The long-standing relationship between robust Enterprise Resource Planning (ERP) systems and the ubiquitous flexibility of Microsoft Excel represents one of the most significant and persistent dynamics in modern corporate finance. This review will explore the evolution of this partnership, its key functional challenges, performance metrics for integrated solutions, and the profound impact it has had on financial planning and analysis. The purpose of this review is to provide a thorough understanding of why this integration persists, its current capabilities, and its potential future development.

The Enduring Partnership of ERP and Excel

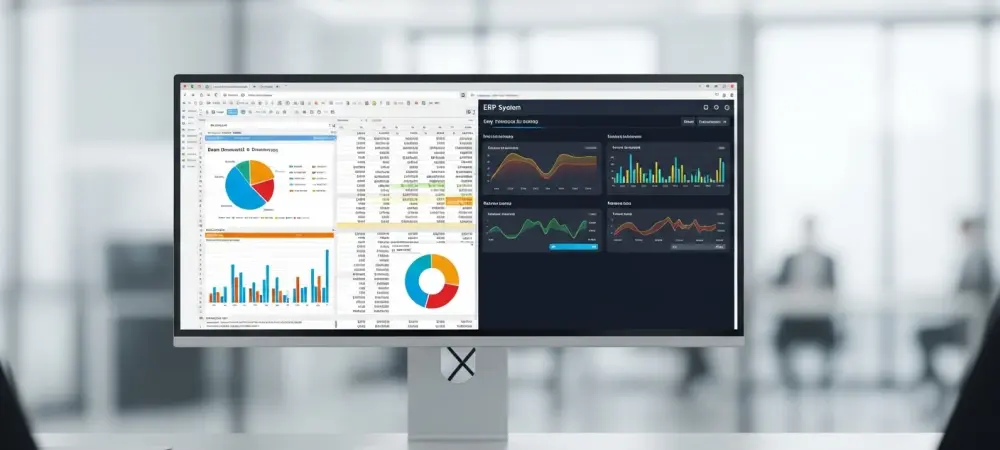

The combination of ERP systems like Microsoft Dynamics 365 Business Central and the adaptable environment of Excel forms the backbone of many finance departments. This partnership is built on the recognition that each tool serves a distinct yet complementary purpose. ERPs are the systems of record, providing structure, control, and a single source of truth for historical financial data. Excel, in contrast, is the canvas for forward-looking analysis, where the unrefined ideas of a budget are first sketched out and modeled.

This dual-platform workflow has become standard practice not out of a resistance to change, but as a practical solution to the inherent nature of financial planning. The budgeting process is rarely a straightforward data entry task; it is an exercise in strategic thinking, assumption testing, and collaborative refinement. Finance teams rely on the ERP for accurate historicals and the Chart of Accounts, but they turn to Excel for the freedom to build, tear down, and rebuild financial models without the constraints imposed by a rigid system.

Core Dynamics of the Integration Challenge

The Iterative Nature of Financial Planning

Financial planning is fundamentally an exploratory process, far from the linear task that many software solutions assume it to be. A budget does not begin fully formed; it evolves through a cycle of discussions, trade-offs, and refinements. Finance teams often start with high-level directional inputs and key operational drivers rather than a complete set of general ledger accounts. As conversations with department heads progress and strategic decisions are made, the underlying assumptions must be constantly adjusted.

This iterative cycle demands an environment that can adapt in real-time. The initial phases of creating a financial plan are inherently unstructured, focused more on capturing business logic than adhering to accounting formats. A flexible tool is therefore essential to maintain momentum, allowing the model to change shape as the team’s understanding of the business outlook deepens.

Excel’s Inherent Flexibility and Agility

Excel’s persistent dominance in budgeting stems directly from its unparalleled flexibility. Its core design allows for complete transparency, where the logic behind every number is visible within its formula. This empowers finance professionals to work directly with the assumptions driving the model, rather than interacting with a black-box system. This transparency builds confidence and facilitates clearer communication during budget reviews.

Moreover, the structure of an Excel model can be modified on the fly without requiring technical support or interrupting the flow of work. New lines can be added, calculations can be altered, and the entire layout can be reorganized to better reflect the narrative of the financial plan. This agility is crucial for modeling non-linear, activity-based costs—such as project-based consulting fees or seasonal hiring surges—that do not fit neatly into evenly distributed monthly allocations.

