Imagine a major e-commerce platform gearing up for the holiday shopping frenzy, expecting millions of transactions in a single hour, only to face a catastrophic system failure due to insufficient cloud resources. This scenario, far from hypothetical, reflects a growing concern in the digital economy where scalability is no longer just a feature but a critical lifeline for businesses. As enterprises across industries increasingly rely on public cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, the ability to handle sudden demand spikes has become a defining factor in operational success. This market analysis delves into the pressing issue of scalability in cloud computing, exploring whether providers can truly deliver on their promises amid rising workloads and complex use cases. By examining current trends, real-world disruptions, and future projections, this piece aims to uncover the realities behind the hype and provide strategic insights for navigating an evolving landscape.

Market Dynamics: The Rising Demand for Cloud Scalability

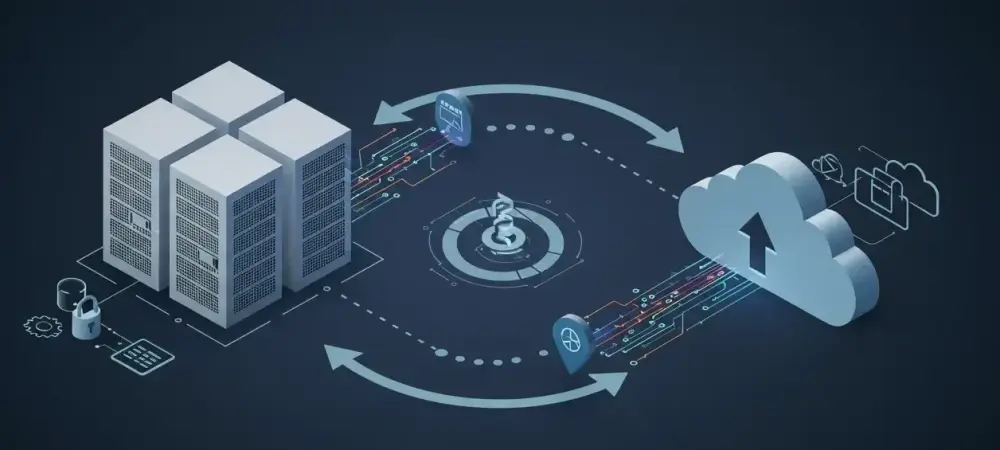

The cloud computing market has witnessed explosive growth, with global spending projected to surpass $1 trillion annually by the end of this decade, driven by the shift toward digital transformation. Enterprises are drawn to the promise of elastic infrastructure, where resources scale dynamically to match demand, eliminating the inefficiencies of traditional on-premises systems. Hyperscalers have capitalized on this trend, positioning themselves as the backbone of modern IT with vast data centers and global networks. However, beneath this growth lies a critical challenge: the strain on physical infrastructure as workloads multiply, from AI-driven applications to real-time data processing. This tension between market expansion and operational limits sets the stage for a deeper look into whether the industry can sustain its trajectory without faltering under pressure.

A pivotal event underscoring this issue occurred in the Microsoft Azure East US region on July 29 of this year, where a surge in demand for virtual machines, exacerbated by Kubernetes upgrades, led to widespread resource allocation failures. This disruption impacted numerous businesses, exposing the fragility of relying on a single provider or region during peak loads. Industry data reveals a 30% increase in capacity-related outages across major platforms over the past three years, signaling that such incidents are not outliers but symptoms of a broader market challenge. As companies continue to migrate mission-critical operations to the cloud, the stakes for scalability have never been higher, pushing both providers and clients to reassess their strategies.

Analyzing Scalability Challenges: Data and Disruptions

Physical Limits in a Digital World

At the core of the scalability debate is the stark reality that cloud infrastructure, despite its virtual allure, remains bound by physical hardware constraints. The notion of infinite elasticity—where resources are always available on demand—has been a key marketing pillar for cloud providers. Yet, incidents like the Azure East US disruption shatter this illusion, demonstrating that when regional capacity is exceeded, even the largest hyperscalers cannot deliver. Market analysis shows that high-demand zones, particularly on the US East Coast, face frequent bottlenecks due to concentrated workloads, leaving enterprises vulnerable to operational halts. This discrepancy between expectation and capability highlights a critical gap in the market, where growth in cloud adoption outpaces infrastructure expansion.

