Bank reconciliation is a crucial task that ensures your accounting records align with your bank statements. This process often feels like solving an intricate puzzle, with each piece representing a different transaction that needs to fit perfectly. Automatic matching features in traditional systems can provide some assistance, but they fall short when faced with more complex scenarios. For example, not all transactions correspond precisely; a single bank statement line might include multiple payments, or slight discrepancies between transactions and records might arise. These deviations necessitate manual intervention, which is prone to human error, consumes valuable time, and increases the risk of inaccuracies. A simple oversight in this process can propagate significant issues in your financial records, magnifying the importance of a more effective solution. A sophisticated tool that not only streamlines the process but also minimizes manual effort and enhances accuracy is essential.

New Copilot Bank Reconciliation Assist

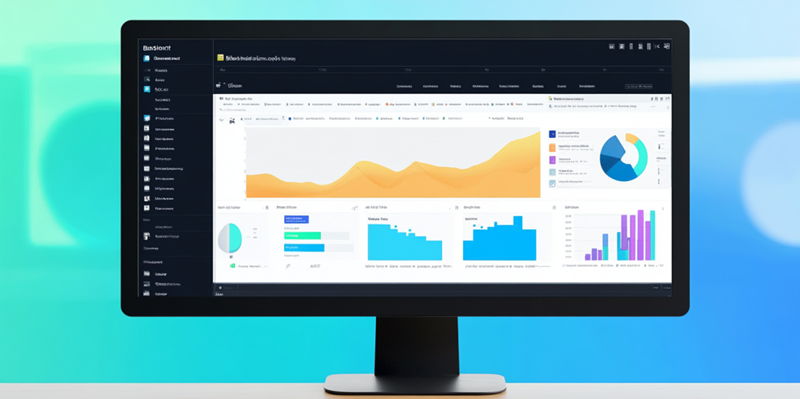

Enter Copilot in Microsoft Dynamics 365 Business Central—a new AI-powered assistant designed to make bank reconciliation smoother and more efficient. This advanced feature leverages artificial intelligence to improve transaction matching and make intelligent suggestions for unmatched items. The enhanced bank reconciliation assist capabilities offer several key benefits that improve both efficiency and reliability in financial management.

Improved Matching of Transactions: Copilot employs AI to identify and match a larger number of transactions that were previously left unresolved. For instance, when a customer makes a lump-sum payment covering multiple invoices, Copilot can automatically match this to the corresponding entries, thus reducing manual effort and saving valuable time. By streamlining this process, businesses can focus on more strategic tasks rather than being bogged down by repetitive administrative work.

Suggested General Ledger Accounts: In cases where transactions cannot be immediately matched, Copilot offers suggestions for potential general ledger (G/L) accounts based on the transaction descriptions. For example, if the description mentions “Fuel Stop 24,” Copilot might suggest posting it to the Transportation account. These intelligent suggestions make the reconciliation process more intuitive and significantly reduce the manual decision-making required, thereby improving overall accuracy and efficiency in financial reporting.

Requirements to Get Started with Bank Reconciliation Assist

To implement the Bank Reconciliation Assist feature in Business Central, there are several prerequisites that users must meet. Firstly, the feature needs to be activated by an administrator within Business Central. Ensuring the correct configuration and activation is critical for leveraging all the benefits that Copilot brings to the table. Proper activation allows the feature to integrate seamlessly with your existing financial systems, setting the stage for enhanced reconciliation processes.

Bank Account Setup: It’s paramount that bank accounts are linked to an online bank account or configured with a bank statement import format to enable data integration. This setup allows for real-time data exchange and ensures that Copilot has access to the latest transaction information. This connectivity is crucial for the tool to provide accurate and timely suggestions during the reconciliation process.

Basic Knowledge: Users should possess a fundamental understanding of the bank account reconciliation process within Business Central to fully utilize this feature. Familiarity with the system ensures that users can actively engage with the suggestions made by Copilot and make informed decisions. While Copilot handles much of the heavy lifting, a basic knowledge base allows users to oversee and refine the reconciliation as necessary, ensuring the highest level of accuracy.

How to Use Bank Reconciliation Assist

Bank Reconciliation Assist can be utilized in two primary ways, depending on whether you are initiating a new reconciliation or working on an existing one.

Starting a New Reconciliation: Navigate to the Bank Account Reconciliations list in Dynamics 365 Business Central. Select “Start New Reconciliation,” and activate the Copilot feature to begin automatically matching transactions with the ledger. The use of AI to match bank statement lines to ledger entries significantly speeds up the setup process, allowing for a more streamlined and efficient workflow. This functionality minimizes initial manual entries and sets a solid foundation for accurate financial management from the get-go.

Working on an Existing Reconciliation: Open an existing bank reconciliation entry from the Bank Account reconciliation card. By applying Copilot, users can identify any unmatched transactions and receive potential matches or G/L account suggestions for these items. Reviewing and either accepting or modifying Copilot’s suggestions ensures that all transactions are accurately reconciled, thus finalizing the reconciliation process efficiently. This feature greatly reduces the time and effort traditionally required to review and match transactions manually.

Conclusion

To activate the Bank Reconciliation Assist feature in Business Central, a few prerequisites are essential. Firstly, an administrator must activate this feature within Business Central. The proper activation and configuration are crucial for unlocking the full range of benefits that Copilot provides. This step ensures seamless integration with your financial systems, enhancing your reconciliation processes.

For bank accounts, linking them to an online bank account or configuring them with a bank statement import format is vital. This setup facilitates real-time data exchange, allowing Copilot to access up-to-date transaction information. This level of connectivity is essential for the tool to offer accurate, timely suggestions during reconciliation.

Users should have a basic understanding of the bank account reconciliation process within Business Central to fully utilize the feature. Familiarity with the system ensures that users can engage with Copilot’s suggestions and make informed decisions. While Copilot handles much of the workload, a basic knowledge base enables users to oversee and adjust the reconciliation process as needed, ensuring the highest degree of accuracy.