure boom requires a keen eye for both promise and pitfalls. Investors and businesses should target sectors directly tied to AI’s operational needs, such as power providers like Siemens Energy, industrial firms like Prysmian, and telecom operators like Orange SA. These areas offer tangible entry points, bolstered by projections like Morgan Stanley’s estimate of €300 million in revenue growth for Nokia by 2026. Geopolitical dynamics also play a crucial role, often favoring European companies over foreign competitors due to regional trust and policy alignments. Yet, challenges loom large—limited liquidity in these markets can hinder swift investment moves, while stringent AI regulations may impose operational constraints. Staying informed through detailed market analyses and regulatory updates is essential to mitigate such risks.

Looking ahead, a long-term mindset is advisable. Europe’s AI infrastructure narrative is still unfolding, and early investments could mature into significant returns as demand for data and power solutions escalates. Balancing enthusiasm with caution, stakeholders must track evolving trends to capitalize on this transformative wave.

Reflecting on Europe’s AI Infrastructure Milestone

Looking back, Europe’s journey into the AI revolution through data centers and power has carved a distinctive path that stands apart from global counterparts. The emphasis on infrastructure has proven to be a masterstroke, turning overlooked sectors into pillars of technological progress. Companies that once operated in the background have risen to prominence, their contributions celebrated as vital to AI’s expansion. As a next step, stakeholders are encouraged to deepen investments in sustainable energy solutions to support AI’s voracious needs, ensuring growth does not come at the environment’s expense. Policymakers are urged to streamline regulations, fostering an environment where innovation can thrive without undue burden. For investors, the focus has shifted to identifying emerging players in this space, anticipating the next wave of infrastructure giants that will shape the digital future. Europe’s story has laid a foundation; the challenge ahead is to build upon it with foresight and resolve.