In the heart of Silicon Valley, where innovation pulses through every circuit, a startling paradox unfolds: towering data centers, built to fuel the AI revolution, stand eerily silent. Santa Clara, California, home to Nvidia, a global leader in AI chip technology, is grappling with an unexpected roadblock—there’s simply not enough power to turn these digital giants on. This isn’t just a minor glitch; it’s a stark reminder of how even the most advanced tech hubs can be crippled by something as fundamental as electricity, raising urgent questions about the future of technology’s relentless expansion.

Why Are High-Tech Hubs Stalled by Something as Basic as Power?

The inability to power up in Santa Clara reveals a critical vulnerability in the tech ecosystem. Data centers, the unsung heroes behind cloud computing and artificial intelligence, require vast amounts of electricity to operate, yet the local utility, Silicon Valley Power (SVP), struggles to meet this demand. This bottleneck isn’t merely a local issue; it mirrors a growing national concern where cutting-edge ambitions collide with outdated infrastructure, leaving multimillion-dollar facilities dormant.

What makes this situation particularly striking is the location. Santa Clara sits at the epicenter of technological advancement, surrounded by companies driving the digital age. Yet, despite this proximity to innovation, the power grid—designed for a bygone era—cannot keep pace, exposing a fundamental mismatch between vision and reality that threatens to slow progress in one of the world’s most dynamic regions.

The Growing Hunger for Power in the Age of AI

Data centers have become the backbone of modern life, supporting everything from streaming platforms to autonomous systems. In Santa Clara, the surge in demand is fueled by the AI boom, with companies like Nvidia pushing computational limits to new heights. However, SVP finds itself overwhelmed, unable to supply the energy needed for these facilities to function, a problem echoed across the United States as the grid lags behind tech’s exponential growth.

The numbers paint a dire picture. According to BloombergNEF projections, electricity demand for AI computing in the US could more than double by 2035, placing unprecedented strain on existing systems. This escalating need highlights a critical challenge: without significant upgrades, the infrastructure supporting digital innovation risks becoming a choke point, stalling advancements that businesses and consumers increasingly rely on.

This energy crisis extends beyond mere inconvenience. As AI applications grow—from real-time data processing to machine learning models—their reliance on low-latency connections near urban centers like Santa Clara intensifies. The inability to power these hubs not only delays projects but also jeopardizes the competitive edge of tech leaders, amplifying the urgency to address this systemic shortfall.

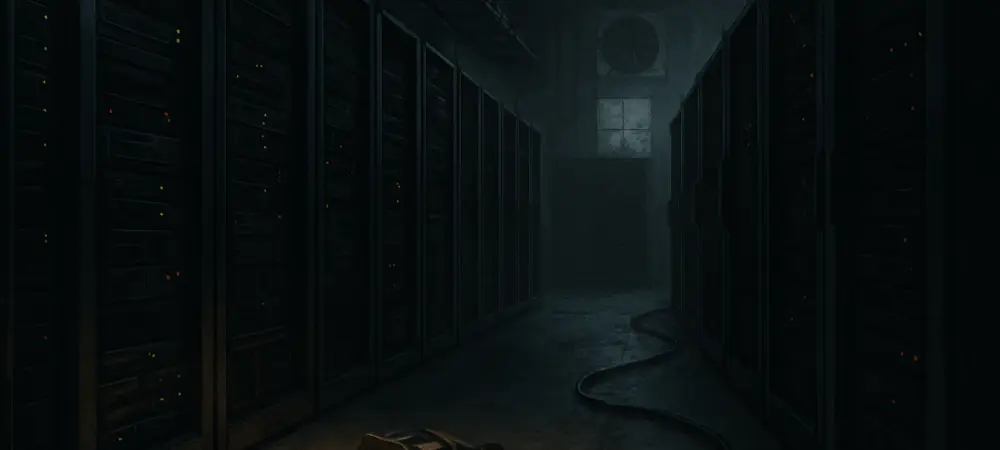

Empty Shells and Endless Delays: Santa Clara’s Data Center Dilemma

Focusing on Santa Clara, the impact of the power shortage becomes tangible through specific projects. Digital Realty Trust Inc.’s SJC37, a massive facility initiated years ago, remains an empty shell, unable to operate due to insufficient electricity from SVP. Similarly, Stack Infrastructure’s 48-megawatt SVY02A stands idle, a silent testament to the delays plaguing the region despite a $450 million upgrade plan by the utility, slated for completion by 2028.

These delays carry hefty financial consequences. Developers face millions in losses as their investments sit unused, while the broader tech industry suffers from postponed advancements critical to AI and cloud services. The wait for power, potentially stretching from 2025 to 2028, underscores how even well-funded projects can be derailed by infrastructural limitations, casting a shadow over future developments in the area.

The problem isn’t confined to this city alone. Across the nation, regions like Northern Virginia’s “Data Center Alley” report delays of up to seven years for power connections, while in Oregon, major players like Amazon have been denied electricity. These widespread issues signal a pervasive bottleneck, threatening to hinder the tech sector’s growth on a scale far beyond local boundaries.

Voices from the Frontline: Industry Leaders Weigh In

The frustration among industry stakeholders is evident as they grapple with these power constraints. Bill Dougherty of CBRE Group Inc. bluntly states, “Power is the single biggest constraint on data center growth today,” emphasizing the strategic necessity of urban hubs despite the challenges. His perspective sheds light on why proximity to cities like Santa Clara remains non-negotiable for certain applications, even at a high cost.

Jordan Sadler of Digital Realty adds another layer to the conversation, noting that securing new power in high-demand zones like Silicon Valley often takes years, forcing companies to adopt long-term planning strategies. This insight reveals the proactive yet constrained nature of developers’ approaches as they navigate a landscape where demand far outstrips supply.

Meanwhile, visionaries like Nvidia’s Jensen Huang and OpenAI’s Sam Altman project trillions in AI infrastructure investments, a forecast supported by CBRE data showing 74.3% of the US data center pipeline already pre-leased. Their optimism clashes with the harsh reality of energy shortages, painting a vivid picture of an industry at a crossroads, desperate for solutions to unlock its full potential.

Navigating the Power Crunch: Strategies for a Wired Future

Amid these challenges, innovative strategies emerge as potential lifelines for the industry. Developers like Digital Realty, with 61% of its $9.7 billion pipeline pre-leased, are banking on future power availability, demonstrating a calculated risk in planning ahead. Such foresight, though not immediate, positions companies to weather delays with a focus on long-term gains.

On a tactical level, solutions like Stack Infrastructure’s dedicated on-site substations offer a way to secure immediate capacity, bypassing some utility delays. This approach, while resource-intensive, showcases how private initiatives can fill gaps left by public infrastructure, providing a model for others to emulate in power-scarce regions.

Broader collaboration also holds promise. By working closely with utilities on upgrade timelines and advocating for streamlined regulations, tech firms can help accelerate grid modernization. Investments mirroring SVP’s $450 million effort must be prioritized by policymakers and industry leaders alike, ensuring that energy infrastructure evolves in tandem with digital ambitions, paving the way for a more resilient future.

Looking back, the struggle to power data centers in Santa Clara served as a wake-up call for the tech world. It highlighted a glaring gap between innovation and infrastructure that demanded urgent attention. Moving forward, stakeholders had to commit to actionable steps—whether through public-private partnerships to fast-track grid upgrades or through localized energy solutions like microgrids for critical facilities. The path ahead required not just investment but also a unified resolve to ensure that the digital revolution wasn’t dimmed by something as solvable as a lack of power.