The Structural Rigidity of ERP Systems

In stark contrast to Excel’s adaptability, the dedicated planning and budgeting modules within many ERP systems are characterized by their structural rigidity. These tools often require a predefined framework—complete with a finalized chart of accounts and a full set of dimensions—before the planning process can even begin. This requirement creates a significant bottleneck, forcing finance teams to make structural decisions before the underlying business assumptions have been settled.

This premature need for structure disrupts the natural, iterative flow of budgeting. Teams find themselves spending more time configuring the tool to accommodate their evolving model than on the critical work of financial analysis and strategic planning. Over time, this friction leads to user disengagement, and the sophisticated ERP module is often relegated to being a simple data repository for finalized totals, with all the meaningful planning work having already occurred elsewhere.

Emerging Trends in Bridging the Gap

Recent developments in financial technology signal a significant shift in thinking. The industry is moving away from the futile effort to replace Excel and is instead focusing on creating live, bidirectional connections that integrate it directly with the ERP. This approach acknowledges Excel’s strengths in the planning phase and seeks to eliminate the disconnect between the planning environment and the system of record.

This trend is driven by the demand for continuity and efficiency. By establishing a real-time link, finance teams can leverage the flexibility of Excel for modeling while simultaneously pulling in live, accurate data from the ERP. This fusion of capabilities allows for a more dynamic and reliable planning process, where assumptions can be tested against actuals without manual data exports or cumbersome reconciliation efforts.

Real-World Application The Modern Budgeting Cycle

In practice, a deeply integrated ERP and Excel workflow transforms the entire budget cycle. Finance teams across various sectors now deploy this technology to streamline their processes from start to finish. The cycle begins with initial modeling and scenario planning within their trusted Excel workbooks, where they can build out complex logic and assumptions freely. However, instead of working in a silo, they use live functions to pull foundational data, such as historical actuals or employee rosters, directly from the ERP.

Once the budget is developed and approved in Excel, the integration facilitates a controlled and validated writeback into the ERP system of record. This automated process eliminates the need for manual re-keying, drastically reducing the risk of error. Following the writeback, the same Excel file can be instantly refreshed with live data from the ERP, allowing for immediate variance analysis and confirming that the approved budget was loaded correctly. This creates a closed-loop system that ensures consistency from planning to reporting.

Overcoming the Handoff Limitation

The primary challenge this technology addresses is the notoriously fragile “handoff” of a finalized budget from Excel into the ERP. This manual transfer has long been a major point of failure in the budgeting process, fraught with technical hurdles. It requires a painstaking translation of a flexible, logic-driven model into the strict, dimensional format required by the ERP, a process that involves tedious data mapping and re-keying. Modern integration tools are designed specifically to automate this translation. They allow users to embed ERP context, such as account and dimension tags, directly within the Excel model. When the budget is ready to be loaded, the tool reads these tags and pushes the data into the correct locations within the ERP, preserving the integrity and context of the original plan. This mitigation of the handoff limitation is a critical step toward a more reliable and efficient financial management process.

The Future of Financial Planning A Connected Ecosystem

The trajectory of this integration technology points toward a future defined by a seamlessly connected financial ecosystem. Forthcoming developments are set to enhance support for sophisticated “what-if” scenario planning and continuous forecasting, enabling organizations to move beyond the static annual budget and adopt more agile, responsive planning methodologies.

The long-term impact of this connected ecosystem will be transformative. By eliminating the friction between planning and reporting, it frees up the finance function from the drudgery of data wrangling and empowers it to become a strategic business partner. With reliable, real-time data at their fingertips, finance professionals can provide forward-looking insights that drive better business decisions, solidifying their role as key contributors to the organization’s success.

Conclusion From Conflict to Continuity

The review concluded that the enduring presence of Excel in financial planning was not a sign of technological lag but a pragmatic response to the unique demands of the budgeting process. Its flexibility is not a flaw to be engineered out but a strength to be leveraged. The core problem has never been the use of Excel or the structure of the ERP, but the broken and inefficient connection between them.

Ultimately, the ideal solution acknowledged the distinct strengths of both platforms. By creating a continuous, error-free workflow through deep integration, organizations enhanced the speed, confidence, and accuracy of their financial management. This shift from a state of conflict to one of continuity represented a major step forward, allowing finance teams to focus less on process and more on providing the strategic insights that guide the business forward.