Beyond specific events, the broader trend of capacity shortages reveals systemic issues within the industry. Reports indicate that as workloads evolve—spanning edge computing, machine learning, and IoT—the demand for real-time resource allocation is straining existing data center capabilities. Smaller providers, lacking the capital to scale infrastructure at the pace of hyperscalers, are particularly at risk of losing market share. This dynamic suggests a potential consolidation in the coming years, where only the largest players may survive the scalability race, reshaping competitive landscapes and forcing businesses to rethink vendor dependencies.

Transparency and Accountability Shortfalls

Another pressing concern in the market is the lack of transparency from cloud providers regarding capacity limits and resource availability. During the Azure incident, delayed communication about alternative solutions or regions left enterprises scrambling, amplifying the disruption’s impact. A comparative review of service-level agreements (SLAs) across major providers reveals a consistent omission: few, if any, offer explicit guarantees on scalability during demand surges. This opacity creates a trust deficit, as businesses often discover limitations only when failures occur, with little contractual recourse for compensation or mitigation.

The market implications of this transparency gap are significant, as it erodes confidence in cloud services at a time when reliance is deepening. Analysts note that enterprises are beginning to demand clearer terms in SLAs, pushing for clauses that address capacity failures directly. If providers fail to adapt, there’s a risk of losing customer loyalty to competitors or alternative models like hybrid cloud solutions. This trend underscores a growing call for accountability, with potential regulatory scrutiny on the horizon to enforce better disclosure practices, particularly in regions like the EU and US where data dependency is critical.

Regional Disparities and Emerging Workload Complexities

Scalability challenges are further compounded by regional disparities in infrastructure distribution, a factor often overlooked in market assessments. High-demand areas face greater strain due to uneven data center placement, as seen in the Azure East US case where localized overloads disrupted operations on a massive scale. In contrast, less saturated regions may have spare capacity, but inter-region load balancing is neither automatic nor seamless, contrary to common assumptions. This geographic imbalance poses a strategic dilemma for businesses aiming to optimize performance without risking single-point failures.

Adding to the complexity are emerging workload trends, such as AI-driven analytics and edge computing, which demand unprecedented resource agility. These innovations, while driving market growth, place new pressures on providers to allocate resources in real time, often across dispersed networks. Industry forecasts suggest that without significant investment in regional infrastructure and predictive technologies, scalability issues could intensify by 2027, potentially stunting adoption in latency-sensitive sectors like finance and healthcare. This evolving landscape signals a need for both providers and enterprises to prioritize geographic diversification and advanced planning to stay ahead of demand curves.

Future Projections: Trends Shaping Cloud Scalability

Looking toward the next few years, the cloud market stands at a crossroads where scalability challenges are catalyzing transformative shifts. One prominent trend is the rise of hybrid and multicloud architectures, with adoption rates expected to grow by 40% by 2027 as businesses seek to spread risk across multiple platforms and on-premises systems. This diversification strategy reflects a maturing market, where reliance on a single provider is increasingly viewed as a liability amid recurring capacity issues. Providers, in turn, are exploring AI-driven resource management tools to anticipate and mitigate surges, though widespread implementation remains inconsistent.

On the regulatory front, there’s mounting pressure for stricter oversight of cloud services, particularly around capacity reporting and transparency. Emerging policies in key markets could mandate real-time disclosure of resource constraints, reshaping how providers communicate with clients. Analysts predict that scalability failures may drive market consolidation, with smaller vendors struggling to match the infrastructure scale of hyperscalers, potentially reducing competition but strengthening reliability among top players. These projections paint a future where adaptability—both technological and strategic—will define success in navigating an increasingly complex cloud ecosystem.

Reflecting on Market Insights

Reflecting on the analysis, it becomes evident that scalability in cloud computing is not the seamless guarantee once promised, as evidenced by disruptions like the Azure East US incident earlier this year. The market grapples with physical infrastructure limits, transparency shortfalls, and regional disparities, all of which challenge the trust enterprises place in hyperscalers. Projections point to a future of hybrid solutions and regulatory shifts, highlighting the need for proactive adaptation. For businesses, the next steps involve negotiating tougher SLAs with explicit capacity assurances and investing in diversified architectures to mitigate provider-specific risks. Providers, meanwhile, need to prioritize infrastructure expansion and real-time communication to rebuild confidence. As the market moves forward, embracing a shared responsibility model offers the most viable path to ensuring scalability keeps pace with digital ambitions, turning past vulnerabilities into lessons for a more resilient tomorrow.