European financial institutions are confronting a perplexing reality where robust, state-of-the-art security measures have paradoxically coincided with a staggering increase in the total value of fraudulent transactions. A comprehensive joint study released by the European Banking Authority (EBA) and the European Central Bank (ECB) starkly illustrates this disturbing trend. The report reveals that while the overall rate of fraud incidents held steady from 2023 to 2024, the financial losses associated with these crimes surged dramatically from €3.5 billion to an alarming €4.2 billion. This troubling escalation persists even as the revised Payments Services Directive’s (PSD2) Strong Customer Authentication (SCA) requirements have been successfully implemented across the continent. The SCA protocol has undeniably fortified transactions, particularly for card payments, by adding critical layers of verification. However, its success has not eliminated the problem but has instead merely shifted the battlefield, as criminals have adapted their strategies to circumvent these powerful defenses entirely.

The Evolving Threat Landscape

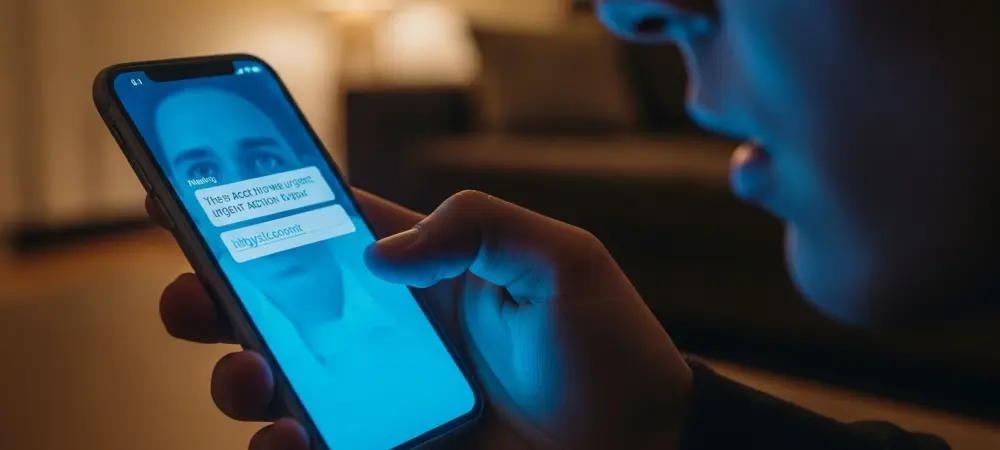

The primary driver behind this surge in fraud losses is a decisive pivot by cybercriminals toward social engineering scams that exploit the end-user directly. Instead of attempting to breach sophisticated authentication systems, they now manipulate consumers into willingly authorizing payments, effectively using the system’s own security features against it. This manipulation takes many forms, from phishing emails artfully disguised as communications from major retailers that lure victims into compromising their details, to fraudulent text messages appearing to be from government agencies that demand urgent payment for non-existent tolls or fines, creating a sense of panic that overrides caution. Another disturbing development is the recruitment of unwitting consumers as “money mules,” who are tricked into using their personal accounts to launder illicit funds, further complicating the trail of criminal activity. This strategic move toward exploiting the human element is precisely why fraud losses are accelerating; criminals can devise and launch new, psychologically potent scams with an agility that heavily regulated financial organizations struggle to match.

A New Paradigm for Proactive Defense

The escalating financial damage from these sophisticated scams made it clear that a compliance-based security model was no longer sufficient to protect consumers. Organizations realized that simply adhering to technical protocols like Strong Customer Authentication, while essential, failed to address the root cause of the modern fraud epidemic: the targeted and psychological manipulation of the customer. To effectively counter this evolving threat, the industry adopted a more innovative and proactive mindset that extended far beyond traditional security measures. This involved a fundamental shift toward educating and empowering customers, equipping them with the knowledge and tools needed to recognize and resist advanced social engineering tactics. Advanced analytics and behavioral biometrics were integrated into security systems to detect anomalous user activity that might indicate a customer was acting under duress or deception, allowing for real-time intervention. The fight against fraud became a more collaborative effort between institutions and their clients, fostering a culture of shared vigilance to protect the entire financial ecosystem.